"The demand for certainty is one which is natural to man but is nevertheless an intellectual vice." - Bertrand Russell

I have been in the Wealth Management Industry for over 13 years and it has been a joyride. But, there have been few bets I made, that have taught me lessons for a lifetime and I want to share these with you -

Story # 1

In my college days, I used to be a very good cricketer. I used to open the batting for my team and we have won many matches together. We would be on the grounds at 6:30 am for warm-ups and play a match there, then head back to our building and play more till it was evening and getting dark.

I still remember vividly when I hit my first century. It was Conwood grounds in Juhu. I was so happy and dreaming (while the game is on) of becoming a National player and participating in tournaments across India and internationally. I would eat, sleep and breathe Cricket.

But I dropped out of Cricket completely as I had to support my family by generating income to meet the needs of that time. Hence I took on jobs that would earn me anything, to begin with. My first one being a Sales Boy in a TV showroom in Lamington Road.

From there, I moved on to a clerical role in an Accounting department of a Transport Firm in Mumbai Central. Income-wise, I moved from USD 30 per month to USD 40 per month. I was thrilled with the extra income 😄

I got home the dough and that saved the day for the time being.

Story # 2

We were in the middle of the biggest real estate boom Dubai had ever seen in 2007 and got seduced into it with the money we didn’t have. I leveraged up against my Salary and borrowed more from my cousins (against my credibility) and pumped it all in the property market here. When the Great Financial Crisis of 2008 happened and the dust settled, our property value had crashed by 75% and stayed there for more than 5 years.

Even today, it’s down by 50% and I don’t see it ever coming back to the levels we bought it at. There goes a lot of our hard-earned money in contribution to Dubai’s Real Estate Sector. And since it is a mortgaged asset, my entire investment in it has gone to 0, after factoring in the Interest cost and the current Selling price.

Story # 3

I left Banking in 2010 and tried my hands at Entrepreneurship full time, starting in 2011. I was building the distribution network for a Leisure & Luxury Brand from Hong Kong and was pretty successful at it. We were making good money and I was confident that the momentum will only grow from there. Hence we started living in a nice house in a plush locality in Mumbai, bought a Mercedes Benz for the family, made 2-3 International trips every year and those were memorable days.

My overconfidence allowed me to slowly and unconsciously build habits and lifestyles that would drain almost all the money I was earning. I didn’t realize it till the challenges in the business almost brought the earning to a halt. Business expenses can be slashed if the business is impacted for a year or two even. But how do you stop the expenses you have stacked up from the lifestyle created.

Before I realized the hole I had created for myself, it was too late and I had to take up a job again to save the day, yet again. It was very difficult for me to muster the courage to send an email to everyone I knew and had ever known, but I somehow did and shot out 100s of emails. It went to people of all profiles, flunkies in an organization to Regional Directors or even CEOs.

Of all the emails sent out, I received 1 response with an interview possibility. Only 1. And cracking that interview in November of 2014 for a job in Dubai, changed my life trajectory in ways I can’t be thankful enough.

The reason I am sharing these 3 stories with you is to make a point - I was certain about things working out handsomely for me, but some did and some didn’t. That’s how it was, that’s how it always will be.

Everything is a bet. You will always act on incomplete information and there is no way out. You will have to make assumptions. You will always find someone with a contrarian opinion. You will always feel unsure or confused. You may even feel overwhelmed when faced with choices to make. And sometimes you will be torn between your values and the options available.

Hence it will always come down to making a bet. I call it a bet since it implies the uncertainty of the outcome in the choice you make. I will always remember a statement I read (don’t know where) - “The only certainty in life is Death. Everything is else is uncertain, unknown, or unknowable.”

And if everything you do is a bet your making, you have to become reasonably good at making bets that have handsome payoffs. That is where the concept of symmetric and asymmetric bet comes in.

Story # 1 is where a symmetric bet pays off. I work in a firm at USD 30 per month and then progress to another firm for USD 40 per month. I complete my MBA at KJ Somaiya College, Mumbai and my income shoots up to USD 110 per month at Anand Rathi Securities. Then I come to Dubai wherein I start earning USD 3,405 per month at Citibank and now, post-CFA and with the experience with various banks, it goes way higher than USD 10,000 per month + bonuses and perks.

But this is the linear payoff and will grow proportionate to my efforts, relationships, networking skills, and clientele. It goes like this - you put X, you get 1.1X in return.

Story # 2 is where a stupid bet doesn’t pay off. It instead harms you beyond your ability to endure. Buying a property is a good investment to make but when you over-leverage against your income to buy the property, then you are creating a very difficult situation for yourself, in case your income is impaired.

I wrote an article on Bill Hwang recently and even his firm blew up because of over-leveraged positions. I have written about Kodak too wherein they failed to develop the digital camera and rather bet heavily on protecting their photography business, and paying a heavy price eventually.

You see stupid bets everywhere, all around you, day in day out. It goes like this - you put X, you either make 2X or it goes to 0. These are like Russian Roulette, where you could win USD 1 million if you survive but you die if you are unlucky. I have written about these in my previous posts and hence won’t delve into that here.

Story # 3 is about Asymmetric Bets and these are the bets you got to make to see your X turn into 10X or 100X or even 1000X.

Nassim Nicholas Taleb has a similar definition for what he calls “Fundamental Asymmetry.” Here’s the definition from his book, Antifragile: Things That Gain from Disorder: Fundamental Asymmetry (also Seneca’s Asymmetry): When someone has more upside than downside in a certain situation, he is antifragile and tends to gain from (a) volatility, (b) randomness, (c) errors, (d) uncertainty, (e) stressors, (f) time. And the reverse.

Sending that email wasn’t a proud moment but the payoffs were life-altering. The effort put in was maybe an hour, to draft the email and press send. The payoff was a fresh new start in the Banking circuit and a shot at success in our highly rewarding industry. The intellectual stimulation provided is an added bonus that comes along.

I am currently learning to write professionally and getting to work with a lot of talented writers from around the world. I’m in Week 2 of On Deck Fellowship for Writers and it’s been a memorable experience already. It’s an 8-week course with 10 odd hours of weekly commitment. That amounts to 80 hours of learning everything about being a successful writer i.e. writing, resources, different formats, tools, newsletters, community building, paywalls and so much more.

The effort is time-bound but the payoffs are invaluable. My writing is an expression of my insights/observations/learnings. It adds to my CV and builds my credibility. It allows me to add value to others and be looked upon for counsel or advice. It makes me go deeper into subjects I write about. It makes my understanding fundamentally solid, allowing me to profit from its implementation in real life.

I can’t say where and how it will assist me personally or professionally in years to come. But it holds tremendous potential for bringing in an audience for my content and a battery of clients that may look up to me for my skillsets and expertise. Add to this, the plethora of opportunities to collaborate with others on business or content creation. It’s an exciting world that opens up and if the cost is only 80 hours in 2 months, then YES is my answer.

Another example of an Asymmetric Bet is posting your work online for all to see and comment upon. This opens the door for you to be attacked and trolled too. But the payoff is that someone could take a liking to you and hire you. Think about it - how many people do you know who are really strong and sound in their understanding of their field of study/occupation? And if you know some, then how many of these are good at expressing their knowledge in a manner that makes the subject easy to understand for the reader or receiver?

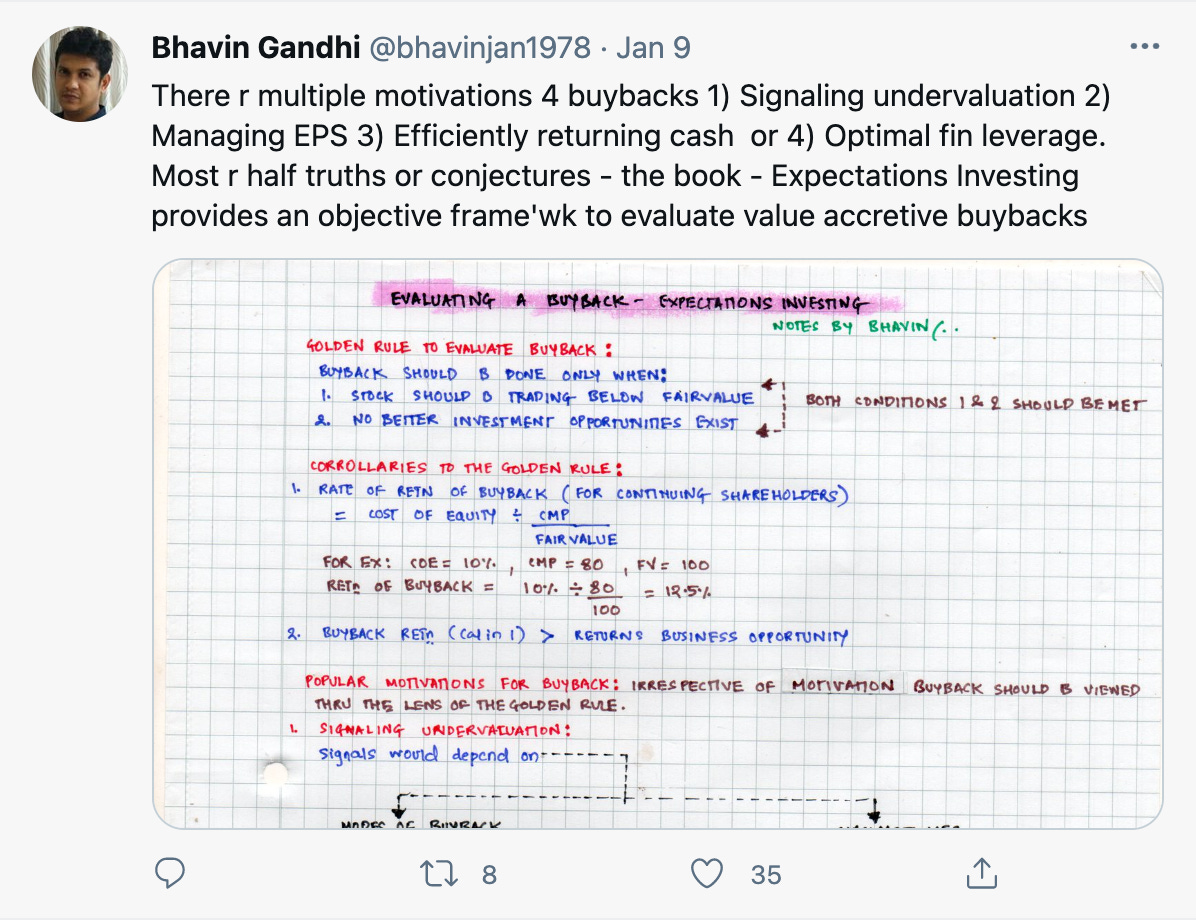

Very few, according to me. And if these very few get discovered online, why wouldn’t they be offered opportunities by the entrepreneurs who know how to prowl the online jungle to discover a hidden talent. Following is an example of Bhavin Gandhi’s work who was recently recruited personally by Mr. Kalpen Parekh, President of DSP Mutual Fund, India.

Bhavin has been posting since Dec 2019. 2.5 years of making his understanding available for us all to benefit from, has psychic benefits to him for sure i.e. in terms of friendships created and value-added to the FinTwit community. But how do you quantify the financial rewards that were to come in time for him? How do you put a price tag on the opportunity to work with one of the biggest AMC’s in India in the Research Team? How do you value the resources he has at his disposal today to compound his capital at a very handsome rate?

You Can’t. It is an asymmetric bet and isn’t linear.

Even Rahul Mathur, Founder of BimaPe in India has posted about hiring via Twitter where talented individuals display their work in public to be looked upon or commented upon.

Just in case you spotted Balaji in the tweet above, let me share his profile with you, only if you were curious to know -

Balaji S. Srinivasan is an angel investor and entrepreneur. Formerly the CTO of Coinbase and General Partner at Andreessen Horowitz, he was also the co-founder of Earn.com (acquired by Coinbase), Counsyl (acquired by Myriad), Teleport (acquired by Topia), and Coin Center.

He was named to the MIT TR35, won a Wall Street Journal Innovation Award, and holds a BS/MS/Ph.D. in Electrical Engineering and an MS in Chemical Engineering, all from Stanford University. Dr. Srinivasan also teaches the occasional class at Stanford, including an online MOOC in 2013 which reached 250,000+ students worldwide.

There is merit in writing online, posting your work online, tweeting your work, engaging with the brightest in your field of interest, and surrounding yourself with people smarter than you.

You can’t quantify the payoffs here but they surely can be 100X or 1000X of your investment of time or money.

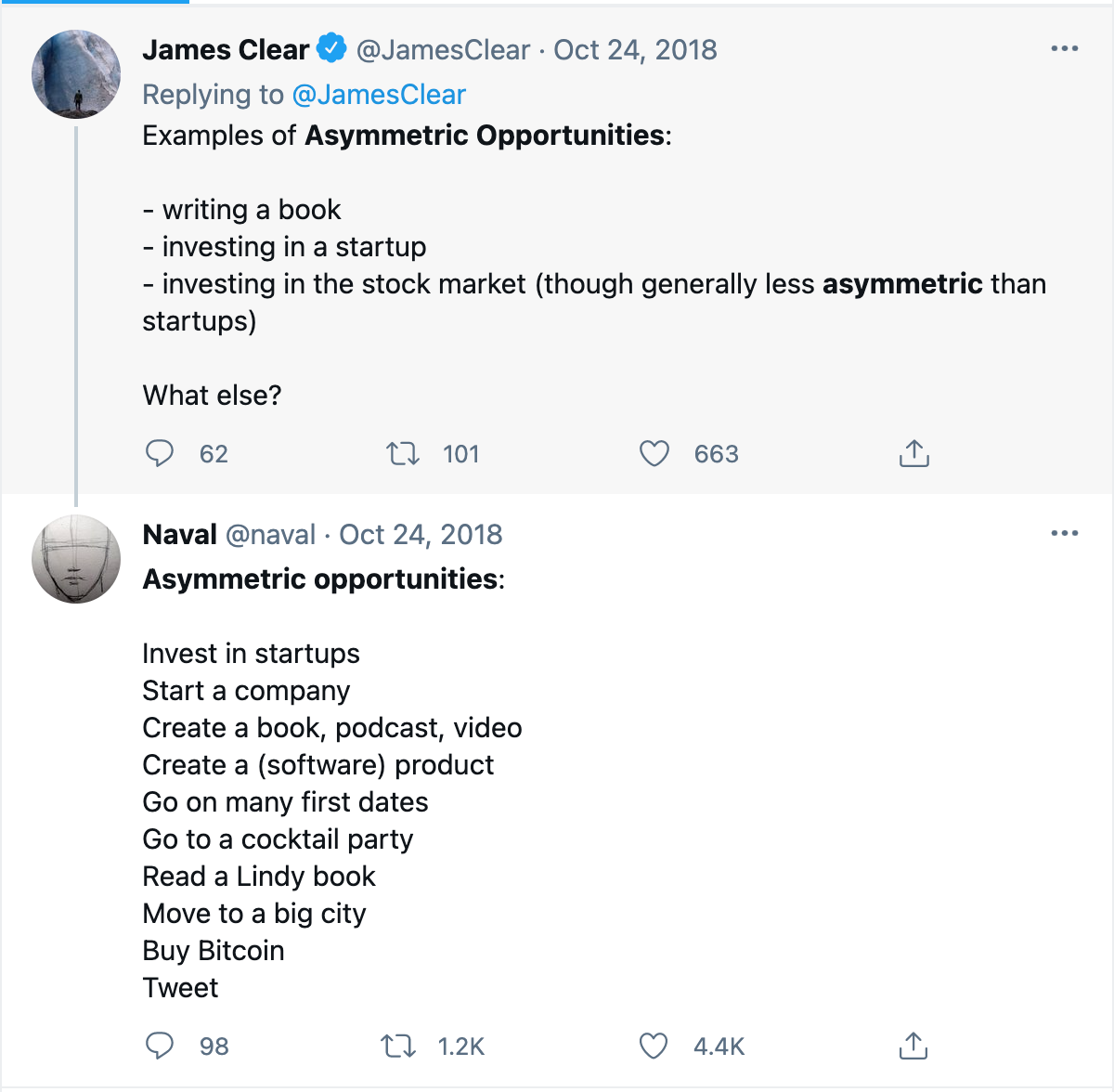

In case you have heard about the International Best Seller Atomic Habits, then you would be familiar with the author James Clear. If not, then please do get your hands on this book and read it, please. Even he has something to share about Asymmetric Bets -

Naval Ravikant is an Indian-American entrepreneur and investor. He is the co-founder, chairman, and former CEO of AngelList. He has invested early-stage in over 200 companies including Uber, Twitter, Notion, Clubhouse, Opendoor, Yammer, and more than 10 Unicorn companies.

The reason why Best Selling Authors or Uber successful Venture Capitalists talk about asymmetric Bets, then one must pay heed to what they are trying to say. Buying Bitcoin is one such bet which can 100X your investment. But limit the investment to 1-5% of your capital so that you don’t lose sleep due to the volatility in the asset class.

How much can go wrong by going to a Cocktail Party? Not much actually. But what if you get to meet interesting people from your industry, what if you get in on a conversation about the next breakthrough technology, what if you become aware of a new opening in a firm you were keen to apply to? The possibilities are huge, just needs some effort to turn the stones in the rough.

How much would you pay for reading a Lindy Book i.e. a book that has stood the test of time e.g. Snowball, Titan, One Up on Wall Street, The Little Book that Beats the Market, Poor Charlie’s Almanac, Seeking Wisdom, or others? How much time would it take to read one of these? How does this cost of USD 20 and the time investment of 20 hours compare to the learnings you may receive from these books? It is 100X or more, surely not less.

I have shared in my earlier newsletter about my learnings from Warren Buffet’s Annual Letters since 1965. These 55 letters changed me fundamentally. It altered my view on my Investment Portfolio, my spending habits, my saving habits, my reading habits, my circle of competence, the people I started surrounding myself with and so much more. I have learnt more from these 55 annual letters than my MBA, CFA, and my 14 years of Wealth Management experience.

“Uncertainty is an uncomfortable position. Certainty is an absurd one.” - Voltaire

Make Bets by all means. Just make better bets, instead of the linear ones only. It’s exciting to go through rabbit holes that could surprise you with relationships and opportunities that you couldn’t have planned for even in your wildest dreams. But these rabbit holes or choices are uncertain and out of your comfort zone.

But they also are as exciting and memorable as your junior years in college would have been, where you were exploring and discovering new things about self, others, and life in general. It feels liberating to forge new paths and bump into magical moments.

Youth isn’t about young age. Youth is about being alive. Being alive requires you to change the set patterns life tends to get into. Change is the only constant if exponential growth is what you seek. And many goals that you chase today are only possible via exponential growth and not linear ones.

Think about it …

“The only thing harder than changing is paying the price for not changing.” - Shane Parish

Wishing you loads of love and luck.

Manish