The more decisions you make, the less willpower you have. It’s called decision fatigue. Focus on making fewer and better decisions. This allows you sufficient time to think about each decision deeply and reduces the chances of making a mistake. We should restrict ourselves only to those cases in which the investment decision looks like a no-brainer. As Charlie Munger says, “The goal of investment is to find situations where it is safe not to diversify.” - Gautam Baid in Joys of Compounding

If you go into the history of business failures globally, you will be surprised to learn that many a time, the entity got distracted from its core product/service and paid attention to the non-essentials where mistakes could prove fatal to the point of no return.

Few Examples from Valuer #

Case # 1

Enron Corporation was an American energy, commodities, and services company, which was named as America’s most innovative company by Fortune from 1996 to 2001.

At the end of the 1990s, the Dotcom Bubble was on the rise and Enron decided to participate by creating Enron Online in 1999, an electronic trading website. By mid-2000 EOL was executing nearly $350 billion in trades.

That same year the dot-com bubble burst and Enron quickly began building high-speed broadband telecom networks. This project ended up costing a fortune for the company with no return in profit. The CEO of that time Jeffrey Skilling had been hiding the losses from the company.

When Ken Lay took over as CEO in 2001 Enron’s broadband division reported a massive $137 million loss. In December, Enron filed for bankruptcy and in 2002 the Justice Department launched a criminal investigation, where Enron’s accounting firm, Arthur Andersen was convicted of obstructing justice.

Case # 2

Kodak, a technology company that dominated the photographic film market during most of the 20th century. The company blew its chance to lead the digital photography revolution as they were in denial for too long.

Steve Sasson, the Kodak engineer, actually invented the first digital camera back in 1975. “But it was filmless photography, so management’s reaction was, ‘that’s cute—but don’t tell anyone about it,” says Sasson. The leaders of Kodak failed to see digital photography as a disruptive technology.

A former vice-president of Kodak Don Strickland says: “We developed the world’s first consumer digital camera but we could not get approval to launch or sell it because of fear of the effects on the film market.” The management was so focused on the film success that they missed the digital revolution after starting it. Kodak filed for bankruptcy in 2012. The Kodak failure surprised many.

And there are many more all over the world and some of you would have seen personally how people have ruined well-established businesses, small or big.

What went wrong and what does it have to do with Investors like you and me?

If you look at Enron’s case, they were doing USD 10 billion + revenues in 1996 and had a lot going on for them. But the team of Lay, Skilling, Fastow, and others was paying attention to pleasing Wall Street and taking home higher incentives which were built on flawed Accounting models, wherein revenues were overstated and the cost of revenue was understated.

Instead of paying attention to the business and securing its moat for a very long time to come, the management was distracted with incentives, making an impression, being in the news and this costed them dearly.

Kodak management too was distracted with pampering its Sacred Cow, instead of protecting its business by working on technologies that could tomorrow disrupt their very existence.

Yahoo was distracted with the objective of turning itself into a media empire that does everything instead of building Search or Email into a dominant player in its category.

Nokia, like Kodak, got distracted with the objective of not upsetting their customers with a change in the technology and interface. Instead of focussing on the product/service and its enhancement and constant up-gradation so that no competitor comes close to threatening its dominant position in the market.

The same story repeats with Kingfishers & Satyam’s in India. Distraction from the core objective leads many astray. It makes for a good story and movies/books are written on these fallen angels. But come to think of it, it is basic human instinct to be seduced into many attractive distractions and they start small, very small but get bigger with time if left undetected and allowed to grow into a monster of its own.

This tendency has been at the source of derailing an empire/entity/king/individual into a very difficult situation from which very few have had the stomach or the resources to dig themselves out of.

Instead of “don't put all your eggs in one basket,” we get Mark Twain's advice from Pudd'nhead Wilson: “Put all your eggs in one basket—and watch that basket.”

Let’s start with the definition of distraction. Distraction is “the process of interrupting attention” and “a stimulus or task that draws attention away from the task of primary interest.” In other words, distractions draw us away from what we want to do, whether it’s to accomplish a task at home or work, enjoy time with a loved one, or do something for ourselves....

If distraction becomes a habit, we are unable to sustain the focus required for creativity in our professional and personal lives. Worse, if we are constantly pulled away from friends and family by distractions, we miss out on cultivating the relationships we need for our psychological well-being. - Nir Eyal

This is one of the most profound videos I have seen. It so beautifully depicts the state of human affairs when you are constantly distracted. It could be a mobile device as shown in this video or it could be umpteen other interruptions that take you away from the task at hand.

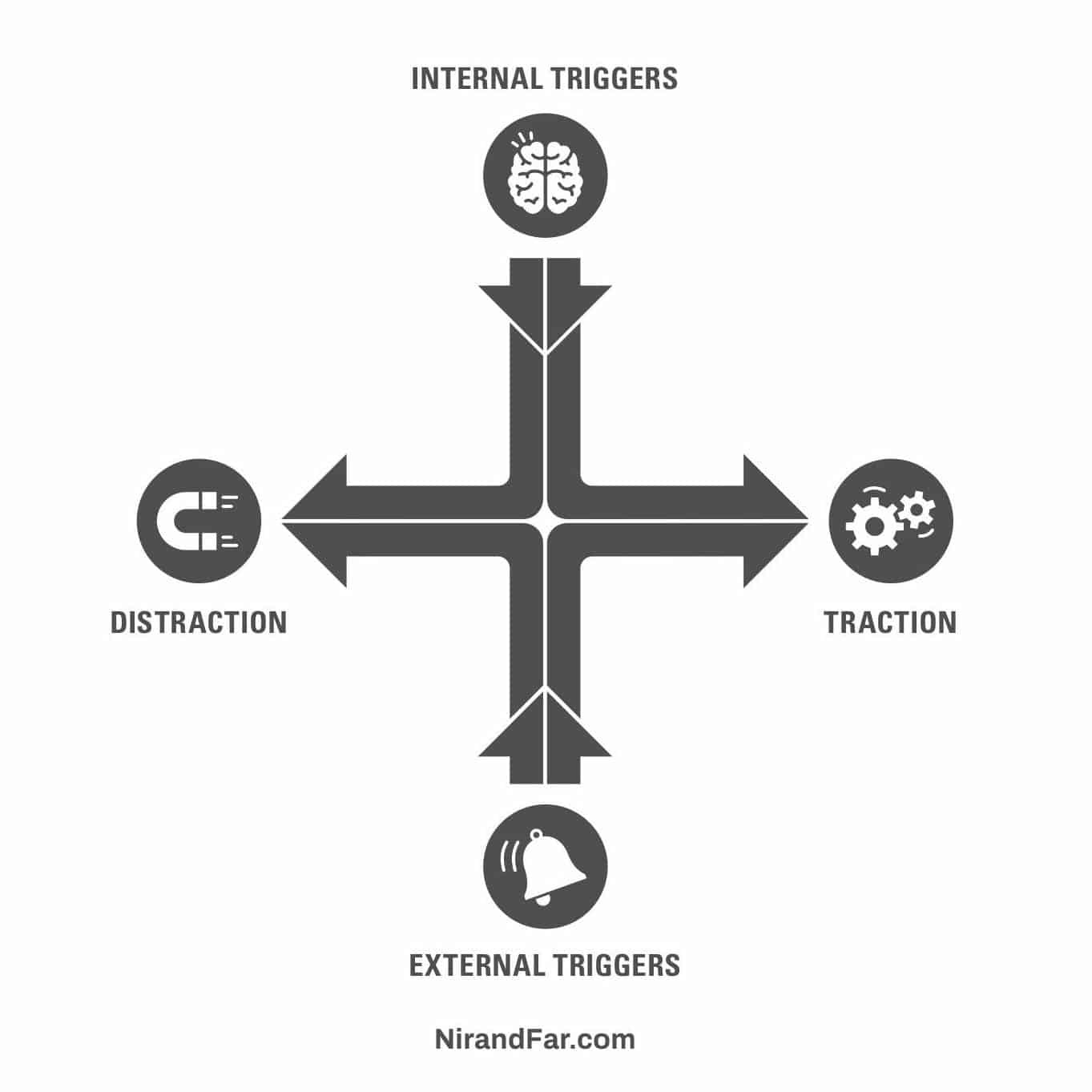

These distractions, at the core, are caused by internal and external triggers. Internal triggers could be the avoidance of some pain or discomfort, FOMO, boredom, laziness, insecurity, fatigue, or another bad feeling that a human being has to constantly deal with.

Now these internal turmoils have a whole field dedicated to them and there is a lot of data supporting the psychological impact events, people and circumstances can have on others. And hence one has to find ways that are unique to you and work best on you to get you in the zone. For me, my meditation sessions and workouts early in the morning play a major part in keeping me thinking right. I have a friend who feels the same post cycling and dancing does the same for my wife.

Conquering one’s internal demons doesn’t have a one-stop solution. It is a battle that will go on till your alive and wanting to kick ass at what you do. And hence, it’s a journey to be on and explore. Having the right people around you is also fundamentally important.

But today’s post is about the external triggers that distract us from what we need to focus on. And that’s the environment around us that isn’t structured in a way to support our goals.

Let’s look at distractions in your pursuit to Investing Smart #

When you have options to trade that provide you with all the bells and whistles in our business, you can’t help but get seduced into making many decisions to buy and sell. It is so easy to place a BUY order for 1000 Dogecoins when you see Musk referring to it on his Twitter feed or to place a SALE order on your Amazon stock since you need these sale proceeds to buy more of a Biotech company that is a penny stock today but could be a USD 100 billion company tomorrow.

Your constant Buy & Sell decisions have costs attached to them and they interrupt the compounding of your portfolio unnecessarily, assuming that you are holding a solid portfolio of stocks/ETFs/funds. Technology has made Investing so easy but it ain’t an advantage to an untrained eye, it is just convenient, nothing else.

The advantage would be when you have an insight into the business/sector that would make you bet heavy on your selected security and make handsome gains due to the size of the bet. But because things are convenient, one could get caught in the gamification of Investing instead of digging deep into the nuts and bolts of what moves the price of the security for the long run in the first place.

And the most natural outcome of you enjoying these games created by Robinhood, Interactive and others, is that you will over diversify i.e. hold many securities in your portfolio in small lot sizes. And hence even if you gain 100% on one security, it doesn’t move the needle for you since the position size is small. But you surely will have a story to share with others about your 100% gains and also the feeling of being a good investor tickles your senses making you want more and more of this thrill.

But this ain’t the way to really make it big in Investing. Let’s hear from Warren Buffet on his take on Diversification #

“The stock market is a giant distraction to the business of investing.” —John Bogle, Founder of Vanguard Group.

And hence I love the platforms which are very simple, without any bells and whistles to make it look fancy. I prefer my Stockal or HDFC Securities Account that provides me a facility to place orders. I have to use many other resources to arrive upon my decisions to buy/sell but it sure ain’t my broker’s messages or platform. And these resources are screeners, annual reports, Koyfin, Twitter, Podcasts, and sometimes even coat-tailing other legendary investors.

But this is work and not as convenient as pressing a few buttons to buy or sell. I was told yesterday by a friend to buy Palantir but I did not even though I could just place the order on Stockal. Unless I haven’t done my own reading on the company through many resources I have built into my research stack, I just can’t and won’t place the order.

And hence I may not make the 100% on Palantir if my friend does, but I am happy making 20% y-o-y on my portfolio. This allows me to sleep well instead of looking at Palantir prices first thing in the morning tomorrow on my fancy app, which of course I don’t have. All my buy-sell decisions happen from my desktop version, only after I have written down my reasons to buy the same and also the probable reasons my decision may go wrong.

This helps me to stay away from unnecessary interruptions to my portfolio’s compounding. I don’t have a trader's mindset and hence this works for me.

“A strategy of financial and mental concentration may reduce risk by raising both the intensity of an investor's thinking about a business and the comfort level he must have with its fundamental characteristics before buying it.” - Warren Buffet

Another distraction is the constant stream of communication from your brokers, apps, agents, credit cards, government agencies, Bloomberg, gym, and everyone else who wants to reach out to you and let you know how much they care for you and how their service or product can change your life 😃

This barrage of communication is a threat to your ability to FOCUS and get things done. It’s like being interrupted by a crying baby on another table when you are out on a candlelight dinner with your spouse on Valentine’s Day. The cranky baby isn’t gonna let you have a memorable evening with your spouse. The night will be ruined unless two of you or the baby leave the restaurant.

But we still allow others to bombard us with messages only because your FOMO induced brain wants to be in the know of everything that is happening with your country, your investments, your government, your gym, your credit card points, your clients, your family - and all this info has to reach you the moment it is sent out by these agencies.

By the very virtue of keeping your notifications on, you are making a statement that everything in my life is equally important and hence should have the right to disturb me, irrespective of what task I’m doing. Well, if everything is equally important, then nothing is really important to you.

If you look at my iPhone screenshot, I have all notifications turned OFF. All of them barring 2 i.e. incoming calls and my To-Do List which I manage through the THINGS App.

Only 2 things matter, for me at least - Getting Things Done as planned/scheduled in THINGS and being in communication with my team/partner/family/line manager/client so that the work gets done seamlessly.

If it’s urgent and important, I will get a call, no doubt about it. But if it isn’t urgent, then I will get an email/text/WhatsApp. Hence the Call Notification & Sound is On. As for text/email/WhatsApp - I will revert and respond to that once the task at hand is completed. And it gets completed faster when you are not interrupted.

THINGS notification serves as a reminder for me to look into it as there still would be things pending to be completed for today or rescheduled for later.

Every other app on my iPhone can wait and it does. I go on Twitter when I want to, not when someone else would like me to. I will download the new podcasts when I want to, not when Overcast is ready to stream them to me. I am not interested in the new card or loyalty points launched by my bank and hence I don’t want to hear about it. I don’t want to know the new IPO launched by HDFC Mutual Fund. If it is good, I would come to know about its performance through my reading on Indian Markets via Twitter/Newsletters.

As Nir Eyal says “The right approach is to ask whether the external trigger is serving you, or are you serving it. If the prompt leads you to traction, keep it. If it leads you to distraction, eliminate it.”

Just in case you are like me, then you too would be getting many emails from many places. Some would be your fund transfer receipts, some your trade confirmations, some purchase receipts, some from the newsletters you subscribe to, some could be waiting for a job offer or your exam results - the options are unlimited.

The problem is that our email has been registered with 100s of agencies/institutions and that database is also sold to others and hence we get important emails, unimportant emails, rubbish or nuisance emails, spam, marketing promo emails, and it’s endless and hitting your inbox constantly.

Hence I subscribed to a service through Mailman that blocks out all emails and sends them to me only at a predetermined time of the day i.e. 4:30 pm every day. I don’t get any emails till 4:30 every day, and I love this service. No inbox, no anxiety, no interruptions, no checking inbox constantly, Zero Distraction.

I must admit that my wife laughs at this purchase of mine. But I know that this is money well spent as it allows me to focus on the task at hand and cuts out the world that has an incentive to gain my attention and seek my eyeballs to read what they want me to 🤠 I am not available till 4:30, Sorry …

In today’s world, staying focussed and getting work done is a super power. That’s what moving from distraction to traction in the above slide refers to. That is what’s needed to build momentum in the projects you have taken on. Multi-tasking is unavoidable, but let’s reduce the number of tasks to address by cutting out all the noise and nuisance that fills our day.

2020 was one of my most productive years ever. I cleared my CFA Level 3, started a blog that you are reading right now, started a podcast which will be launched in March, finished a Valuation Course by Vishal Khandelwal and also had a super productive year in my Banking career. All of this in 365 days became possible with one tweak to my lifestyle i.e. cutting out the noise post 8 pm.

By cutting out the noise post 8 pm, I meant calling it a day and wrapping up everything I was doing so that I could crash. This was radical in a way and I literally was not available for many calls/zoom sessions/parties/events/conversations or tasks. I am sure some would have thought that I am becoming an uncle or an old bum who has lost it.

But it was super productive for me on many counts.

I had 4 hours to me before my job began i.e. from 4 am to 8 am. I used that time to meditate, workout and study everyday. This habit got so ingrained in me, that I started waking up at 4 am even on weekends. By 9 am on weekends, I was done with 2 hours of study and my workouts. 99% of people I know wouldn’t have even woken up by then.

I am tired by the end of the day and hence not thinking straight, which makes one do sloppy work or make bad choices. I cut this out by crashing early and keeping all tasks and choices for the next day, wherein I will be at the top of my game.

Since I got the best 8 hours of sleep, ever, this helped me to be mentally charged up to take on all tasks and execute them with efficiency I haven’t operated at. I could study in 2 hrs what would take me 5 hours earlier, I could finish my blogs in less than 4 hrs which would take me more than 10 hours every time, I would have the zest and zeal in my demeanour at all times till it was time to call it a day.

My workouts started having the desired effect on my body and for the first time in my life, I wasn’t fitting in Medium sized clothes. I was thrilled to be shopping for Large sized clothes and that wasn’t because I was putting on fats. I was developing a better physique, a better posture and feeling good about myself.

The time created for me by starting so early, also allowed me to learn Valuation from Vishal Khandelwal in India which prepared the grounds for doing my own research on stocks and building an equity portfolio across India & US. Markets have done well in 2020 and so have I. But I am prepared for tomorrow with the tools I learnt yesterday.

In 2020 alone, I would have read 25+ books along with 60 years of Annual letters from Warren Buffet.

Sounds Wow when I read it but it was simply, cutting away distractions and making room only for what attracts me.

I started journalling in 2020 too. Since I was cutting away the nuisance to a great extent, I had time to think about how was I progressing on daily basis. And hence I would ask myself the following questions daily #

My Learning -

My Crazy Thing -

My Generous Thing -

My Creative Thing -

What bad habit did I curb today -

How am I better today -

Resting Heart Rate -

Books I Read Today -

Podcasts I Heard Today -

These look like simple items to answer but it reinforced the habits I needed to be forming to make my day productive, which leads to a productive year, which leads to a life that’s been impacted with the right habits.

If you were to ask me what did I do on 18th March 2020, I can tell you what all I did that day, how I slept that (resting heart rate data), what did I read, etc. It’s been amazing to build this habit since most of life gets forgotten due to the responsibilities we have upon us. But it’s interesting to journal every day and look back and realise how far I’ve come, how much better my day goes, how many things have got accomplished.

“Minimalism is basically an extension of simplicity—you not only take things from complex to simple but also try to get rid of anything that is unnecessary. Few things in life really matter. Because few things matter, we must think carefully about what really matters to us and then commit our time primarily to those things. That way, we will remain focused on what matters rather than chasing the new thing, which probably will not really matter. The goal is not to have the fewest number of things but to have the optimal number of things.” - Greg McKeown in his book Essentialism.

Hope this post gets you started to making life simple. It is a SUPERPOWER.

Loads of Love & Luck.

Manish