“The only way to win in a Las Vegas casino is to exit as soon as you enter.” - Morgan Housel

Morgan makes this statement only because the odds are against you at the casino. Not only are the games designed with low odds, but even the environment is gamified to make you lose any sense of time or any guilt-like emotion.

Casino designers have many objectives to deliver upon. The most important one is to make you stay there for as long as possible. Now that would require them to give you a dopamine hit constantly, while removing all possible distractions that could take you away from the action on the floor.

And hence, there is free food so that you don’t feel hungry. There is free booze so that you ain’t tempted to visit the bar across the street. There are all kinds of shows that give you a taste of your guilty pleasures. There are spas, rooms, business centers, theatres, and many other attractions built-in. Why would you leave? Where else on earth would you get this kinda action?

Since there is none. You stay put. Add to that the missing clocks and missing windows, you even lose any sense of time. All this leads to you spending more time playing games with a higher probability to lose. But doesn’t this run contrary to your intelligence which is supposed to make you exit situations that are loss-making?

Outside the casino, Yes. Inside the casinos, they are working on all your biases to make you act irrationally. They have data scientists, psychologists, sound and light engineers, and many other experts on their payrolls to work their magic on you. Their potent tools and techniques make your own humanity work against you.

Let’s look at some of the biases they are exploiting -

Loss Aversion Bias #

We experience 2X the pain of a loss vis-a-vis the pleasure for the same amount of gain e.g. Most would refuse a 50/50 gamble with outcomes of a $1000 loss or $1100 gain. Statistically, the gain must be increased to roughly $2000 to make it attractive to most to take this bet.

Visitors land up betting 100s of dollars on the roulette table or blackjack, knowing very well that chances are high they may lose it all. What still keeps them going is the pleasure derived from all the freebies thrown at you and the attention you get while on the table. The pleasure you derive from being at the center of this action overcomes the pain of loss of that amount at stake. No wonder, visitors keep flocking to the casino, rationalizing that it was worth the fun.

Recency Bias #

Something which is more recent occupies more recalling power in the brain compared to something that happened long ago and hence we tend to weigh that activity as more important than others.

If you ever remember going to the casino, it would look like many are winning. You will have people sitting with many chips on the table, people winning on the slot machines, the sounds of coins being released to the winner at the slot machine, high fives, and smiling faces around you. You start believing the illusion that you could be next.

You don’t get to see the losers that came in with USD 100,000 and left with nothing in hand. You don’t get to see the domestic issues of people struggling with their gambling addiction. You don’t get to experience the tales where the greed of earning quick bucks turned into anxiety, leading to desperate measures or rash behavior.

Since you only see the glittering landscape of greed, you believe in the illusion crafted by the characters in there. It’s vivid in its display and it’s addictive in its grasp on you. Hence, you too stack the chips and throw the dice, for the entertainment of the dealer.

Another version of recency bias is “Gambler’s fallacy”. It is a classic phenomenon explaining the bias because of recent events. Investopedia defines it this way —“When an individual erroneously believes that the onset of a certain random event is less likely to happen following an event or a series of events. This line of thinking is incorrect because past events do not change the probability that certain events will occur in the future. For example, consider a series of 20 coin flips that have all landed with the “heads” side up. Under the gambler’s fallacy, a person might predict that the next coin flip is more likely to land with the “tails” side up.”

This is why they show you the last 20 numbers on the roulette table. Your brain sees it and tries to make patterns of the game. There ain’t any pattern, but you are seduced into believing that you can make sense of it all and hence bet on a colored number. What you are actually betting on is either reversion to the mean or the hot hand. This is where you have been suckered in by your misplaced overconfidence.

Overconfidence Bias #

The overconfidence bias is the tendency people have to be more confident in their own abilities, skills, or even their luck.

And a casino exactly knows how to trigger this, again and again, game after game. The algorithm of a slot machine can be easily designed to make small wins happen for you. This is where you make some money, read the congratulatory message and hear the machine go chi-ching. Now you are thinking, you could do better. You missed the jackpot by 1 number last time, this time you might just swing 7-7-7 for the bumper prize.

This is where the hedonic treadmill also plays out against you. The wins you made don’t satisfy. You, psychologically, are driven to want more irrespective of how much you have. And the machine makes you go for more, that’s exactly what it has been designed for. To tease you, to flirt with you, to excite you, and then to dump you.

Your fallacies and vulnerabilities are known to every corporation out there with a product or a service to sell. If the casino can gamify the environment and your experience to make you lose money, then making you spend money is even easier. It just needs to be gamified so that you can take pride in playing the game the corporation wants you to play. If they can have a bigger wallet share of your savings, then they will be coming onto you with all guns blazing. Let me share with you a few examples -

Retail Stores use Decoy Effect #

The decoy effect is defined as the phenomenon whereby consumers change their preference between two options when presented with a third option.

Imagine you walked into Sharaf DG Showroom to buy a 42 inch TV and you are looking at the BENQ model (USD 500) since it’s cheaper and has almost the same specs as Samsung (USD 1000). While shopping around, you noticed a 72 inch TV by Samsung that retails for USD 2500. You might just give it a pass and think that it’s irrelevant for you. To you, it may be irrelevant but its effect on you isn’t.

Once you have seen a TV priced at USD 2500, your brain rationalizes you choosing Samsung for USD 1000 over BENQ, since it’s better than BENQ but cheaper than the USD 2500 screen you saw. Even in a coffee shop, you have 3 options - small, medium, and Grande. Chances are you might choose small almost always, but since Grande is there, Medium becomes the default option for most drinks.

Digital Magazines use Bundles #

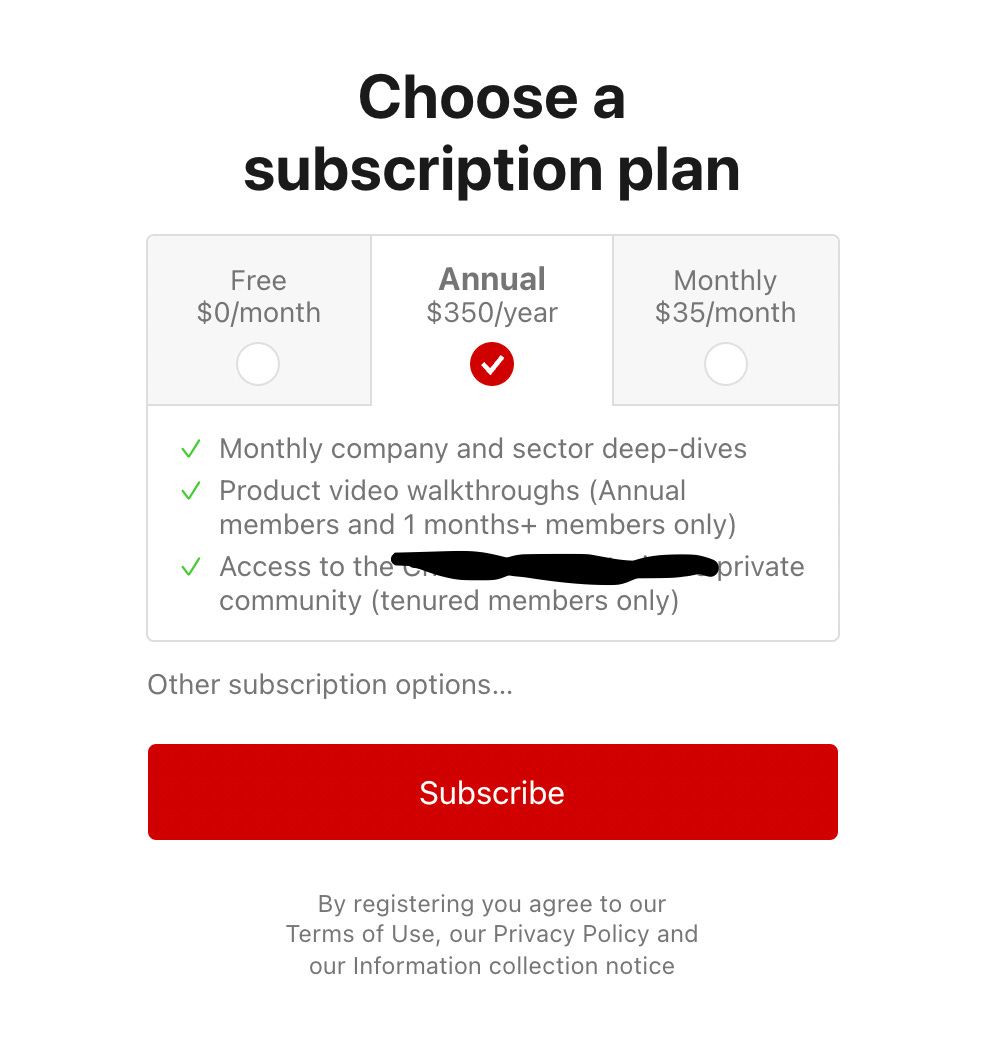

Even digital bundles work on the same premise. There is a whole field of studies emerging in Psychology that attempts to understand what makes people buy. If you go deeper, it would also reveal answers to ‘what would make people buy more and more?’ Let’s look at Newsletter Subscription options -

The Freemium model gets you hooked on and many a time you will get very insightful posts with the content behind a paywall. You ignore once, twice and after some time, you decide to bite the bullet and subscribe. A yearly subscription offers you a discount, rightfully so for getting locked in. But alternatively, it also makes your purchase decision for the monthly option easier. You may just opt for it to try.

But once you have paid, inertia and laziness or any friction built into the cancellation process will just keep you away from canceling the subscription. I remember I had to call a publication in the US to cancel my monthly payment option. They had built enough friction in the process by removing the cancellation button on their mobile app or website. But I was hell-bent on not being gamed by them and hence I made the call and got rid of the service.

Twitter goes Verified #

Now it’s a game for who gets the maximum brownie points, eventually to be gifted the blue tick. There are courses on how to crack Twitter’s algorithm, how to tweet effectively, how to engage and how to build an audience.

Don’t get me wrong here. I love Twitter, own its shares, and have even bought courses to build my tweeting skills. But it’s a game, and I consciously want to play it. But even within the game, there is a game going on. For the highest no. of likes, no. of followers, super followers, or verified accounts. It’s a meta-game created to keep you in the game, where there is no end, no last stage, no life to lose — just play as long as you can.

Credit Cards have loyalty points #

Bankers are scraping every possible loyalty point/air mile to become a part of the privileged club of frequent fliers to whom all perks are showered upon. These travelers can use the first-class lounge, take their guests with them, have a pick-up arranged, and have wifi on the flight.

Fuel Up Scratch Card #

My gym cafe has a scratch card which allows the 7th meal to be free. That makes me buy regularly from them, carry their bag every day to my office, build a certain liking for the food, and make Fuel Up my go-to cafe eventually e.g. this Saturday I was in a hurry to reach somewhere, and I passed by my gym cafe to eat something I liked before reaching the venue.

The scratch card works. It always did.

Kindle Streaks #

Kindle notifies me on my reading streaks and congratulates me on being consistent with this activity. Owner of Kindle, Amazon awards me Diamonds for regular purchases. For being a prime member, I get my goods delivered in 24 hrs whereas the same product could take 3-4 days for a friend who isn’t a prime customer. That makes me wanna continue paying to be prime and makes my friend consider the option to become prime.

You can’t avoid getting sucked in or seduced by these exciting games around you. All of these games have pleasant people showering upon you perks and attention that make you the center of a story being built. It’s like being in a movie and the technology hides in plain sight while it shouts ‘Lights, Camera, Action’.

You cannot stop your human biases to take control unless you are an evolved saint, and absolutely devoid of emotions and urges.

Hence the only way out is to decide on games you want to play. Instead of having a wide net, you need to have a thin net with a very fine filter. A fine filter will eliminate most things from getting through, leaving you only a few to consider from. That cuts the noise and allows you to pick from the very small universe.

Having a filter is possible once you have clearly stated objectives? Without that clarity, you will be casting a wide net and letting every kind of distraction come in. But with a fine net, only those games come in that move you towards your goals. If they don’t, your out. At least for the time being.

As Jordan Peterson says in his book Beyond Order — “If you try to be everything, you will become nothing. If you try to be something, you will become a damn good something.”

This week, I had to decline -

A Networking event

A Personal Finance Course

Late night dinner with colleagues

An invite for a spiritual event

All of them were referred by people I like and some I even look up to. It’s just that the invite did not meet an objective I was committed to achieving. I could have said yes, but that would mean I am saying NO to utilize my time on certain priorities that have engaged me mentally.

As Simon Sinek says, “unless it’s a HELL YEAH, it’s a NO.”

The outcomes from your decisions aren’t in your control and the odds for desired outcomes are low too. The good news is that your decision-making framework is completely in your control.

But if you lose control over your decisions and allow the environment to decide for you, then you and your money will be played like a pinball machine.

You are being gamified by every single company, brand, corporation around you. Either be naive and let them take advantage of you. Or make the most of companies, brands, and corporations in your life so that it gets you closer to your goal.

You are the only one playing that game. Everyone else is playing the game that takes them to their goals. So get damn good at the game you are playing. Damn good, and nothing less !!!

Recommendations for the week #

Samir Vartak was interviewed by Vishal Khandelwal on his One Percent Show. It was a fabulous story of India’s emerging PMS Fund Manager, who began his journey in the industry around 40 and still went on to create a very successful business in a highly competitive environment. Loads to learn from this interview.

Mathew Walker’s interview on Joe Rogan’s podcast was absolute gold. This dives into the various facets of sleep, how it enables you to operate at peak capacity and how the lack of it jeopardizes your performance and functionality in every possible way. Highly recommended.

Nitin Bhasin & Vinit Powle presented a very insightful session on Forensic Accounting. This is very relevant for Investors that select direct equities in Indian or global markets.