“All of humanity’s problems stem from man’s inability to sit quietly in a room alone.” - Blaise Pascal

It’s amazing to take a trip down my Twitter feed and just observe what’s going on. I follow 730 people and this list includes, billionaires, VCs, PE Investors, Analysts, HF managers, Fund Managers, CEOs, CFOs, Founders, and many others. My timeline is filled with thoughts/ideas/businesses/thesis that these high IQ people are mentally engaged with. It’s fascinating, to say the least.

Just yesterday, I read Alex Morriss's (@tsoh_investing) comments on Spotify’s venture into Video Podcasting. I even joined the Twitter Spaces where Alex, @FrancoOlivera, and @SleepwellCap discussed the opportunity ahead for the entity. I was exploring the music streaming business in India and wanted to know about Spotify and how it intends to compete/innovate in the west, which would give me some idea as to what will happen in India a few years down the line. It was time well spent and I gained insights that informed me enough about my investment decision in one of the music publishers in India.

A few days back, I read an article shared by @dollarsanddata on ‘the new kind of Fear and Greed’ by Josh Brown. It was a brilliant read on how Envy, FOMO, YOLO, and Insecurity have taken over the psyche of investors today. It very pointedly shared the incentives that people have for sharing their newfound wealth on various social media handles or deriding others on their choice to stick to conventional assets. This article is worth a read and I have even shared in the recommendations of the week.

But, you also get to see the variety of projects that people are involved in. Some are involved in DAOs, some are building AI algorithms for Valuing companies in public space, some are building Edtech companies, some building Insurtech businesses for Billion Dollar NBFCs, some are building no-code software as a business, some are sharing a certification gained after completion of a new course from Harvard / Stanford, and the list goes on.

It feels magical to see the plethora of exciting adventures people are embarking on. It’s exciting to get more information on these, it’s tempting to try some of them, it’s unnerving to miss the joyride someone’s got on and it’s overwhelming to decide upon from the options at hand. It’s like landing in New York with a map of the whole place in your hand and also the list of Top 100 tourists attractions that travelers love. BUT, only with 2 days in hand. Now, which attraction will you visit? Which party will you go to?

Choice # 1

Make a few choices based on your priorities and your preferences. Go all-in on these choices and make the most of the moments spent there. Take time out to make friends there, get to know people, enjoy the cuisine, explore the historic places, learn about the monumental events and take as many pics as you can.

This is exactly what we did on our visit to Switzerland. We spent 6 days in Luzerne and had a blast of a time visiting the mountains, taking a ferry ride, enjoying local food, cycling around, walking around, praying at the local church, paragliding, and shopping at the local handicrafts store.

This meant not going to Zurich, Geneva, Basel, or many other places. But that’s ok. Those 6 days were the most memorable days of all my trips with my wife.

Choice # 2

Decide to see all of New York in the 2 days that you are there i.e. visit 100 places in 2 days and take hi-res pictures with Statue of Liberty, Empire State Building, in Central Park, in Times Square & on Brooklyn Bridge. And that’s it - just get the taste of these places and capture them well on your camera so that you can share with the world about the places you’ve been to when in New York. And that gets brownie points with people, hence people do it.

But did you get to enjoy Central Park fully? It’s 3.4 square kilometers of beauty in the middle of one of the most densely populated metros in the world. Did you hear the birds chirping, did you smell the air, did you enjoy the walk that alone can take hours to complete? Did you visit the Bethesda fountain? Your answer will be a NO but you may rationalize it by saying “Who Cares?” since you visited the central park for a few mins and have it captured as a memory.

That argument holds only if you are traveling with an outer scorecard i.e. conscious about the points others will give you on your trip abroad. In that kind of scoring, it doesn’t matter if your trip was joyful or not. It doesn’t matter if you made cherishable moments with your loved ones. It doesn’t even matter if you got to know anything about the place, its soul, its culture, its roots. All that matters is how good your Instagram Feed will look.

Nothing wrong with this, but it’s pretty lame a way to travel. It’s like having constant pressure to score those brownie points that others are very stingy as it is to give. But that’s what most do and hence their travels are as stressful as their daily jobs. It’s so funny and yet true for many.

If you think harder, your Investing Journey is very similar to your 2 day trip to New York. In the world of Investing too, there are multitudes of games -

Equities

Bonds

Commodities

Real Estate

Fx

Crypto

Now to make this mix even more interesting, you have 100s of routes to choose from - direct vs passive, funds vs PMS, local vs international, diversified vs concentrated, short term vs long term, leveraged vs non-leveraged. If this isn’t overwhelming yet, then let’s add to the mix -

10,000+ equities

Millions of bonds

100s of commodities

1000s of real estate options

10+ major currencies

6000+ crypto coins to play in

This eclectic mix of investing choices, vehicles, structures, holding periods, and geographies is a mind-numbing affair for a mortal. Even the gods might be feeling sympathy for us Investors and the task at hand. What makes it extremely tough is the mental perseverance needed to stay off distractions or the shiny objects that so easily lure most. If it was a solo game, you still could mentally hold on to your principles, processes, and values. But when you are exposed to the wealth being created by others, that becomes unnerving and frustrating if you don’t get to participate.

As Josh Brown said in his piece “Envy will make you take wild risks with a portfolio. Especially when all you see around you are so many people you have such little regard for profiting off of things you know they themselves barely understand. The more exposure we have to the way others are investing, the more we begin to look at their returns as though that’s the appropriate benchmark. All sense of reason and perspective is left behind. If that asshole is doing it, I can do it better.”

The same thing is happening with many adults today. They want to play all the games in town and make hay till the sun shines. When I say adults, I refer to all of them, even Donald Trump’s of the world. E.g. he announced yesterday a new SPAC that wants to be the next Netflix, Amazon, Facebook & Twitter, all in one. It basically wants to be everything and hence launched a SPAC to see its price skyrocket 800% in 2 days.

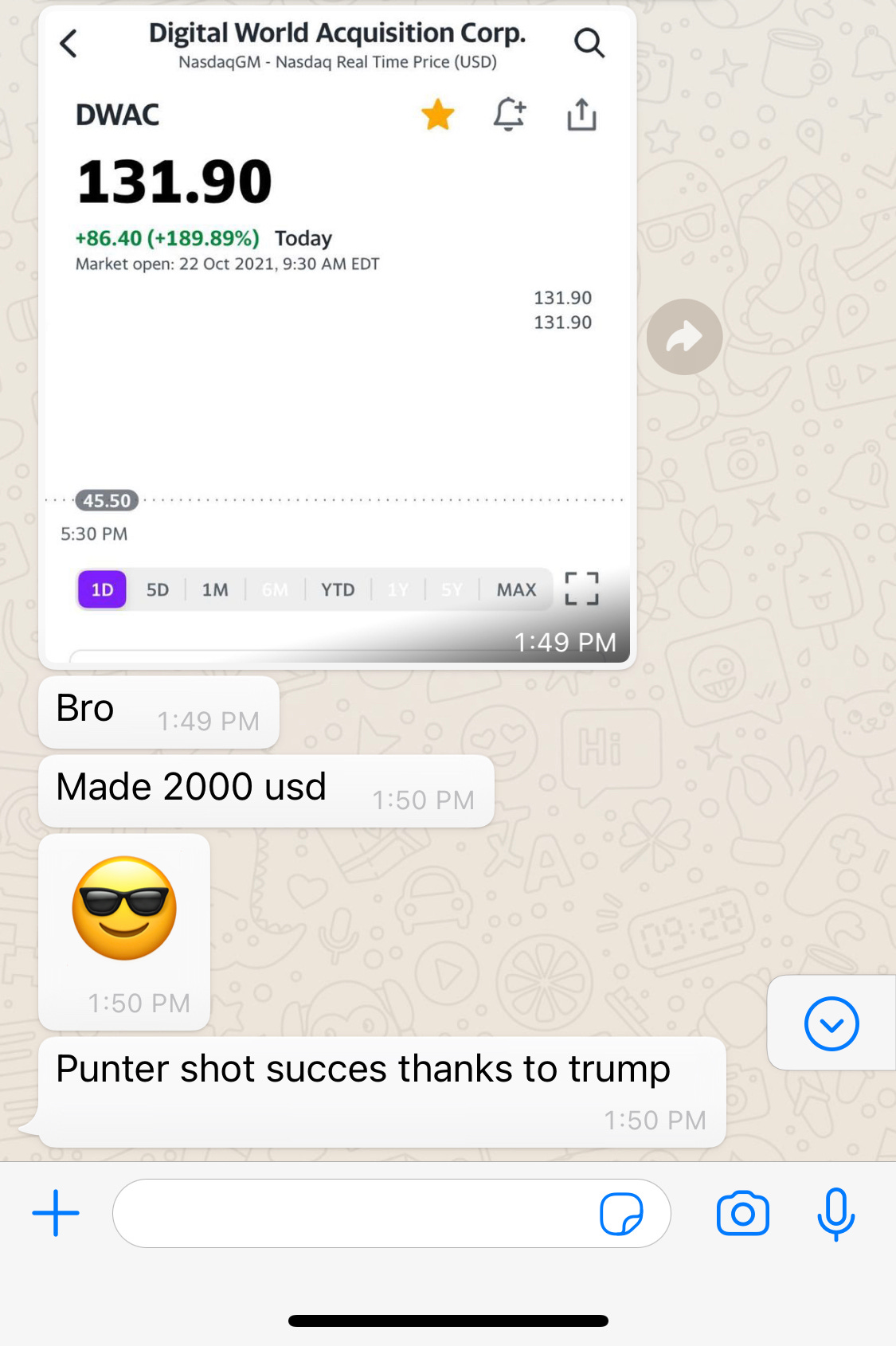

This company has no product yet, the founder has made the US presidency a joke and we still have people buying his wares. Donald Trump definitely wants to catch up and not be left behind his billionaire peers. But the ones buying his SPAC also do not want to be left behind their successful peers and have bought a ticket to this lottery called SPAC. I just had a friend share with me today morning that he made USD 2000 by betting on Trump’s SPAC ‘DWAC’.

I have a friend who was studying for his level 3 CFA but has dropped out to focus on building his own Crypto Coin. He ain’t an engineer and has no experience in Crypto Asset Management/Trading, but he still chooses to pursue the crypto dream. With 6000 + coins, the odds are against 99% of the coins in play. If it works out for him, it would be a story that will take the press by storm. If it doesn’t, he still had the courage to try, and I have immense respect for that virtue.

The NFT boom has taken the space in all business publications worldwide. I recently started seeing DubaiPeeps NFT on my Instagram Feed and even if UAE doesn’t have the talent pool for the creation of NFTs, it has enough pool of Money to be splashed on this asset class. It’s only a matter of time that my colleagues and friends will be posting their NFT purchases on their feeds or boasting about it in social circles. If spending some money makes you sound cool and in touch with the digital economy, then it’s worth it for many I guess.

The temptation is too strong, the urge to do something has invaded the minds of people, the looking good syndrome has spread further than COVID, and hence finding people developing excellence in their chosen profession has become a rare commodity.

Even companies know the psychological flaw in many i.e. Everyone wants to grow faster, get bigger, do more, achieve more with less !!! So why not promise the abundant wealth at a click of a few buttons, why not promise expertise with one course online, why not promise the stars with a potential raffle draw and why not promise the adulation with a fancy watch or a suit.

Being unaware is helping society to work against you and swindle you of your own time, money, energy, and resources. It’s like having yourself dig your own grave since you’ll be visiting very soon.

Ironically, everyone you look up to has gone deep in the trenches of their trade. Take any professional who has become an authority in his field, he would have decades of experience filled with his and lows, success and failures, booms and busts. It is only after the anxiety-filled ride called LIFE, have they gained a reputation and respect from audiences all over the world. It could be Amitabh Bachan as an actor, Warren Buffet as an Investor, Dhoni as a Cricketer, or Dwayne Johnson as an Entrepreneur.

They chose to go deep in their trade before they could spread their wings and go wide in adjacent opportunities. Don’t let the internet and its open-door policy sway you into believing that going wide is more profitable than going deep. Even if the short-term opportunity makes money, in the long term, it’s the lack of focus and commitment that will get you.

The only way to protect yourself from the world of plenty is to have your own inner scorecard i.e. your own goals, your own path, your own process, and your own guard rails. Your goals provide the direction, your path is the route opted to reach the destination, the process refers to the rituals/protocols to follow on a daily basis and guard rails are systems that will avoid a rash/emotional decision that could cost you.

In no ways does an inner scorecard stop you from venturing out of your circle of competence. I have a podcast, a substack, a banking job, and recently started a beauty salon business in Mumbai. And I would be in 10s of more ventures in times to come. But I surely won’t be craving to be at every party in the city. I can’t. I don’t want to.

But for the party that I choose to attend, I will make sure that the party is a blast for everyone involved. I will make friends there, enjoy the music there, stay there till the sunrise and make it memorable for all. Now that’s a party I wanna remember having attended.

My choices will result in me losing out on multi-million opportunities. But I am, as it is leaving millions on the table by not trying to be the nest software genius. I am, as it is leaving millions on the table by not trading in crypto or being a momentum trader. I as it is will have 1000s of people more successful than me. There is no escaping that. Elon Musk has overtaken Jeff Bezos & Warren Buffet in way lesser time than imaginable by anyone 10 years back. So be it.

Without your own inner scorecard, you are evaluating choices on the basis of someone else’s scorecard. If someone bought this, even I should. If someone did this, even I should. If everyone is talking about it, then I should delve into it too. If everyone looks up to it, then I should too.

I rather choose what makes me happy instead of what would please others so that I get to fit in. The former is long-lasting and in my control, the latter is not and hence a guaranteed path to misery.

“Probably ninety-nine percent of people on this planet wonder what the world thinks of them.” A tiny minority take the opposite view, which he poetically expressed as follows: “F*#@ what the world thinks.” - Mohnish Pabrai

Hope you attend the right party while in town. Invites will be coming soon ;)

Recommendations for the Week #

The new fear and greed article partly inspired today’s post and I highly recommend this one from Josh Brown.

Tyranny of Convenience is a New York Times article and it’s commendable in its depiction of what convenience is doing to us as a species. It’s under the radar and hence you don’t even realize the manner in which it softens you and weakens you. This one may be a wake-up call to let go of the comforts you have built around yourself - Google Docs Link or original piece

We released Episode # 12 on our Better Bets Podcast. We discuss Gold as an Investment in modern times and supplement the argument with its antithesis too. We also discuss the options available to take exposure to this asset class.

I will be off to India from 27th October till 12th November. I keenly look forward to celebrating Diwali with my family after years. I may not be able to publish original pieces during this time but will surely share recommendations for the week along with a third-party piece that I enjoyed reading.

Stay Safe…