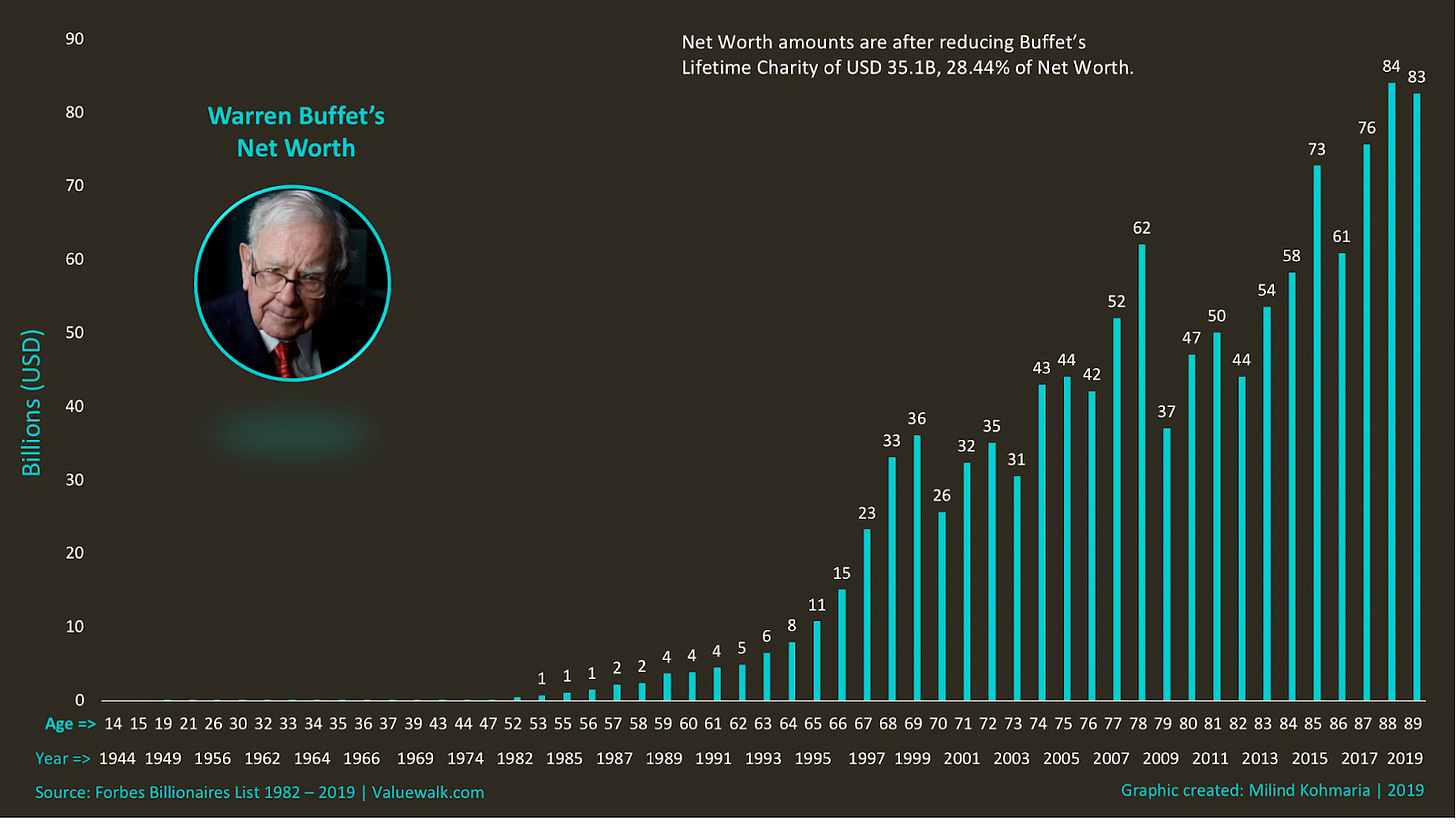

“Warren Buffett is a phenomenal investor. But you miss a key point if you attach all of his success to investing acumen. The real key to his success is that he’s been a phenomenal investor for three-quarters of a century.” - Morgan Housel

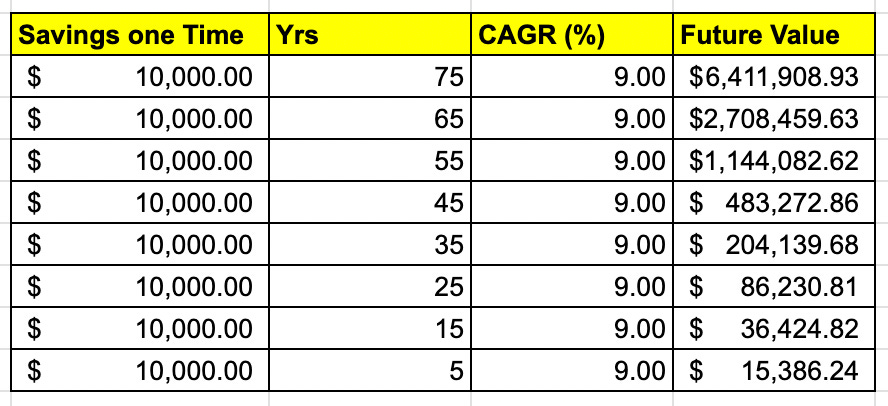

Three-quarters of a century i.e. 75 years of investing. And if you and I had that runway ahead of us, you and I too could accumulate wealth that would handsomely provide for our families, our lifestyle, and our hobbies. I will try to illustrate what 75 years could do to your savings of a mere $ 10,000 -

This is awesome and life-changing in so many ways. All you need is patience, which is surely in short supply in our instant fast-food generation. But doesn’t harm in serving another reminder.

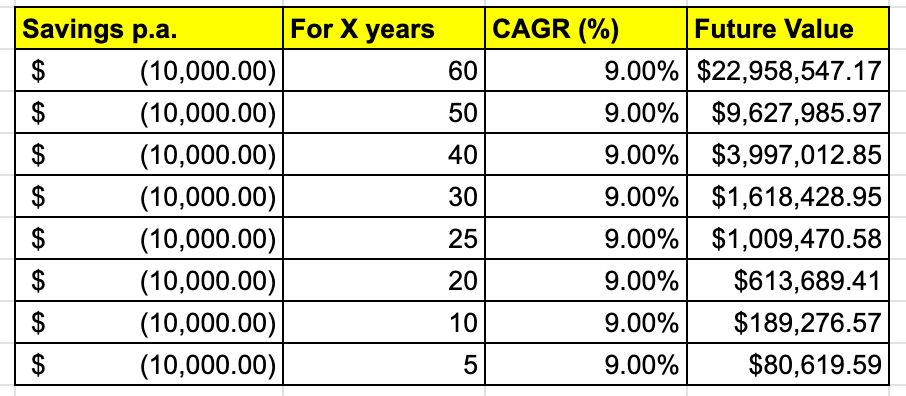

Let’s take this thinking further. How would the savings accumulate if you saved USD 10,000 p.a. Over many years and invested the same?

In case you are thinking about “who's seen 75 years” or “you don’t want to live for 60 more years” - then you can stop that chain of thought, and shoo it away for now. Just for the next 15 minutes, think about creating long-term wealth, without the stress and anxiety that accompany those who risk their reputations, lives, savings, and relationships for get-rich-quick fixes.

What would help you instead, is noticing how soon can you accumulate USD 1 million. It seems like a daunting figure, but it need not be.

If you saved USD 10,000 and let it work for you, then it would take slightly more than 50 years, as provided in the 1st table. But if you saved USD 10,000 regularly every year, then you could hit this coveted milestone around the 25th year, that is ½ the time. That’s 25 years saved from the toil and the wait to see this happen.

This is great. The milestone seems doable and within grasp. And it’s important to understand the importance of achieving this milestone.

Only 1.1% of the global population has accumulated this amount. That’s how small this group is. Millions toil away daily, struggle to make ends meet, study night and day to secure good jobs and hustle away to become entrepreneurs. But only a few will come out on the other side of their journey with glory and sunshine.

Hence, it would help if you could start seriously thinking about being a part of this group, which has enough to provide their loved ones with the perks of life. If USD 1 million is way more than what you may require, then you are welcome to plan for an amount that you think will be enough.

Irrespective of the amount, it would need a few things to happen on your side:

Saving regularly

Sustaining earning momentum and progressing professionally

Eliminating all expenses or potential headwinds that could derail the savings rate

Morgan Housel has a very profound saying on the subject of savings — “When you define savings as the gap between your ego and your income you realize why many people with decent incomes save so little. It’s a daily struggle against instincts to extend your peacock feathers to their outermost limits and keep up with others doing the same.”

Simplicity + Frugality = High Savings Rate

That’s all there is to the concept of savings.

As for sustaining earning momentum - this has to do with your domain expertise, your work ethic, your networks, and your ability to maximize growth opportunities. And I am sure that you are doing some of these, or all of them, to the best of your ability.

And if you did have the courage to go through 10 or more autobiographies of the people you admire the most, you might just walk away feeling like you have hardly done anything yet. The ambition that people like Bezos, Ambani, and Jack Ma bring forth and the energy they devote to making this vision come true, are miles away from the intensity of the games you and I indulge in.

In case you haven’t yet gone through at least ten autobiographies, then I urge you to list the names of your heroes and get your hands on the books that could give you a ride through their lives. This would be the best investment you would make in yourself. It could change you in more than one way.

Now the tricky part - keeping expenses low. And I am not talking about your lifestyle expenses, your travels, or gifts for dear ones. I am mainly referring to keeping your outflow for medical expenses to the least. This is one expense that has caused a major number of bankruptcies in the developed world and seems to be on a roll in emerging countries too.

Warren Buffet has a famous saying “Life is like a snowball. The important thing is finding wet snow and a really long hill. ”

But most will never find wet snow or a really long hill, because expenses and deteriorating health conditions will throw a spanner in the works. I have seen enough and more people’s careers getting derailed or professional growth coming to a standstill because their health didn’t allow them to carry on.

I still have vivid memories of a friend of mine who was suffering from advanced-stage of breast cancer and couldn’t walk from her bedroom to the hall. I have seen her crawl from one place to another because she didn’t want any of us to help her. She was fierce in her resolve to fight the disease, but she lost the battle eventually. It pains me even today to think about the struggles she endured in her last days.

This would sound like an extreme case, but I see people around me with back pain, headaches, joint issue, sleep problems, body pain, brain fog, and chronic fatigue. Surprisingly, this is considered normal because most people seem to be having these. Even you would know a doctor or a specific pill for each of these ailments if they happened to pay you a visit.

But a doctor or a pill just suppresses the symptom, it doesn’t deal with the root cause - which could be stress, lack of adequate nutrition and exercise, or the presence of toxic substances in your body that found their way in under the garb of delicious foods. Sometimes, it could be emotional trauma that has been hiding in the recesses of your heart from your childhood days.

But you would never know unless you took professional guidance to find the root cause of why your body is suffering or why isn’t it operating as well as it once did.

Warren Buffet earned 99% of his wealth post his 60th birthday. But he got lucky while dunking on Coke and Peanut Brittles from See’s Candies. Everyone may not be that lucky.

The other headache is the impact your deteriorating health can have on your mental agility. Your sharp and quick - that goes out of the window. You are wise in decision-making, but soon you may depend on others for doing your tasks/remembering things. You may have no choice but to retire from work or sell your business to someone.

And the worse is the physical immobility that comes along - not being able to move freely, attend events, make presentations, and learn from others. Yes we are in the jet age and most meetings happen online, but there is a lot that gets done one on one. Meeting people, closing deals, exchanging pleasantries, building connections - all of this doesn't happen on zoom as well as one on one.

Can we quantify it?

We can try to.

Just try to answer the following questions -

What if your medical expenses wiped out USD 30,000 from your savings in the 10th year, or USD 100,000 in your 27th year, would you reach the USD 1 million mark in 50 years?

What if you ignored your health and allowed stress and burnout to affect you physically and mentally, would you have a long runway ahead?

What if you ignored good practices only in pursuit of more money and more success, would you land up amassing more money and more success? If yes, would it be worth it?

NO WAY !!!

In case your save annually and I hope you do, then Table # 2 applies to you -

A few questions to consider -

What if you had to incur a medical cost of USD 250,000 in your 15th year, would you see USD 1 million by the 25th year?

What if you lacked in work ethic or were plain unlucky and lost your job, would you be able to save regularly?

What if you had an adventurous bent of mind and displayed a tendency to take huge risks, would you be able to keep your hands off from the slow compounding wealth?

No WAY !!!

The worse outcome to happen would be that you kick the bucket. And the regret that many have expressed during their dying hours was “I wish I had not stressed out so much” or “I wish I had taken care of my health” or “I wish I had spent more time with my family”.

You don’t need to feel this way.

You won’t feel this way if you lived your life well.

You will feel a million times better and happier if you took care of your health.

The ROI on being healthy is beyond any google sheet calculation. It’s not about the dollars or financial payoff. It’s about being someone who has the vibrancy of a child, the maturity of an adult, and the wisdom of an octogenarian. And having the money becomes the bonus that allows you to do what you’d like to do, spend time with people you’d like to spend time with, and become independent in as many possible.

It’s priceless !!!

Recommendations for the week #

Today’s piece was inspired by 3 separate pieces of content that I bumped into, and coincidentally, it all came together this last week. I couldn’t resist the urge to give you my take on prioritizing health and hence the write-up. All 3 pieces of content with their links are provided below 👇

1/3

Disney Plus gives you access to fantastic content like Marvel, Star Wars, Pixar, and Disney itself. I haven’t missed a single Marvel movie to date and am keenly looking forward to the new seasons of Moon Knight, Loki, and Hawkeye. But Disneyplus also gives access to a very rich library of National Geographic, which is a treasure trove for a curious mind.

In there lies a show called Limitless, where Chris Hemsworth is confronting his aging body and is in pursuit of means through which he could extend his health span and lifespan. This show is visually fantastic and will make you drop everything and binge-watch this journey he is on. Highly recommended !!!

2/3

Peter Attia recently launched his book ‘Outlive - The Science and Art of Longevity’ and I bought the book on the launch day itself. I haven’t yet gone through it but went through a youtube video where is interviewed by Rich Roll. This interview was touching in so many ways - it was personal, emotional, deep, and a loud wake-up call for everyone to take care of themselves before it’s too late. Do give it a watch. It’s almost 3 hours long but it’s worth all the time and attention you will pay. It will reap rich dividends for a long long time to come.

3/3

Every Friday I read a book on Health or Nutrition related topics and I have followed this habit for more than 4 years now. And this Friday, I dusted off the book ‘In Defense of Food’ that has been lying on my shelf for years. From page 1 itself, it became increasingly clear to me that BIG FOOD isn’t interested in my health or longevity. They care for profits and don’t really care if it comes from lowering the quality of ingredients or misguiding consumers by overpromising the health benefits of their wares.

This book will make you question what goes in your mouth. Is that even food? How sure can you be about the claimed benefits? What’s the incentive for your doctor to peddle this particular brand of supplements? Is fat really bad? Is protein really good?

“Questions open a space in your mind that allow better answers to breathe.” ― Richie Norton

Fantastic Read📚

Wishing you all a fantastic weekend.

And sending loads of love and luck🧿

Manish

Amazing as usual