Yesterday, I booked my tickets for the annual Biohacker Summit in Finland in June 2022. The last time I had been there in 2019, it was a memorable experience. I got to meet very interesting people - some having dedicated their lives to mastering Breathing Techniques, some had created breakthrough supplements enabling complete digestion, some had designed ergonomic workstations and some had grown medicinal mushrooms that could be consumed with coffee or shakes of any kind. It was fascinating, to say the least.

The event in June 2022 seems interesting, especially since it has Longevity as its principal theme. As the website states -

This is my initiative to learn the tools and systems that could allow me to live a longer life with vitality and joy. Anyone who knows me well, would have heard about my aspiration to live for 100+ years and that too with a sound mind & body. Now that may sound like a lot but I have met people who have lived healthy lives and kicking ass even in their 90s. Warren Buffet & Charlie Munger stand out for me in the Investment community. A few of my favorite actors are around 80 i.e. Amitabh Bachan, Morgan Freeman, Robert DeNiro, Anthony Hopkins and there are more.

But if I could live longer, then I could create time to play the long-term games that provide joy and satisfaction that chasing a career and dollar bills do not.

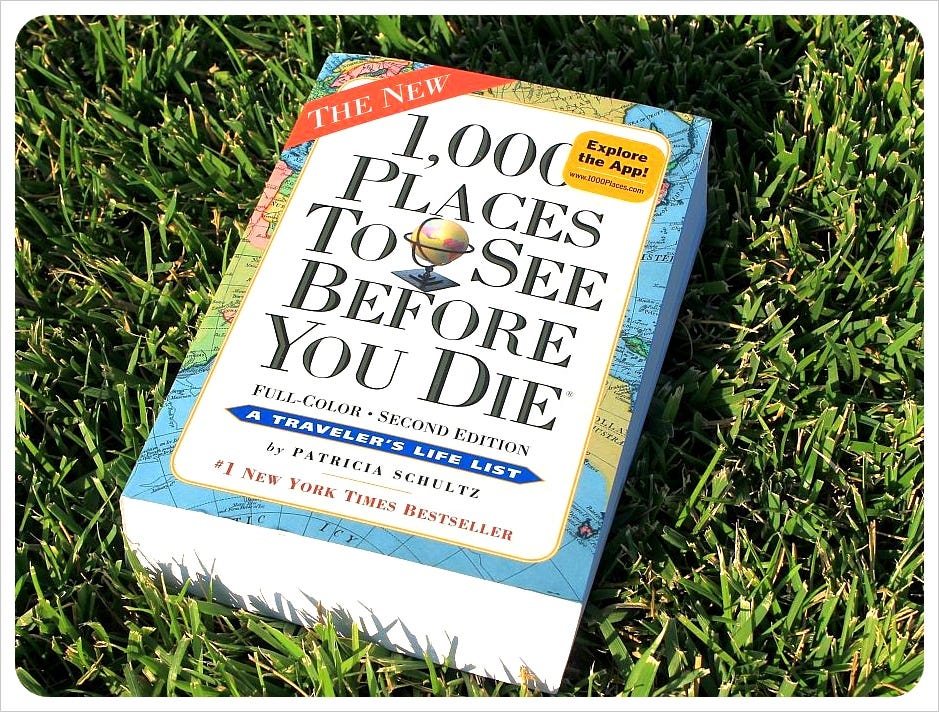

One of the dreams my wife & I have is to travel the world. There are so many beautiful places to see. We have only seen 25 countries to date and there are 150 countries more to go to. At the rate of travel since 2005 (when I first traveled abroad), I am visiting 1.56 new countries every year. At this rate, I will need 96 more years. The probability of that happening is very low. So let’s not bank on that one.

If I increased it to 3 countries per year, I still would need 50 years ahead of me. Now that is possible and would require me to plan out the resources this aspiration of mine would need. Money & Healthy Body are 2 of the main ones to take care of and both would need me to think about 3 things -

Things in my control

Things partially in my control

Things not in my control at all

Living till 100+ is my aspiration but not completely in my control. It would need the divine gods to be completely generous to grant me a safe passage for the next 59 years. Only time will tell if I had gained enough brownie points with them :)

But learning about health, nutrition, biology, fitness, foods, supplements, and tracking devices is the least I could do and it’s completely under my control. Attending conventions, reading books, watching seminars, interacting with professionals, and listening to podcasts is available at my fingertips. And that is what I am indulging in.

I have been laughed upon by many when I express my views on living longer & healthier. Some make statements like “why even live if you don’t drink or smoke?” or “what a boring life if you sleep early” and sometimes it goes like “you can, we can’t”.

I am not an evangelist and hence do not spend an iota of energy to convert anyone to think long term. For some, living in the moment with constant dopamine hits is a pleasant way of life, and that’s absolutely the perfect choice for them if it gives them happiness.

But I surely want to play the long-term game wherein traveling the world is just one side benefit of it. And the joy I get by imagining that kind of life itself is blissful. Hence I have taken to heart lessons I have learned about meditation, sleeping, eating right, working out, fasting and so many more.

Even when I eat organic meat in restaurants, I am not 100% certain about all of it being 100% organic. But I trust the cafe to provide me with the food as labeled. And hence I visit this cafe almost daily. In this case, ordering healthy food is in my control completely but what I actually get would depend on the intent of the owners or the efficiency of the staff to segregate the foods properly.

What’s completely out of my control is the supply chain’s inability to stock the products in the store. If my favorite beef patty is out of stock, then it’s out of stock and I can’t do anything about it. What I can do, is move to option 2 i.e. Salmon Fillet, and make the most of it. That’s delicious too.

As seen above, eating healthy has its own set of concerns and I can mainly be focused on things in my control and leave the rest for someone else to deal with. Doing my part well gives me peace of mind and confidence for having done the work that’s needed to make my aspiration come true. Worrying about things out of my control would only give me anxiety and stress. No one lived longer with these 2 emotions, so why even allow them in my space.

This is the trichotomy of control that Stoic philosophy has taught me well. It’s only after understanding the writings of Seneca, Epictetus, Marcus Aurelius, and Ryan Holiday, that I have got some clarity on what to focus on and what to let go of.

Even managing money would need clarity on this trichotomy. For instance, I had a friend who recently earned a quarterly bonus of USD 40,000 and he had decided to spend the whole amount on buying a car. This would be understandable if he had made enough Investments for long-term compounding to work in his favor. But he had not. And hence his answer surprised me.

Why spend on a depreciating asset when you could put the money to work? Or why spend the whole amount when some chunk of it can be put to work?

I shared with him the calculations that could turn his USD 40,000 into USD 1.5 million in 20 years if compounded at 20% p.a. At 15% p.a., the figure turns into USD 654,661. The intent of my discussion being that savings compounded at a healthy pace over the next few decades could create enough corpus that makes life comfortable in the later years when you would like to live a comfortable life, travel the globe, take time out for hobbies or learn new skills and explore the economic opportunities then.

My travels all over the world too will need decent sums parked in today so that they compound handsomely till I start dipping into them. Hence saving more than 50% of my income is in my control and is my preferred choice. But that requires me to be very careful with my money being invested or spent on things that signal to others that I’m successful.

The Gucci shirt above is only for USD 1200 and can be bought today without blinking an eye. But it’s not the shirt that causes trouble, it’s that the shirt may then create a need for Gucci shoes, which then may seek Gucci track pants to go with. And since I opened up to Gucci, just one shirt doesn’t look good in the wardrobe, a few more need to come in.

But Gucci likes his cousins too and hence you open up to LV, Hugo Boss, and many of the Joneses brands that like to stay together, almost always. And hence, most land up saving very little, investing even less than what a simple lifestyle could have allowed them.

I had written about the Diderot effect last year and I provide you the background story once again -

The famous French philosopher Denis Diderot lived nearly his entire life in poverty, but that all changed in 1765.

Diderot was 52 years old and his daughter was about to be married, but he could not afford to provide a dowry. Despite his lack of wealth, Diderot’s name was well-known because he was the co-founder and writer of Encyclopédie, one of the most comprehensive encyclopedias of the time.

When Catherine the Great, the Empress of Russia, heard of Diderot’s financial troubles she offered to buy his library from him for £1000 GBP, which is approximately $50,000 USD in 2015 dollars. Suddenly, Diderot had money to spare.

Shortly after this lucky sale, Diderot acquired a new scarlet robe. That’s when everything went wrong.

Diderot’s scarlet robe was beautiful. So beautiful, in fact, that he immediately noticed how out of place it seemed when surrounded by the rest of his common possessions. In his words, there was “no more coordination, no more unity, no more beauty” between his robe and the rest of his items. The philosopher soon felt the urge to buy some new things to match the beauty of his robe.

He replaced his old rug with a new one from Damascus. He decorated his home with beautiful sculptures and a better kitchen table. He bought a new mirror to place above the mantle and his “straw chair was relegated to the antechamber by a leather chair.”

These reactive purchases have become known as the Diderot Effect.

The Diderot Effect states that obtaining a new possession often creates a spiral of consumption which leads you to acquire more new things. As a result, we end up buying things that our previous selves never needed to feel happy or fulfilled.

Don’t get me wrong. I live in a lovely tower in a plush locality in Dubai and enjoy organic food almost daily and also travel very regularly. But I spend on the essentials, not on everything that everyone craves. I spend on a good home so that all of us (6 of us) can have a lovely abode that's in the heart of the city. I spend on good food so it serves my goal to live healthily and live longer. I spend on travels so that I and my wife could create great memories to cherish for life.

But Gucci, Ferragamos, BMWs, or the brand new iPhone that was released yesterday doesn’t serve the long-term game I'm playing. They and their cousins are expensive guests to invite and they have a tendency to keep showing up on short notices. Sometimes they show up even without notice :)

Hence I focus only on what's completely in my control around having enough money in years to come #

The habit of Saving more than 50%

Allocating the savings between Equities & Cash

Learning to invest well

Sticking to what I understand and avoiding playing in games I have no skills or expertise for

Refining my craft and getting better every day

What’s not in my control is the market movements, booms and busts, political scenarios, fed rates, supply chain shocks, inflation, and many other factors that affect my investments on daily basis. I could read about them but cannot influence them. And hence I choose to learn about investing wisely so that I can build resilience in my portfolio instead of making it vulnerable to shocks and losses.

What's partially in my control is how my investments would behave in an adverse scenario. If I did a good job of choosing the right companies, with competitive moats, clean accounting, and management with excellent execution on capital allocation, then I would do well relative to many others. If I am investing in PMS or Mutual Funds, then I have to do a decent job in analyzing the capabilities and the consistency of quality output from these managers over the years.

If I made wrong choices on these, then I am in for a painful ride. When the party is on, every company looks like a unicorn in the making and every manager claims to be a Star Manager. As for today, the party is definitely on. Rivian trades at USD 113 billion with Zero Sales. IPOs in India are valued at 1000 P/E. Shiba Inu & DogeCoin have occupied Economic Publications on daily basis.

These are unprecedented times and no one can be certain about how long the party lasts. Eventually, when the party ends, I don’t want to be the greatest fool left behind. I want to be the one who left the party for a good night’s sleep since I had an Emirates flight to Hawaii the next day with my whole family on it :)

And hence, I focus only on what’s in my control i.e. building resilience in my portfolio, permanence in my Savings, and independence in my thinking (as Tony Deden, Edelweiss Holdings Founder would put it).

The rest, let’s leave some for the supreme to weave its magic for us.

Recommendations for the week #

Morgan Housel surprises me again and again with his profoundly wise write ups that I just can’t resist sharing with you all. This one is on on Experts from a world that no longer exists.

Prabhakar Kudva is the co-founder of Samvitti Capital and his piece on Understanding Your Game is a very insightful one. It talks about ‘what’s in your control’ in more detail. He breaks down the investing process in its most fundamental blocks and shares it with you in a very throught provoking manner.

Ben Bohmer’s open set at Arjunadeep in Prague has become my favorite go to music while focussing on work or during a break. You will enjoy this one. If you have a paid version of Youtube, then this works best since it’s a 1 hour long set.

I’m back from my holidays and had a blast of a time there. I took time out to meet friends, friends parents, cousins and even parents friends. COVID has made me realize that life’s too short and you never know when you lose someone forever. Hence my trip was special as I warmed up many relationships that had gone cold due to distance and time. It was pure joy to spend time with everyone I met.

I head back to Mumbai in December just to meet a very close friend who is travelling to Mumbai for Christmas from New Zealand. I haven’t met him in 10 years and would like to meet up and spend time with him. Nothing beats good times with close family and friends. Everything else is secondary.

Wishing you a smashing day ahead amigos 🤗