“If you want above-average results, you have to say no to average opportunities. If you spend all of your time chasing average opportunities, you'll have no time for great ones. This applies to people, books, problems, etc. Raise the bar.” - Shane Parrish

I was watching Revenant yesterday and I was awestruck with the masterpiece that this movie is. It has been nominated for more than 20 awards at different award nights and has won many of them, which include Best Movie, Best Director, Best Supporting Actor, Best Cinematographer, and more. If you haven’t watched it yet, I invite you to watch it for the most original depiction of living like native tribes.

What surprised me the most was the logistics of the production. The entire cast had to spend 9 months at various sets (all in the wild) across Italy, Montana, and Argentina. And many times, the natural lighting was available only for 90 mins in the whole day. This required the remaining time to be used for rehearsals, setups, resting, and mainly “waiting” for the right moment to shoot under natural lights. Wow !!!

This made me wonder about the common theme that is laced across all glorious achievements and endeavors undertaken by the genius of a human mind. And that is - “paying the price” that the situation/goal/vision/work demands. And even if you did pay the price, it’s not a guarantee that the result will be a great one or well-received. You just may have a better shot at producing work that could bring you the accolades you aspire to win.

And since the future is highly uncertain, the only game one needs to play is doing everything that increases the odds of your success. It’s a Probabilities Game and 50:50 isn’t the odds you wanna play with i.e. you either could hit a home run and turn into a millionaire or you will suffer from financial ruin and derail your life to a point of no return. As dramatic it sounds, that’s exactly the games people play.

How would you define a man who's at the peak of his excitement when he buys a lottery ticket and then waits restlessly for the announcement of the BIG TICKET or DUBAI RAFFLE DRAW or another such lottery? But everything else in his life lacks the zest and zeal that the lottery brings in him.

How would you define a man who's very excited to apply for new roles outside his current line of work and checks Linkedin/Email 20 times a day to see if a revert has arrived in his inbox? But his current line of work lacks the curiosity and the thrill that he seeks from recruiters revert or the new shiny thing ahead of him.

“Most things are harder in practice than they are in theory. Sometimes this is because we’re overconfident. More often it’s because we’re not good at identifying what the price of success is, which prevents us from being able to pay it.” - Morgan Housel

Amir Khan’s physique in Dangal was the talk of the town when the movie came out, but very few would know what he had to go through to build that physique. The director was ok with Amir wearing a bodysuit but Amir wasn’t willing to. The director would have been ok with Amir haven’t a decent physique instead of the ripped one that he actually got. But Amir wasn’t willing to.

Did Amir know that Dangal would break Box Office records the world over? Was he sure of the success of this movie? Did he know that he would be nominated for the Best Actor category for the movie? The answer is NO - But, all the effort was for him to feel 100% committed to the role and that itself, increases the probability of him delivering his best work, which has a higher chance of being received well and win accolades. And that’s exactly what happened.

Just to prick the bubble of “paying the price”, he had put in equal efforts, if not more, for Thugs of Hindustan too but that turned out to be a dud. So no guarantees that you paying the price will reap rewards. But it will increase the odds for sure.

“Think of all the years you were stretched, challenged, confused, uncomfortable the most. Those are the years you grew the most. People who continue to grow don’t wait for external challenges and crises to induce personal growth.” - Kunal Shah, CRED

Successful Investing also requires a price to pay, you just don’t see it. So I will use the blog to share with you the price that needs to be paid.

PASSIVE INVESTING

Passive investing is a long-term strategy in which investors buy and hold a diversified mix of assets in an effort to match, not beat, the market. The most common passive investing approach is to buy an index fund, whose holdings mirror a particular or representative segment of the financial market.

It’s that simple actually. Buying the Index Fund outright or through SIP isn’t a complicated strategy and needs no genius.

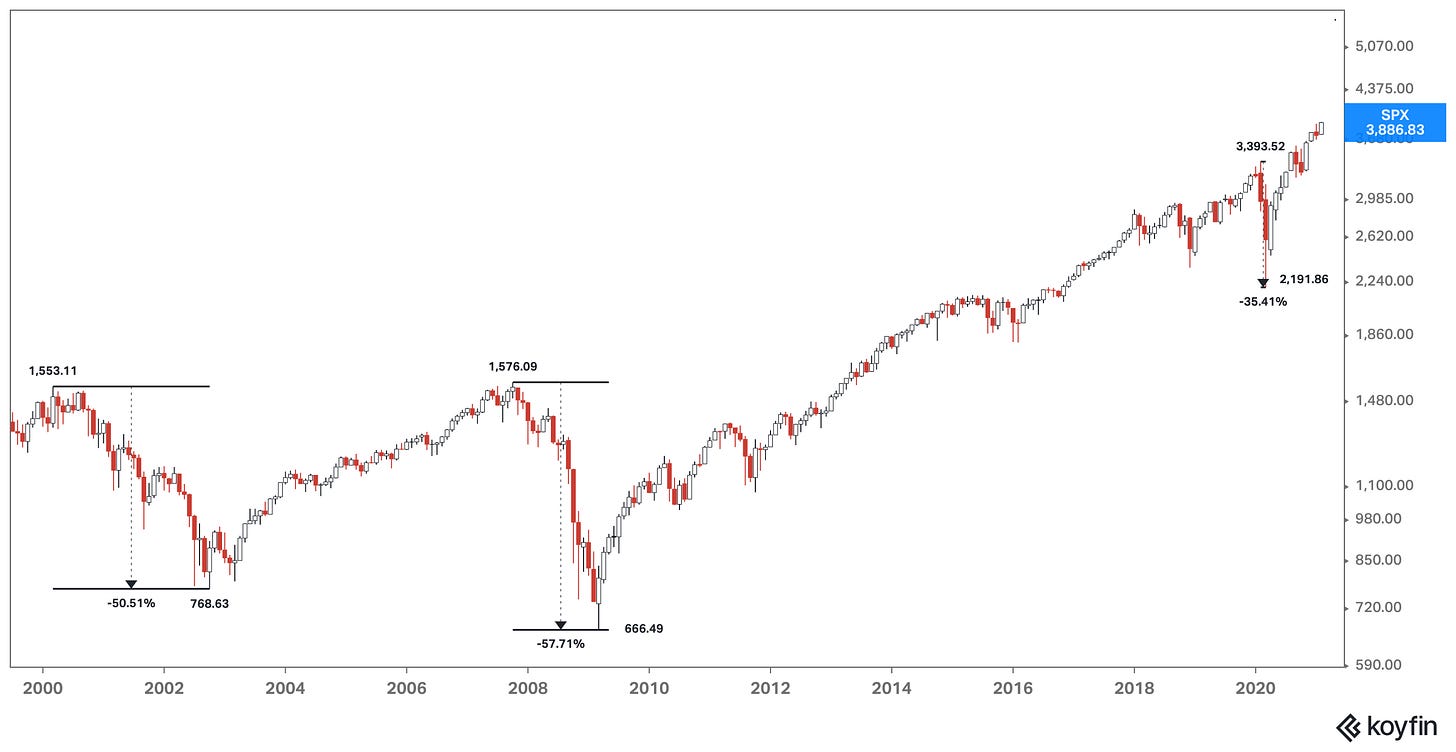

As seen in the charts, you would have compounded your capital even if you bought the index at the height of Dotcom Boom in 2000 or at the height of Great Financial Crisis in 2008. You would have grown your investments in spite of the index crashing more than 50% in both these crisis years.

But the price you pay is that this strategy is boring, it requires a lot of patience, requires you to say NO to almost everything else others are doing, requires you to cut the noise from the markets and rely solely on the wisdom of passive investing working for you via low transaction costs, less taxation, less mental overload, less activity and plain sitting on your ass.

And since passive investing doesn’t target outsized returns, it also entails you espousing frugality i.e. spending less than you earn and putting the surplus towards investing.

As simple as this sounds, it ain’t simple in execution since we are dealing with a human mind here. Delayed Gratification needs you to avoid instant gratification (pleasures) today for rewards in the future. Frugality needs you to be ok with being perceived less successful compared to your peers. Inactivity needs you to say NO to stuff that is exciting and the current fad. Saying “I Don’t Know” requires you to be ok with looking ignorant or stupid.

“It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.” - Gautam Baid in Joys of Compounding

“Acquire worldly wisdom and adjust your behavior accordingly. If your new behavior gives you a little temporary unpopularity with your peer group…then to hell with them.”― Charles T. Munger

ACTIVE INVESTING

Active investing refers to an investment strategy that involves ongoing buying and selling activity by the investor. Active investors purchase investments and continuously monitor their activity to exploit profitable conditions.

This very definition from Google opens up a pandoras box for the art of active investing. Every single act mentioned herein, opens up a checklist of its own. Eg.

Buying - Why to Buy ? When to Buy ? How much to Buy ? For how long to Buy ? For what target price to Buy ? What’s the opportunity cost

Selling - Why to Sell ? When to Sell ? How much to Sell ? At what target price to sell ? If I intend to Buy again after selling, at what price to do that ? Am I booking profits or exiting the idea completely ?

Monitor - Reading Annual Reports, Transcripts, 10K, newsletters, industry reports and publications, books, journals, white papers, interviews and just about anything you can get hands on to give you an informational edge to make a profitable decision. There is a lot of valuable data/analysis available via Youtube and Podcasts too.

Exploit - Spotting opportunities and acting upon it to profit handsomely from the trade undertaken. This requires analysis, loads of it. These could include valuation gaps, mispricings, momentum plays, cyclical chifts, technical breakthroughs, emerging trends, pricing power, sustainable moats, technological breakthroughs, management quality, culture that runs the business and so much more.

Buying & Selling is just an act of clicking a few buttons. It won’t take 2 secs to place USD 10 million dollar transactions. “Faster the better” is the mantra in Investing. But the decision to buy or sell needs countless hours in preparing the thesis to make that decision and more importantly, it needs you to develop the sense in matching patterns or reading between the lines to spot these opportunities to exploit.

“The only way to win is to work, work, work, work, and hope to have a few insights.” —Charlie Munger

Let me share with you a few insightful comments made about the Tech industry #

In his second quarter 2018 letter to Heller House fund clients, Marcelo Lima wrote: “Cheap” is a poor proxy for value: the new business models…—SaaS [software as a service] in particular—are not well suited to traditional GAAP [generally accepted accounting principles] accounting. Here’s why: if distribution costs are zero, the optimal strategy is to gain as many customers for your software product, as quickly as possible. In digital businesses, there are increasing advantages to scale, and many of these companies operate in winner-take-all or winner-take-most markets. The name of the game is thus to build, grow, then monetize. Frequently, this means spending a lot of money in sales and marketing, which depresses reported earnings. Thus, SaaS companies spend to acquire customers upfront, and recognize revenue from those customers over many years. This mismatch burdens the income statement. Some of the most successful—and highest performing stocks—in the SaaS world have spent many years growing despite producing no meaningful accounting profits. They are very profitable in terms of unit economics, and once they stop reinvesting every dollar generated into further growth. The traditional method of screening for low P/E stocks doesn’t work in this scenario.

In a February 2018 Harvard Business Review article, three professors from the Columbia and Dartmouth business schools, Vijay Govindarajan, Shivaram Rajgopal, and Anup Srivastava, summarized their work on accounting for intangible investments. Their key finding, which builds on Baruch Lev and Feng Gu’s analysis in their book The End of Accounting, is that “accounting earnings are practically irrelevant for digital companies.” Likewise, Govindarajan, Rajgopal, and Srivastava found that reported earnings mean less for younger companies than for older companies because of the different nature of younger companies’ expenditures. In fact, they found that “earnings explain only 2.4 percent of variation in stock returns for a 21st century company—which means that almost 98 percent of the variation in companies’ annual stock returns are not explained by their annual earnings.” These claims correlate nicely with those published in Lev and Gu’s book (figure 29.1). The authors found that variations in financial metrics, like earnings and book value, explain 90 percent of the variations in stock prices for companies that went public between 1950 and 1959, compared with explaining only about 20 percent of the variation for companies that have gone public since 2000.

Just these 2 paragraphs give you an insight into the drawback of using conventional Accounting metrics to evaluate the current breed of Technology companies. If you were not willing to learn the basics of Accounting and how to treat capital light businesses, you might never invest in Tech since it will appear expensive to you, almost always !!

Accounting principles have been principally designed keeping in mind businesses that have huge capital expenditures on plant & machinery or physical assets. Hence the notion of Book Value was so important once upon a time. Even Warren Buffet’s annual letters used to begin with a reference to the Book Value of Berkshire Hathaway.

Today’s tech businesses are dominating the economic landscape with the might of their intellectual capital, network effects, workforce culture, performance incentives and outsourced solutions. A lot of this doesn’t show up very well in the accounting statements. You’ll need to develop an acute sense of Technology businesses to be able to even make sense of the current price at which any company trades.

This needs a lot of work if your not willing to pay the price. But if you do carry the vision of a future you intend to create for yourself, then discovering the way world works could be a fascinating journey to get onto. I find Tech Investing fascinating but I am not from an Engineering background, nor do I hold a CA/CPA designation.

And hence I have to put in a lot of time learning a lot of basics from both these fields. I am currently a student in The Analyst Academy run by Stephen Clapham and also subscribed to many Tech newsletters , few of them being paid ones. I am putting in the time to build my understanding on both these fields and hoping to have a few insights that would provide me opportunities to profit handsomely.

Is it painful - you Bet !!

Is it frustrating - YES !!

Is it completely out of my comfort zone - Oh YES !!

Does it make me feel I’m not picking it up quick enough - EVERYDAY !!

But does it move me closer to my vision of being a Capital Compounder - YES !!

“A hundred-bagger is a ten-bagger twice over. Even if someone bought it after it became 10×, it still went up another 10×. This shows the importance of actively keeping up with a company’s story even after you have exited it. Think of investments not as disconnected events but as continuing sagas that need to be reevaluated periodically for new twists and turns in the plot. Unless a company goes bankrupt, the story is never over.” - Gautam Baid, Joys of Compounding

Hence reading is important. Not just elementary reading, but it would take Syntopical reading. This is termed as the highest level of reading and it entails reading several books on the same subject so that you could approach the topic from various viewpoints . This allows you to gain insights and ideas that wouldn’t be available to you with a shallow or a biased understanding of the subject. This is an essential step towards gaining proficiency in original thinking.

“Deliberate practice is all about having a blue-collar mind-set. In his book wrote: From a distance, top performers seem to live charmed, cushy lives. When you look closer, however, you’ll find that they spend vast portions of their life intensively practicing their craft. Their mind-set is not entitled or arrogant; it’s 100-percent blue collar: They get up in the morning and go to work every day, whether they feel like it or not.” As the artist Chuck Close says, “Inspiration is for amateurs.” - Daniel Coyle in The Little Book of Talent

This is where work ethic comes in. This is a daily grind and it ain’t sexy or exciting at most times. It is plain broomwork and the progress is slow but it surely is there. Many a times, when I’m reading a newsletter from Matt Levine of Beth Kindig, it completely beats me and it doesn’t sound english to me. It seems like I am reading matter from a different economic system but I’ve been at it for a long time now and hence have started connecting the dots. Now, when a Gamestop story erupts, I know what’s happening and hence can easily stay away from the herd mentality driving the markets away from its fundamentals.

“The first thing to realize is that it takes a long time. I started when I was eleven. Accumulating money is a little like having a snowball going downhill; it’s important to have a very long hill. I’ve had a fifty-six-year hill. It’s important to work in sticky snow and you need a little snowball to start with, which I got from delivering the Post actually. It’s better if you’re not in too much of a hurry and keep doing sound things.” —Warren Buffett

And lastly, it’s a long term game and hence will take loads of patience, irrespective of your choice of passive investing or active investing. Many of us choose active investing so that we can earn way more than an index and the reason is not the accolades that the market would bestow on you and it shouldn’t be. If that’s the case, then it’s your ego running your life and may ruin it too.

The joy of discovering compounders and willing to bet on them has a thrill of its own. It satisfies our curiosity into the nature of things and businesses and allows us to become sharper and wiser with time. It’s not for everybody, but it surely is a game with good odds if your willing to put in the time.

Jeff Bezos has retired from the CEO’s position at Amazon but his long term thinking will always remain legendary. And if there is one letter from Jeff Bezos that I would encourage you all to read, that would be his 1997 letter. Btw, he attaches this letter at the bottom of every letter sent to shareholders since then.

There is a paragraph that stood out for me in that letter -

“It’s not easy to work here (when I interview people I tell them, “You can work long, hard, or smart, but at Amazon.com you can’t choose two out of three”), but we are working to build something important, something that matters to our customers, something that we can all tell our grandchildren about. Such things aren’t meant to be easy. We are incredibly fortunate to have this group of dedicated employees whose sacrifices and passion build Amazon.com.”

If you too are working to build something important, for yourself and your family, then working long, hard and smart is the only option to choose. There ain’t any other. That’s the Weight of Gold and the only cross to carry.

Wishing you loads of love & luck.

Manish