“Our economic systems were not built for a world driven by technology where prices keep falling. They were built for a pre-technology era when labor and capital were inextricably linked, an era that counted on growth and inflation, an era where we made money from scarcity and inefficiency. That era is over. But we keep on pretending that those economic systems still work.” - Jeff Booth

I read this book over the last 2 weeks while having a time out with my folks in Mumbai. It didn’t take much time to finish the book but it definitely played on my mind more than many books I have read before.

The entire premise of the book is that Technology will disrupt economies, companies, and existing power structures which will lead to deflationary pressures allowing people to enjoy goods at lower prices and not needing to run on the hedonic treadmill. I had written about this relentless pursuit of higher income and better lifestyles in my earlier blog post on Medium.

What If, this ain’t needed? What if you could enjoy the best that the world has to offer at lower and lower prices with time? What if you could get by comfortably even at an income lower than your current one? What if technology breaks down the barriers to entrenched industries like education, health care, investing?

Let’s look at the basics -

Inflation, simply put, means increasing prices of goods/services which feeds into increasing asset prices, creating longer-term wealth. If we leverage those assets by adding debt, our return is even greater because the asset increases in value while the dollars that we pay back in debt are priced in today’s dollars—and with inflation, and growth in our incomes due to the inflation, we pay back the debt tomorrow in dollars that are worth less.

This is key to understanding why inflation or inflation targeting is such a key policy initiative of governments worldwide. You keep reading news clippings like below constantly since a lot hinges on this for the governments, individuals and corporations.

The maths is simple. If You have bought an asset for USD 1,000 and it was funded by a bank today, turning the debt into EMI or Interest Only payments with Principal to be paid at Maturity. Individuals choose the former and corporations go with the latter. Either ways, as time progresses, the price of asset is normally seen to appreciate, wages increase, price of goods/services sold increases and hence the inflow will keep rising with inflation but the level of debt will remain the same i.e. USD 1000 till it’s paid.

This is very beneficial to all in the system that benefit from rising incomes as debt loses time value and doesn't keep up with inflation, making it cheaper to be paid in future, on relative basis to increasing incomes. Hence governments borrow to pay later, individuals borrow to pay later and corporations borrow to pay later.

“Christmas is the season when you buy this year’s gifts with next year’s money.” - Anonymous

On the other hand, deflation means reducing prices. Deflation, put simply, is when you get more for your money—just as inflation is when you get less for your money. With deflation, a currency becomes more valuable because its buying power goes up in relation to goods and services. With inflation, it’s the opposite: the prices of goods and services go up and therefore a currency’s value is lower as purchasing power is less.

Read again - a currency becomes more valuable because its buying power goes up in relation to goods and services. This means prices of goods/services reduce, allowing you to buy more with the same amount as last year. This would result in lower incomes/wages and lower asset prices which would impair one’s ability to pay your debt which then would lead to the system defaulting on their debt and that my friend, could be a big bang implosion for the whole economic system.

This is exactly the reason governments fear deflation and you keep reading news clippings as follows -

And hence the urge to resort to credit/loans/financing/debt/private lending and all mechanisms to fund the growth engine that would keep the party going, leading to inflation, sustaining the ever increasing asset prices and keeping the illusion of wealth creation alive for all.

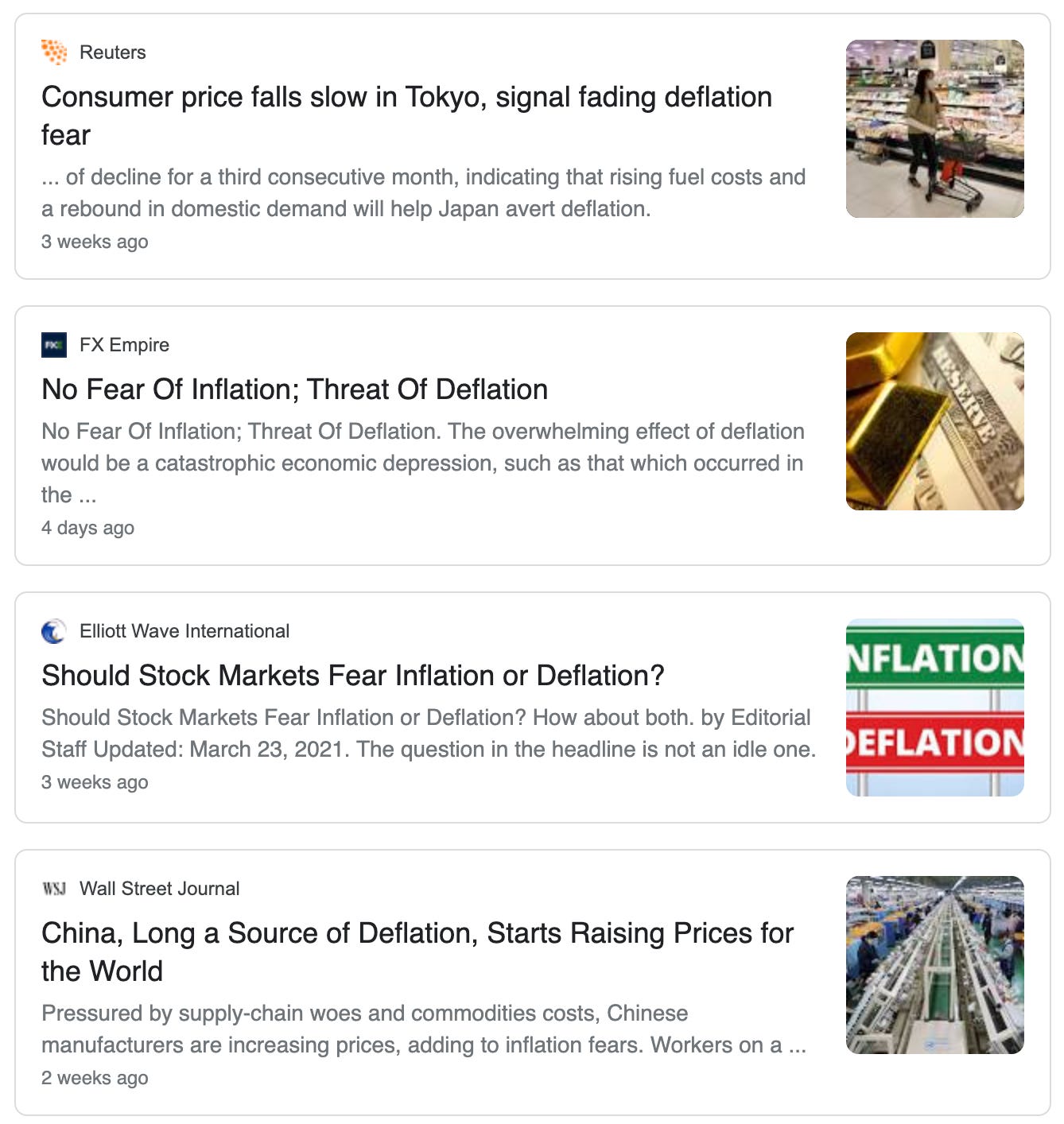

I know it’s a loaded statement but let me share with you some figures from Semper Augustus 2020 Annual Letter, penned by Chris Bloomstran.

Just check the growth in US GDP over the years relative to growth in Total Credit Market Debt. For 1982 - 2000 period, GDP grew from 3.3T to 9.9T i.e. 3X. But to bring this about, the Total Debt grew from 5.2T to 26.7T i.e. 5X.

For 2000 - 2007 period, GDP grew from 9.9T to 14.6T i.e. 1.5X and to bring this about, the Total Debt grew from 26.7T to 51.2T i.e. almost 2X.

For 2009 - 2020 period, GDP grew from 14.4T to 21.4T i.e. 1.5X and to bring this about, the Total Debt grew from 54.6T to 82.3T i.e. 1.5X.

Inspite of the gargantuan lending undertaken to stimulate the US economy so that the targetted inflation of 2% is hit, you still see Inflation no.s only dropping. Its at the lower spectrum of Inflation figures ranging from -9.9% to 11%, for a period of 92 years.

Jeff Snider,Head of Global Research at Alhambra Investments shared the following on Macro Voices Podcast yesterday -

The market isn’t pricing inflation , yields have stopped at 1.75%, Government wants it but it ain’t coming inspite of 100s of billions through stimulus. Markets are seeing reflationary trades but rates haven’t gone up. Even the global bond market is unenthusiastic about inflation, its only the press talking about it. Japan/Europe is the evidence that deflation could still come in spite of all government stimulus. Market sets interest rates, not government or central banks.

The following is shared by David Rosenberg, ex-Chief Economist and Strategist for Merrill Lynch Canada and Merrill Lynch in New York and now President and Chief Economist & Strategist of Rosenberg Research -

And people say to me, ugh, I can’t wait to go back to the old normal. Remember that old normal was low growth, low inflation, and low interest rates for a variety of structural reasons that haven’t gone away because of the pandemic and the fight against the pandemic. In fact, the structural impediments to growth have been accentuated through this period.

Well, it’s like déjà vu all over again. These are probably the same people that were telling you in 2010 to be braced for a decade of inflation because, of course, the Fed was embarking on quantitative easing and we had that initial boost in the fiscal deficit from the Obama fiscal package on infrastructure.

Of course we coupled that with the Trump tax cuts. We finished the last cycle with a trillion-dollar deficit at a time of full employment. And yet, what was inflation? Basically 2.

Let’s look at global figures -

In 2000, the total debt in the world was approximately US$62 trillion. At the same time, the world economy in 2000 was about US$33.5 trillion. Since 2000, the world economy has grown from US$33.5 trillion to about US$80 trillion, but to achieve that growth, the total debt has grown to over US$247 trillion as of the third quarter of 2018, according to the Institute of International Finance i.e. 4X explosion in debt levels to create 2.5X of GDP Growth.

That’s a lot of data to show that inflation isn’t on the horizon as many predict.

“...in my view, risk is primarily the likelihood of permanent capital loss. But there’s also such a thing as opportunity risk: the likelihood of missing out on potential gains. Put the two together and we see that risk is the possibility of things not going the way we want.” —Howard Marks

Now let’s add the massive impact of Technological Developments globally to this mix of the economic situation playing out in the developed markets. I would like to share a few pictures for making my point here. All of these have been sourced from ARK Invest’s Big Ideas Deck on their website.

Micrsoft recently bought Nuance for this very reason. Apple has invested heavily in their own M1 chip, capable of 11 trillion operations per second. Nvidia recently announced its first data center CPU, an Arm-based processor that will deliver 10x the performance of today’s fastest servers on the most complex AI and high performance computing workloads.Massive Investments are being made in AI/ML that will enable breakthroughs at an unprecedented pace.

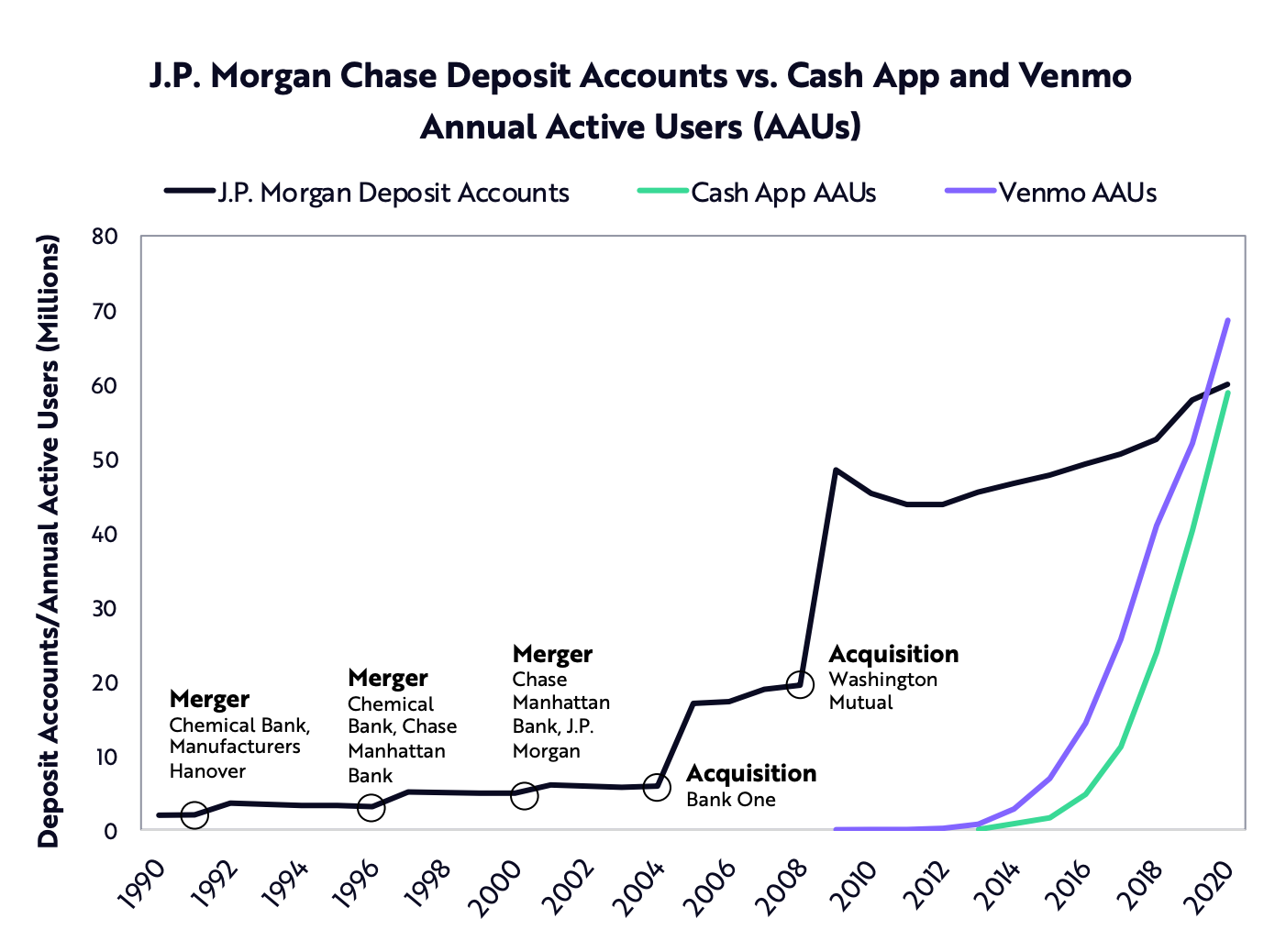

What took JP Morgan 20+ years, is being achieved by Fintech companies in less than 5 years. The processing fees are lesser, friction is gone, delays are gone, security is higher, human errors are almost non existent and best of all is the ease and comfort to carry out transactions with a few clicks.

Most importantly, the customer acquisition costs have reduced drastically i.e. USD 20 for having a new customer try your service. And since the point of reference are the archaic systems of old school banks, the experience is just wonderful, making one stick to Fintech companies instead of using banking services. E.g. My experience with Zeroddha for buying Indian funds & stocks is so much smoother than using my bank account that also has its trading platform. The UI/UX is miles better.

BioTech is finally bringing its power to the commercial front. Multi-Cancer Screening Costs have been brought down significantly and in few years will be available at a fraction of a cost for all globally. For the first time ever, vaccines were created and cleared for usage in less than 1 year. This is just a glimpse of a life where living healthy and longer could be in everyone’s grasp, rich or not.

Automation adoption has gained steam during COVID and will only accelerate from here. Robots don’t get tired or emotional, making them more efficient and cheaper to get the job done, with no cribbing, complaints, lapse of judgements, ego issues or organisational politics. It’s a very juicy incentive for corporations and governments to go all in full steam.

Virtual Reality is just round the corner and it will pervade every fabric of society. E.g. In 2019, had attended a Biohacking Festival in Finland and there was a company (I forget the name) that had their VR meditation product on demo. It would give me an experience of being at a beach in Australia with the sounds as real as it could be and I could move my head around to scan the whole landscape. It was just brilliant.

With the costs going lower every year and with Facebook and peers betting on AR/VR as the next frontier in Tech Platform Development, this space has huge implications for bringing to you experiences that were not possible before.

The battery costs have been going down while the capacity for storage keeps getting better. This is why EV industry has attracted massive investments and attention from car manufacturers globally. Just in case you feel that the EV optimism is short lived, let me point out that it is a reality and growing at an exponential rate.

2020 became a great year for plug-in vehicles, in the end. With only a few details still to be reported we are expecting global BEV+PHEV sales of 3,24 million, compared to 2,26 million for the year previous. - Ev-Volumes Website

All these developments get people/press to salivate on the future possibilities but the 2nd order effects of these will be felt by governments the most. Since they are spending trillions via monetary and fiscal measures hoping for inflation to be revived, they may face a valley of disappointment ahead.

Now there is another factor that adds to this potpourri of economic underpinnings. That is the zest and zeal of entrepreneurs to bring a product or service that breaks entry barriers or moats or legacy shops set up by incumbents. This adds to the deflationary pressure by bringing down prices across the industry, making it a boon for consumers, not necessarily for the corporates hoping for ever larger profits or the governments hoping for increased taxation revenue.

Let me give you a glimpse of what is going on in the best of companies from across the world -

Doing right for the customer means providing him service with seamless execution at the lowest cost possible. This is damn good for the customer, not for the industry as it will bring down the profits enjoyed for all these years by incumbents.

CRED has helped in eliminating crores of rupees of hidden charges, late payment fees and extra interest charges. This is just a sign of disruption in prevailing business models and the current breed of entrepreneurs, aided with technology, are going to break down revenue models that don’t serve the best product at the cheapest cost that is technologically and economically feasible.

Shopify, Indiamart and many others will encourage local brands with enough firepower to take on global giants. They will not provide the product but they surely can take care of presence online, payment systems, shipping, tracking, logistics, community building, engagement, loyalty metrics, promotions and so much more. All this used to be overwhelming for an entrepreneur to manage but not any more.

If today’s platform businesses like Shopify can bring local players with all the ammunition which was only possible for deep pocketed brands, then the sustaince of moats is only going to get harder and rarer. Every businesses is one brand away from disruption.

What stands out for me is Toby Lutke’s statement “The goal is not to win, the goal is to see how deep the rabbit hole goes.”

If entrepreneurs could explore business models and experiment with iterations with nominal costs made possible by technology, this makes it a giant leap forward for entrepreneurship. What earlier was defined by possibility of failures with ruinous implications for the family of the entrepreneur, isn’t that bad anymore. It infact has become cool to try out things from your basement.

Most times, the entrepreneurial spark comes from envisioning the way the world could work versus the way it does now.

To summarise the Enterepreneur’s passion to solve problems, I will share a quote from the founder of BookMyShow, India’s biggest online ticketing platform.

How would a corporation survive against the nimble and intense competition from start up companies while they are saddled with 1000s of employees, with bloated cost structures and inefficiencies and without the ambition or the enthusiasm of a team with a mission.

I even have an example of what’s to come in the future from all these deflationary forces coming together at once against the incumbent giants -

Jeff Booth makes a very insightful comment in his book about our current state of denial regarding deflation -

The problem comes from believing we can outrun deflation and the natural order of things by creating more and more debt. It’s a bit like trying to flap your arms to fight gravity: gravity will win. Even a plane using massive energy to stay in the air must eventually land.

Debt combined with deflation is a toxic combination, because borrowers have to pay the same for their interest payments while earning less. This raises the real value of the debt, making it more unlikely to ever be paid back. Defaults soar and credit is destroyed, leading to severe depressions in economies.

Even Ray Dalio, Founder of Bridgewater Associates has hinted at the mess Central Bank’s are stuck in -

There are four levers that policy makers can pull to bring debt and service levels down to income and cash flows that are required to service them: Austerity—spending less Debt defaults/restructuring The central bank printing money or other guarantees Transfers of money from those who have more than they need to those who have less (much higher taxes for the rich.

Dalio concludes that in the end, “Policy makers always print. That is because austerity causes more pain than benefit, big restructurings wipe out too much wealth too fast, and transfers of wealth from haves to have nots don’t happen in sufficient size without revolution.”

So debt levels are here to stay and so are the tectonic shifts in technologies enabling consumption of goods and services. These 2 will play out in a way that could keep inflation at bay for a long time, as seen in Europe & Japan.

Even if economies don’t experience deflation or depression, they may certainly be seeing reduced levels of inflation and in this scenario, you have to make Investment choices very carefully. You could evaluate every choice through either of the 4 lenses available -

Safety e.g. US Treasuries as they could benefit with yields going lower. Even if they don’t, they provide way higher yields than many developed economies and Fed has expressed clearly their intention to stay away from negative rates

Scarcity e.g. Crypto Assets benefit due to their scarcity and also as a hedge against fiat money losing value in absence of inflation

Valuations e.g. You still have quality companies available at attractive valuations. My biggest holding is Berkshire Hathaway and at P/E (LTM) of 15 or P/E (NTM) of 25, it still is pretty exciting a stock to keep accumulating

Moats e.g. If you spot companies with Moats that look very difficult at being disrupted, then they make a good BUY too. I find Facebook in this spot. Inspite of all the attention for wrong reasons from US, it still continues growing on the back of its Ad Revenue Money Monster. If it’s bet on Oculus pays off, then it could be miles ahead of competition in AR/VR space.

The credit driven party has been going on for a long time. The Geeks have arrived on to the scene. The party is gonna end bad for many people. You better be the one prepared to leave the scene before its too late.

Wishing you loads of love and luck.

Manish