Whereas most technologies tend to automate workers on the periphery doing menial tasks, blockchains automate away the center. Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the customer directly.” – Vitalik Buterin, co-founder of Ethereum

Long before money was invented, people were quite happy exchanging goods they owned for goods they desired. As communities grew, the exchange of goods grew amongst people and so did the need for keeping a tab on these transactions, for tax purposes and reconciling accounts. Sticking to barter exchange would have been problematic and hence was born the need for finding a good, that could be used as a standard unit for purchases/exchanges.

“The Yurok Indians, for example, used shells and they were serious about their shells. They would have tattoo marks on their arms to measure the length of shells and that told you the denomination, the value of how valuable that shell was which corresponds to how scarce it was in nature. They would use these for an inheritance, for injury compensation, for bridewealth, and so forth.” - Nick Szabo

Many experiments were conducted with various goods. Barley, whale’s teeth shells, feathers and metal coins, and many others were tried out, but none lasted for long. Barley was too heavy to carry around, whale’s teeth were not easily divisible, shells were easily found at the beaches and hence not scarce, feathers did not have intrinsic value and hence not accepted for trade outside immediate communities.

Eventually, Kings decided to mint coins from metal with a seal on them. Coins satisfied all the criteria for a unit that could facilitate trade with others from various regions. Coins were durable, portable, scarce, and divisible. And the legitimacy was provided by the seal.

This continued for centuries and eventually gave into paper money, started first by Chinese Emperors. Coins were problematic to carry around in bulk and hence they would issue IOU notes for long-distance trading while stocking all the coins within their kingdom. This practice got followed for centuries and by many countries globally.

For all these years, colonial powers, kings, and emperors would tax their colonies and flush out as much money from their subjects to fill the treasury for further conquests, facilitating trade, maintaining the army, and the opulent lifestyle. It was these very taxes and the scarcity of access to GBP, that irked the American colonies in the 18th century and inspired them to band together against the might of their colonial rulers. The American Revolutionary War brought the U.S.A. its independence and thus began the first-ever mint in the US, tasked with production and distribution of coinage and paper currency.

Today, USD has become a global reserve currency and the entrepreneurial spirit and capitalist structure of the country have played a huge role in it. But the problem that the colonies faced at the hands of Great Britain, is now being faced by many citizens at the hands of their own country’s ruling elite. If we look at the USA for example, the system seems broken at many levels -

Since the Gold Standard was dropped in 1971, unlimited printing money (with no upper limit) has been resorted to, for solving all kinds of problems i.e. Great Financial Crisis (GFC), lower growth, higher unemployment, or COVID now.

US National Debt stands in excess of USD 25 trillion in 2020, USD 4.2 trillion higher than 2019.

Wealth Inequality has increased severely e.g. Top 10% owns more than 70% of the Wealth and their share keeps increasing.

The regulatory capture (tax) on income is in excess of 25%.

Misallocation of resources causes asset bubbles or economic shocks which affect the bottom 90% of the population more than the top 10%.

1/3rd of the population has no access to the current financial system and hence pays very high fees or transaction costs for Banking services.

The Private Debt - GDP has increased to 235% in 2020, rising from 218% in 2019.

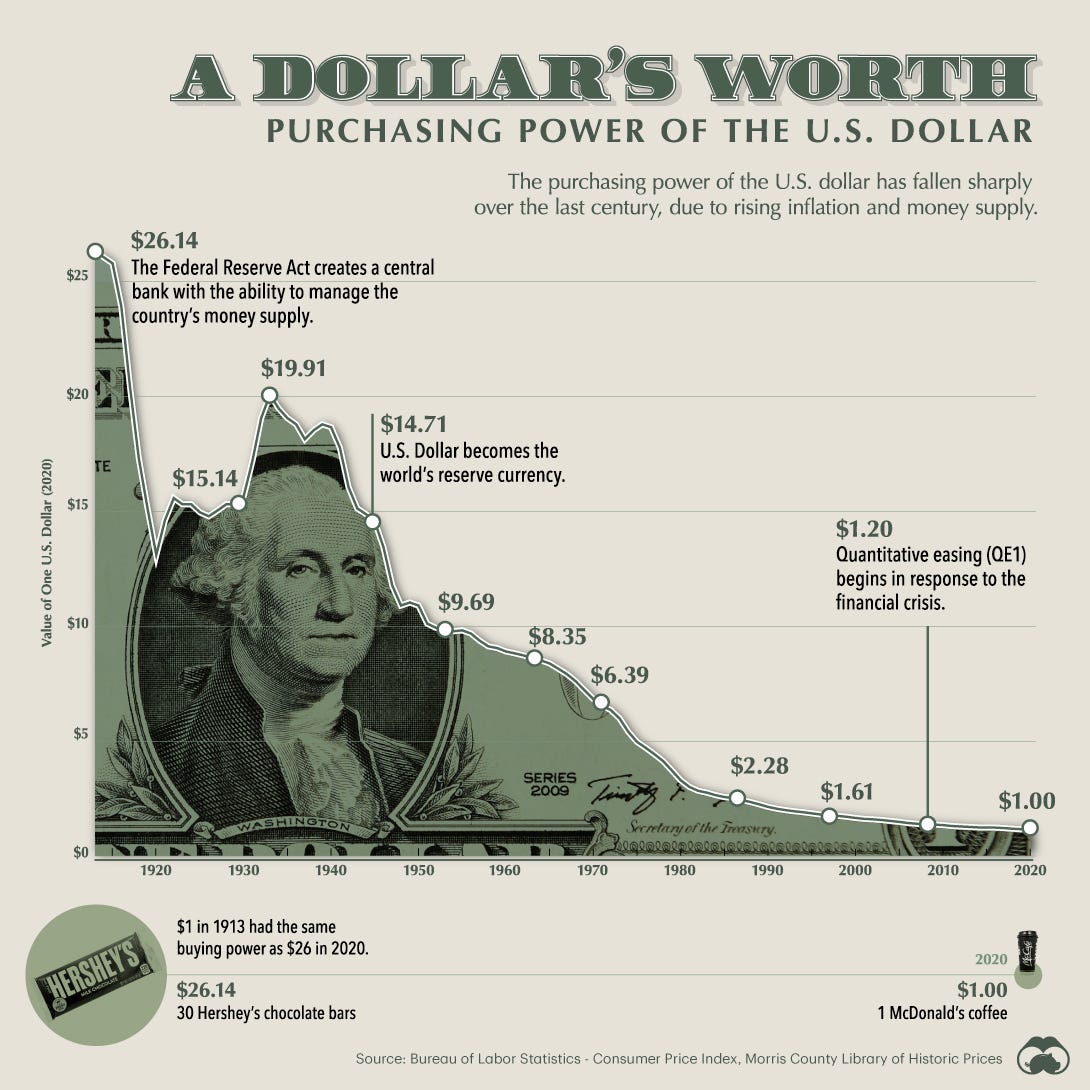

The losing purchasing power of the currency i.e. USD has lost 96% of its unitary value in inverse correlation with the amount of money printed.

All these factors make the country very fragile and could devastate the livelihoods of many, bringing the whole economy to a standstill, as seen during Covid or GFC. This same fragility exists in many countries worldwide, with varying degrees of wealth inequality, suppression of free press and expression, regulatory capture in terms of direct or indirect taxes, and unavailability of access to money. The system is designed to benefit a few elite and people associated with these mega-corporations and owning legacy assets in terms of equity, bonds, land, etc. but not everyone.

And many in the US and elsewhere do not want to be a part of this broken system. They want a whole new system built from scratch and that is robust, decentralized, efficient, low cost, and one that doesn’t differentiate between people irrespective of their background, race, country, or status. And this burning desire by many is slowly coming true, thanks to the Engineering Nerds and evolution of the Internet.

If the internet allows for peer-to-peer networks to be established for sharing songs, movies, videos, documents, ideas, and other goods/services. Then P2P exchange of Money is the next frontier of technological advancement. That would need money that is native to the internet. Money that is not controlled by Authorities. Money that isn’t centralized. Money that can be used by everyone anywhere on the planet. And that Money is taking shape as I write this.

“Just like the internet took out Hollywood with Netflix and Spotify, and it took out newspapers with publishing and Twitter and Facebook, and it’s taking out all kinds of industries; the internet is going to fundamentally change and possibly take out the finance industry as we know it.” - Naval

The seeds for this new age system were sown during the 2008 GFC. While the world was dealing with the financial system meltdown, a mysterious person or group of people, under the pseudonym of Satoshi Nakamoto had quietly published a white paper. This report described a new monetary system that would rely on a decentralized network of computers to verify all peer-to-peer value exchanges through a digital token called bitcoin. Largely unnoticed at the time, Bitcoin was fundamentally suggesting a new monetary system that could make the centralized banking system largely obsolete. It wasn’t until January of 2009 that Bitcoin was released with an initial market price of $0.08/bitcoin

It’s been more than 12 years and bitcoin continues to survive all speculation, resistance, clampdowns, non-acceptance by banks, government bans, and all the naysayers, even the most prominent ones in the Investment community. Not only has it survived, but it has also thrived in spite of the odds against it.

It has inspired a whole generation of Engineers to dedicate their every waking hour to making this utopian dream of a decentralized financial world come true. And it has, slowly but steadily. It has spawned many businesses, coins, capital structures, digital architectures, communities, ardent supporters, and forced for the development of a better education system that could prepare students for the truly digital future in the making.

One could miss the forest for the trees, if you were hooked onto the % gains bitcoin has provided since its inception. It’s an astronomical return that comes once in a lifetime and allows investors to create generational wealth. But there is much more substance to bitcoin and the whole crypto space than meets the eye, especially for those entrenched in the legacy financial system.

“Innovations are very cruel by nature. They destroy the old ones to create space for themselves.” - Sukant Ratnakar

Let’s first look at what purpose does crypto asset like bitcoin really serve #

As the historical record shows, it’s a store of value. So even if you’re not exchanging it, you just want to be able to store value. You may not want to store diamonds or houses or cash. So a crypto asset could be a choice.

And then it’s also a unit of account. In other words, you have to denominate prices in something. You can’t price a car in terms of 1000 loaves of bread. That would be funny. But you can price it in no. of bitcoins.

The scarcity is an essential part of it. If it starts inflating on you, then your share of it goes down so the scarcity is quite essential to it. This incentivizes all parties involved to keep its supply under control, unlike the FED or other Central Banks.

Other things are you want it to be easy to secure and transport and Bitcoin has the advantage that you can send it to people all over the world and store it on a hardware wallet, which is a fairly secure way to store it.

It’s not a surprise to see many mega corporations either converting a portion of their Treasury into Bitcoin or creating the infrastructure to support its usage as a mode of payment or exchange. If the Financial system does actually break and weakens the dollar, it would pave the way for Bitcoin to be looked as a store of value a.k.a. Digital Gold and hence the interest being generated in the community is intense. It’s mainly retail participation today but there is enough work going on to convert the corporations and sovereign wealth funds to look at this emerging asset class.

Bitcoin has spawned many other cryptocurrencies with varying characteristics. And if these characteristics allow digital assets to be looked at as a medium of exchange, then we would also need digital contracts to facilitate the smooth execution of such exchanges.

This is where Smart Contracts come in. Ethereum is the 2nd biggest after Bitcoin and has become a global supercomputer that provides a flexible and secure platform to build, connect, and monetize an ever-expanding ecosystem of decentralized applications (dApps). As a result, Ethereum now underpins thousands of new applications (smart contracts) across a broad range of industries. To understand the applications aspect, you first need to understand “blockchain” and “smart contracts”.

“If you see a fly in amber and it’s got a millimeter of amber around it, that could have been done yesterday or a year ago. But if you see the fly is trapped in a huge block of amber, you know it’s been there for a long, long time; it’s been accumulating. So a blockchain is a series of blocks. Each block is a series of computations done by computers all over the world using serious cryptography in a way that’s very hard to undo. So each block is like another thin layer of amber, and the chain of blocks represents the depth of that amber; how long that fly has been trapped in, and therefore you can trust that honest signal. Anything deep down in the blockchain is mathematically, cryptographically, and just economically impossible to undo.” - Nick Szabo

It’s the blockchain that brings the security and privacy aspect to crypto. The smart contracts bring in collaborations, contracts, and various forms of exchange.

The idea of “smart contracts” was first introduced in 1994 by computer scientist and cryptographer Nick Szabo. This concept was proposed years before blockchain had even surfaced as an idea. Szabo had described what was effectively a “set of promises, specified in digital form, including protocols within which the parties perform on these promises.”

Nick always refers to the old-fashioned vending machine as the granddaddy of all smart contracts. Vending machine in contract law terms, it verifies a performance. You put in a quarter and it verifies you’ve put in the quarter through its mechanical apparatus. It has logic in that says okay, you put in a 5 AED, the soda costs 1 AED so I’m going to give you 4 AED back and the soda you selected.

“A smart contract is a special protocol intended to contribute, verify or implement the negotiation or performance of the contract. Specifically, smart contracts are the reason why blockchain is referred to as being “decentralized,” as they allow us to perform trackable, irreversible, and secure transactions without the need for third parties.

The obligations are written into the code in “if-then” form, For example, “If Person A completes Task 1, Then payment from Person B is delivered to Person A.” Using this protocol, smart contracts allow for the exchange of all kinds of assets with each contract replicated and stored in decentralized ledgers. This way, none of the information can be modified or corrupted while data encryption works to assure full anonymity among participants.” - From Transcripts of Tim Ferriss Podcast with Naval & Nick Szabo

The most famous contract people may have read about is NFTs (Non-Fungible Tokens). “Non-fungible” more or less means that it’s unique and can’t be replaced with something else. For example, a bitcoin is fungible — trade one for another bitcoin, and you’ll have exactly the same thing. A one-of-a-kind trading card, however, is non-fungible. If you traded it for a different card, you’d have something completely different.

It basically allows an artist to sell his piece of art digitally to someone, who lands up becoming the sole owner of the art. We can make copies online for free, but the owner is only one. It work’s like the ownership of the Mona Lisa painting where copies of that painting are found in every corner of the globe, but it’s owned only by the French Republic and displayed at Louvre in Paris since 1797.

NFT

You might find the USD 69 million price tag on Beeple’s “Everydays - The First 5000 Days” as absolutely ridiculous. But the key takeaway here is that this piece of art was built over Ethereum Blockchain and sold digitally. This may be just the beginning and you may hear a lot of crazy success stories that reflect the fanatic followers and believers of digital art. But the possibilities are huge.

Since it is digital and trackable, it can also be monetized by the owner if it is allowed for use in digital metaverse i.e games, animations, Sci-Fi movies, or any other form. The owner also keeps earning from the artwork when it is sold to someone and resold later. This would imply that the owner could draw an income for this piece for life without being taken for a ride or short-changed by humans involved. The transaction is on the blockchain and is structured in a way that rewards previous owners.

Just imagine if James Patterson writes his new book and issues NFT for the same. The same need not be bought by 1 person, it could be collectively bought by 10 of us. What if the book becomes an international bestseller and the profits earned from global sales get split between the 10 owners of this NFT. This would be seamless in execution and marvelous as an idea. As I write this piece, this is already happening -

Jack sold this NFT for more than USD 120,000 and he allowed many of us on Twitter to participate in the ownership of his 1st NFT. This whole process was carried out on Foundation Platform that gets creators and collectors of digital art together. The art was created digitally, bought by someone across the globe digitally, and with digital money.

If this can be done for Art today, it can be done for almost all things digital today and for many physical goods eventually. Music is made available by Spotify, Information is made available by Wikipedia, Bedspace is made available by Airbnb, Hotel rooms made available by Expedia but they all have payment gateways that need currencies that are centralized in printing and distribution.

What if money itself gets decentralized? What if money is created by the people living on the internet and for the people on the internet. That’s exactly what Defi is attempting to do. It’s taking at a shot at the Fosbury Flop.

Untill 1968, high jumpers had to land on sandpits or low piles of matting. Hence it was a preferred option to land on the feet or at least land carefully to prevent injury. Dick Fosbury was the first one ever to attempt landing on his back. This was possible only because in 1968, deep foam matting had replaced the earlier versions of matting and it became possible to land on the back without any injury. It was his Gold medal in the 1968 Summer Olympics that brought this style to the world’s attention.

DeFi is basically the Engineering Nerds attempting a Fosbury Flop with the help of Internet Infrastructure being made available globally. The basic tenants of DeFi applications are:

1) No Custodian. In other words, there is no bank or custodian in-between transactions. Each individual controls access to their own crypto, transactions, and data around their activity.

2) The network is Global. There are no borders, exchange rates, currency differentials, or waiting for global transfers. Everyone on the network, regardless of country, will be able to transact instantly with anyone else in the world with ease.

3) The network is open source. This allows developers to view the code of any and all applications on the Ethereum blockchain and for the ecosystem to evolve.

4) Decentralized network. The Ethereum blockchain is run off of thousands of “nodes.” These nodes are constantly computing the transactions within the blockchain from around the world, making it nearly impossible to hack as well as regulate.

That means that somebody in India can do a smart contract with somebody in Peru and to the extent that they can formulize their deal mathematically to this logic code, they don’t have to rely on the Indian authorities or the Peru authorities; they can just do business directly.

These are essentially chunks of code that handle your money for you, as opposed to bankers or investment managers. When people talk about the value “locked-in” or “locked up” in DeFi, they’re talking about the amount of money, users are entrusting to these systems. The current number is around $80 billion, according to data from the analytics site DeFi Pulse. That’s up from around $1 billion at this time last year.

This hints at a system that doesn’t have it’s levers in the hands of the elite. This hints at a system where 7 billion people get to be a part of one world with no borders, potentially. This hints at really smart and talented people getting a shot at generating wealth instead of only those that have the Harvard/Yale degrees or the right connections. This hints at a possibility of educating masses at scale to upskill and upgrade their knowledge to be a part of the new world in the making.

Many services are being built on top of the Ethereum Blockchain. These include -

Payment platforms like Coinbase Commerce, Circle, and Bitpay allow for efficient payment in your preferred cryptocurrency for goods and services. The transactions take place in a few seconds/minutes and with nominal or no fees.

Lending & Borrowing programs on Dharma & Compound. The yields offered on these platforms can be 4 - 8% for the short term and in excess of 15% for the long term. I heard Kevin O’Leary (Shark Tank fame) talking about yield farming through these platforms where he lends his crypto assets to earn 4-8% on them for ST contracts.

LedgerX and Synthetix allow entering into synthetic contracts and creating derivative positions on many cryptocurrencies and some stocks too.

MetaMask, Brave, and Coinbase Wallet provide Asset Management tools while acting as a custodian. It is a specialized financial institution that safeguards a user’s financial assets and is not engaged in any traditional commercial or banking services. These institutions are focussing on taking away the friction and inefficiencies in the System, which will encourage many to participate seamlessly.

Nexus Mutual and Cdx are Ethereum-based decentralized insurance protocol that uses a risk-sharing pool allowing anyone to buy an insurance cover or contribute capital to the pool. Its members wholly own the pool. Anyone can participate as the mutual by contributing ETH into the pool in exchange for NXM – the native token. The token can be used for claim assessment, risk assessment, governance, etc.

“Cryptocurrency currencies take the concept of money, and they take it native into computers, where everything is settled with computers and doesn't require external institutions or trusted third parties to validate things.” _ Naval Ravikant

I may have painted a very utopian picture in my comments till now. I don’t want it to sound too good to be true and hence will lay down a few disclaimers too. The industry is at a very nascent stage. It’s where the internet was in the 1990s. Everyone knew the potential of the technology but nobody could point out the winners from the lot. If you could, you would have been a billionaire by now. But the uncertainty and the volatility in the internet era destroyed trillions of dollars due to wasteful allocation, speculation, overpaying, leverage, unrelated diversification, or failed execution.

The exact story will play out in Crypto land going forward. Though the market cap of all coins has reached USD 2 trillion, the industry has large inefficiencies and massive speculation going across its 6000+ coins. It’s like the Wild Wild West and you cannot point at any crypto-asset today and state with certainty that it will be there 10 years down the line. Bitcoin standard seems to have crossed the longevity barrier but it still needs to protect its turf against many solutions popping up in the marketplace.

Few risks that one must watch out for are -

Infrastructure Risk - Systems and exchanges can be hacked into, resulting in your coins being stolen. Hence the savviest players do not hold their crypto assets on exchanges. They hold it in cold storage or wallets designed specifically for this purpose.

Regulatory Attack - the US may make Crypto ownership illegal

Paywall Attack - China may ban any payments to or from Crypto Exchanges or Wallets

99% coins could go bust, and there is a high probability they will

Counterparty Risk - Stablecoins that are backed by US Dollars illustrate this risk, as the company issuing the coin may not actually have the US Dollars on hand sufficient to back the digital asset.

In spite of the odds against them and the challenges faced by the crypto community currently, it still remains a futuristic solution to the problems of the past. You could choose to play it in 3 ways -

Hold some (around 5%) crypto directly for diversification or hedging purpose. 50 - 50 in Bitcoin and Ethereum could be the safest option to go with.

Trade to exploit inefficiencies in the system (if you are nerdy enough to figure out the nuts and bolts of the system)

Invest with managers who are very skilled in the space (find the best in the game and allocate capital to them)

If blockchain technologies do succeed in creating a decentralized financial infrastructure, it could create enormous wealth for the ones involved. And if it doesn’t, you shouldn’t lose your house on it. That’s the way you can play this game.

Heads I Win, Tails I don’t lose much.

“Crypto Community is a Win and Help Win community. It’s ambitious, positive, and collective. Crypto enthusiasts are a bold lot that is aiming for Infinite Frontiers and Eternal Life, instead of just moving the gravy on the plate.” - Balaji Srinivasan, ex-CTO of Coinbase

Wishing you loads of luck.

Manish

Sources #

Tim Ferriss Podcast with Nick Szabo & Naval and with Naval alone

Tim Ferriss Podcast with Kevin Rose

Tim Ferriss Podcast with Balaji Srinivasan

The Capital on Medium

Crypto Market Recap on Arca

Nick Szabo Blogspot

Open University Youtube Video on Finance

Blockgeeks blogpost for DeFi

My conversations with Eugene, Zack & Maomao. These are professionals currently involved in Asset Management, Trading, or Operations in the crypto space.

Sir, what if we bet on businesses which will benefit, whichever crytpo currency comes in circulation . As u stated above, what if we bet on businesses like crypto exchanges, or businesses which are facilitating crypto lending or exchanging or business etc. We can take inspiration from the analogy -When there is Gold rush dont mine Gold sells shovels.