The Swiss army knife is ‘a penknife incorporating several blades and other tools such as scissors and screwdrivers.’ How cool is that? One device to address umpteen issues. When was the last time you used it? I have one and don’t even remember where in the house it’s been hiding ;)

Isn’t it surprising that a multi-purpose tool has zero utility in real life?

The scissors are too small for me to effortlessly use for cutting open my packet of frozen berries

The knife is too blunt for any use in the kitchen

The screwdriver is inconvenient or impossible to use around corners with less space to move

The saw blade makes for a good showpiece but I doubt I’ll ever be in the woods

Some even have a magnifying glass leaving me to wonder what to use it for

We may have bought it thinking of umpteen reasons, but we almost always chose the most effective tool for the task at hand, and it wasn’t the swiss knife ever.

Similarly, many investors make naive attempts at investing in everything they possibly can. It seems to say NO is a really difficult thing for many who are presented with a once-in-a-lifetime opportunity of sorts :)

Just like the call I received now from Danube Properties where I and my family have been exclusively selected for their roadshow for new launches. The same script would have been used 1000th time already in the last 3 hours across residents in Dubai. I am sure they will find a few fish to fry.

I started thinking on these lines in the afternoon when I met a client who has been investing only in real estate and has made millions of dollars from this asset class. He hasn’t made any money from stocks, bonds, crypto, or anything else. Just stuck to what he understood and continues to hit one home run after another.

He has gone wrong too at times, but his hits have more than made up for his wrong bets.

This strategy is simple, repeatable, and with the highest return per unit of stress (HRUS) undertaken, for him. How about you? What’s your strategy that meets the criteria of (1) simplicity (2) repeatability (3) HRUS

What’s ‘simple’ exactly?

I define it as a task/tool that is functional in nature and can be explained to a 10-year-old kid too. I still use the iPhone XS in spite of repeated attempts by friends to get an upgrade on the device. But XS works just fine, especially for the two things I use the most on the phone i.e. Whatsapp & Calling. I just haven’t seen the need for a fancier device and hence stayed away from it.

In investing too, you can have a strategy in place that’s simple, something you understand well, something you can explain to a 10-year-old easily, and something that’s worked over the long history of booms and busts.

One of our Senior Product Managers in the bank has been index investing for decades. He invests all his surplus in Vanguard World Index Fund and is content with the results to date. He isn’t chasing alpha returns nor is he excited about becoming a millionaire in a year. He finds this Index Fund as a fair representation of global equity markets and he keeps loading up on these every time he can.

What interested me about him wasn’t the returns he’s achieved on this investment or the amount of money saved to date, but it’s his contentment and peace of mind that he enjoys through this particular choice. He’s not risking complete capitulation nor is he going for the stars. He’s happy earning the average world index returns and at peace with that.

That’s an example of what ‘simplicity’ looks like. It need not be average market returns, but it needs to be simple given your understanding of the markets and the relevant expertise in the field.

Let’s look at what’s ‘repeatable’.

I work out at least 5 days a week and I push hard enough to build muscles, but not as hard as a bodybuilder would need to. I spend 45 mins max working out, instead of the 2 hours that I’ve seen many devote to the gym. My workouts can be done at home using bodyweight and resistance bands if need be, it doesn’t always need hi-tech equipment. And they are always done around 6:30 am in the morning which allows me to start my day with great energy and high spirits.

Your investing strategy could also have that repeatable element in it instead of making just one investment and hoping that turns into a home run. For e.g. I have a friend who has bought a property on a mortgage. His EMIs constitute about 1/3rd of his monthly income, not leaving enough room for making other investments. Any incentives earned, are kept aside for future EMI payments in case he was to experience a job loss or economic slowdown of any kind.

He has also lost optionality of any kind i.e. with a multi-million mortgage loan on him, he cannot risk his job, or stand up for what he believes in if it was to irk anyone senior to him at work, or take up a job he really likes but at a lesser salary, nor could he let go of his 9-5 for a shot at entrepreneurship.

If you can buy Real Estate every quarter or once a year, then you could follow the strategy that one of our clients has been following for years. But if one property purchase will set you behind in your ability to invest on regular basis or lose optionality, then it’s a tricky decision to make and I would choose not to if it was me making the choice. I have even written on this specific choice and you can read it here.

Even the once-in-a-lifetime opportunities that come our way do not qualify for this test. “Villas on Sale only for next 24 hours”, or “20X leverage available only if you open your crypto account right now” and many such FOMO-based offers aren’t repeatable in any way.

These are marketing messages or environments created to induce a rushed purchase without fair evaluation of the opportunity given your resources and understanding. You will be better off giving it a pass. If I sense anyone rushing me into making a decision, that is enough to tick me off and let go of the purchase.

I want to invest my money, but I won’t invest now just because you want me to. I will invest when I want to invest, given enough time to think about its pros and cons, and maybe even doing some scuttlebutt or asking around.

Currently, I have a certain amount allocated for buying Equities on a monthly basis in companies that I have researched and am comfortably holding for the next 3-5 years unless my investment thesis wasn’t valid anymore due to serious business disruption or any indication of governance red flags. Some of it even goes to Mutual Funds which I intend to hold on to for a decade or more.

This recurring amount is also a portion of my income that leaves enough room for my family’s lifestyle expenses and it's in an asset class I understand and can keep a tab on, irrespective of which country I am in or what part of the day it is. I’ve made it as “repeatable” as I possibly can.

I know I may be missing out on the next sexy thing that the world will wake up to, but it's okay since I need to go to sleep peacefully every single day before the world wakes up to something mind-bending or earth-shattering ;)

Now we get into the most important part of the trifecta i.e. “return per unit of stress”.

Prof. Bakshi wrote in one of his posts –

My advice to those who ignore the stress part of the equation but focus only on returns per unit of risk: You cannot take it away with you, so what’s the point of all that stress, just for the money?

Seriously, what’s the point?

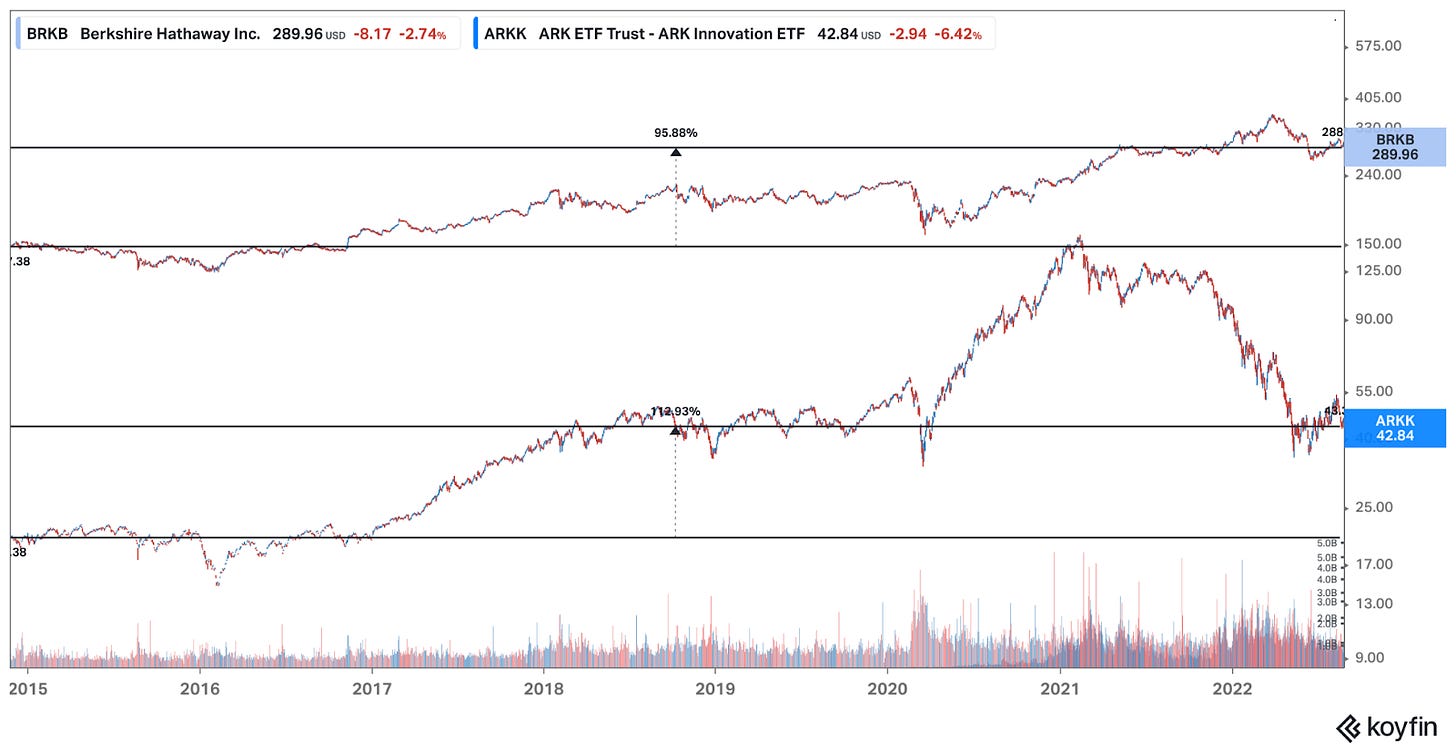

If you look at the 2 charts below, the one on the top is Berkshire Hathaway compounding slowly and steadily from Nov 2014 till date. It has returned almost 100% in 8 years i.e. 9% compounding p.a.

The other chart represents ARK Innovation Fund growing very fast and crashing even faster in the last 18 months. It has returned more than 114% in the last 8 years i.e. 9.97% compounding p.a.

Which one would you prefer to be invested in? The slow and steady compounder that doesn’t give you the heartaches that come with hypergrowth strategies, or would you chase market-beating returns irrespective of the leverage and complexity involved? That too for just that additional 0.97% p.a.?

Think about it. I would go with Berkshire anyday.

An investor is presented with tons of options that are marketed as high returns with less risk or less capital involved. Some options are even sold as simple and effective in spite of the ticking time bombs that they are. A few of these options are presented below -

Derivative products like Futures & Options

IPOs / SPACS

Leveraged Trading

Angel Investing

Shorting

Dealing on Inside Information or tips

Initial Coin Offerings (ICOs)

Following blindly/hero worship

Whatsapp University based trades

High P/E Stocks

Cyclical Stocks

Many of these strategies are opted for by investors as they are experiencing emotions that they are struggling to deal with i.e.

FOMO (Fear of Missing Out)

Envy

Greed

These emotions have influenced mankind for billions of years, and they will continue to do so for the next billion years. You will have to fight these urges and shape your own psyche around money and investing before you start the process of accumulating wealth for your future.

Why compare your returns with others, when others might be playing with fire and not care deeply enough for their future goals or families?

Why fret over others making tons of money playing high-risk high-stress games when you could accumulate wealth too, just slowly and steadily?

Why pursue being a millionaire tomorrow when being a millionaire day after would be as sweet, or maybe sweeter since you didn’t take on a lot of stress or risk to reach there?

Why envy someone else who risked his life playing Russian Roulette and won a million dollars?

Once you have mastered the inner game, then you need to get good at managing your portfolio too. Individual stock returns are good, but it’s the total portfolio that matters after all.

That would require your portfolio to be diversified enough to provide protection from market volatilities that won’t affect all the sectors that you are invested in. At the same time, you will need to avoid being concentrated enough so that massive drawdowns in any of your portfolio holdings don’t wipe out a huge chunk of your invested capital. E.g. I have 14 stocks in my India portfolio of which 2 of them make up 22% and the balance 78% is spread across the remaining 12 stocks. None is in excess of 15-20% to cause me serious damage of any kind, and none is so small that its 2X gains have no impact on my portfolio.

The balancing act between diversification and concentration is a tricky game to play, but it will let you earn high returns per unit of stress undertaken during your wealth accumulation journey.

I’ll let Nassim Taleb end the piece in the most eloquent manner that he’s known for -

…people who look too closely at randomness burn out, their emotions drained by the series of pangs they experience. Regardless of what people claim, a negative pang is not offset by a positive one (some psychologists estimate the negative effect for an average loss to be up to 2.5 the magnitude of a positive one); it will lead to an emotional deficit.

…people in lab coats have examined some scary properties of this type of negative pangs on the neural system (the usual expected effect: high blood pressure; the less expected: chronic stress leads to memory loss, lessening of brain plasticity, and brain damage). To my knowledge, there are no studies investigating the exact properties of trader’s burnout, but a daily exposure to such high degrees of randomness without much control will have physiological effects on humans (nobody studied the effect of such exposure on the risk of cancer).

…wealth does not count so much into one’s well-being as the route one uses to get to it.

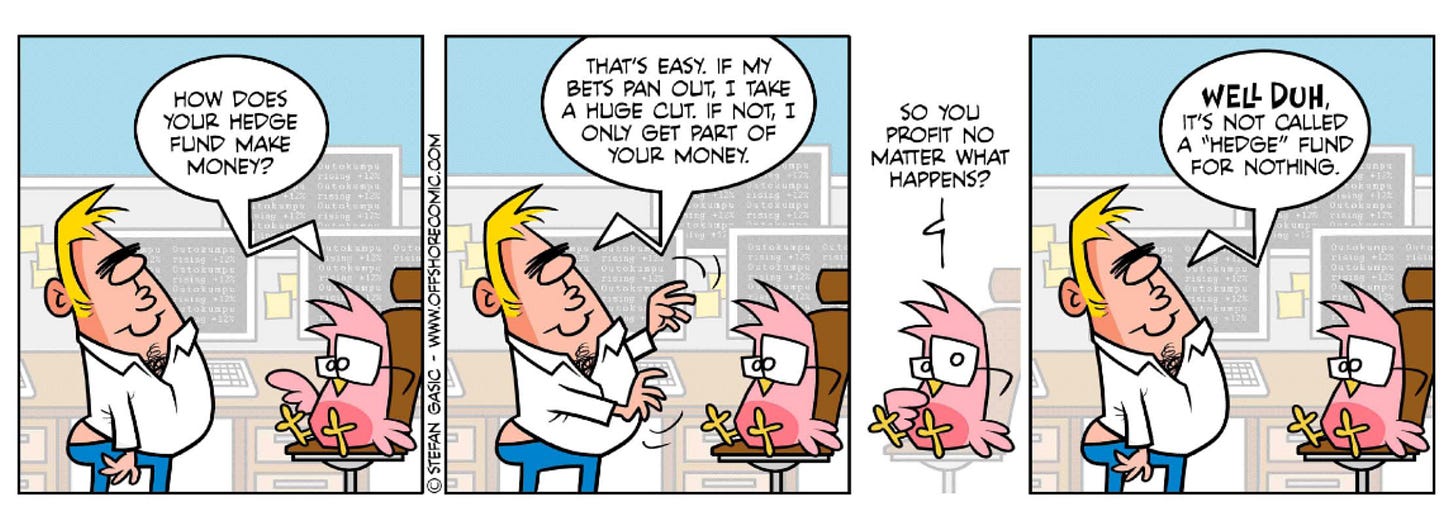

Hope you learned a bit about hedge funds from Stefan Gasic’s comic strip ; ) The same story applies to a lot of investments being peddled to you on daily basis. You got to be on guard at all times. It’s your hard-earned money after all !!

Wishing you loads of love and luck.

Manish

Beautifully articulated and so incisive. Thanks for keeping the flame of intellect burning!