The Burden of Numbers

Ignorance and Casualness around this subject is Astounding…

“Not everything that counts can be counted, and not everything that can be counted counts.” — Albert Einstein

Numbers play a very crucial role in almost every decision that we make, but surprisingly, it isn’t a domain where many specialize or take a deep interest in. It’s merely taken on face value, assumed, opinionated, judged, and worse, acted upon. And this happens day in day out, purely on a heuristic basis.

A heuristic, or a heuristic technique, is any approach to problem-solving that uses a practical method or various shortcuts in order to produce solutions that may not be optimal but are sufficient given a limited timeframe or deadline. — Google

MAY NOT BE OPTIMAL is an understatement. Using heuristics for deciding upon numbers that you encounter is like playing chess blindfolded. Let me share with you a few, very peculiar and fundamental examples I came across in Peter Bevelin’s book ‘Seeking Wisdom’.

Works like “big” or “small” have no meaning in themselves. A number has only a size in relation to another no. USD 1 billion says nothing about economic performance unless we compare it with how much capital was needed to generate it. What if the company needed USD 100 billion in equity and debt to run the business? That’s only a 1% return.

Just digging deeper into the numbers changes your perspective towards the company in question. A similar analysis can be done for your income. Eg. you currently earn USD 75,000 p.a. and this affords you a decent 2 BHK, a nice Toyota sedan, 2 kids, and 1 international holiday every year. This income places you to be the breadwinner in your house, garner respect and adulation from your family members and cousins, and makes you the one that calls the shots for all decisions at home.

BUT, let’s look at this no. i.e. USD 75,000 and the 2 perspectives that you may carry that could change your relationship to what this income can do for you.

Scenario 1 # What if your peer group earns USD 200,000 on average, live in a 5000 square feet villa, own 2 luxury SUVs, have 2 kids in the best of schools, and take 3 international trips every year. The probability is high that your lifestyle will pale in comparison to your peers and that may dent your levels of satisfaction and happiness.

Scenario 2 # What if you land up reading the Global Wealth Report 2018 published by Credit Suisse and you realize that a net worth of USD 93,170 would make you richer than 90% of the world. Again, the probability is high that this could boost your level of satisfaction and happiness, knowing that you are more privileged than 90% of the global population.

It’s not the USD 75,000 in isolation that matters, what it’s being compared to has a huge bearing upon you, mentally and emotionally.

“There are good guesses and there are bad guesses. The theory of probability is a system for making better guesses.” — Richard Feynman

A lottery has 10,000 tickets and each ticket costs AED 1,000. The cash price is AED 1,000,000. Is it worthwhile for Mary to buy a lottery ticket? (eg. taken from Seeking Wisdom but currency and figures changed for UAE angle to it)

The expected value of this game is the probability of winning (1 in 10,000) multiplied with the price (AED 1,000) less the probability of losing (9,999/10,000) multiplied with the cost of playing (AED 1,000). The calculation is : [(1/10,000)*(1,000,000) — (9,999/10,000)*(1,000)] which works out to -999. This means that Mary’s expected value of buying a lottery ticket is a loss of about AED 999 every time she purchases an AED 1,000 ticket.

Most of our decisions in everyday life are one time bets. Choices we face only once. Still, this is not the last decision we will make. There are a large number of uncertain decisions we make over a lifetime. We make bets every day. So if we view life’s decisions as a series of gambles, we should use expected value as a guide whenever appropriate. Over time, we will come out better.

This quantitative thinking is most applicable in Investing / Money related matters and I will share with you a few examples #

This chart shows Berkshire Hathaway stock losing almost 50% of its value in Nov 2008. That is a huge drop, an indication of a 50% write-down of capital invested in this stock. This would create fear, panic, and anxiety in investors holding this stock.

But a 24-year chart of the same entity shows the 2008 volatility only as a blip in the growth trajectory of this entity. A long term investor wouldn’t panic if he knew that the 50% drop in price had no bearing on the intrinsic value of the business and hence may have bought more. Whereas a short term investor may have exited the stock or the stock market as a whole and vowed never to invest in equities again.

It’s the same company and the same numbers, but the understanding of these numbers is fundamental to one’s decision-making ability. Most do not get to the root of the numbers, but get easily seduced into the story around these numbers and buy into it at face value. That’s laziness at most times, blind faith sometimes, and sheer casualness in balance cases.

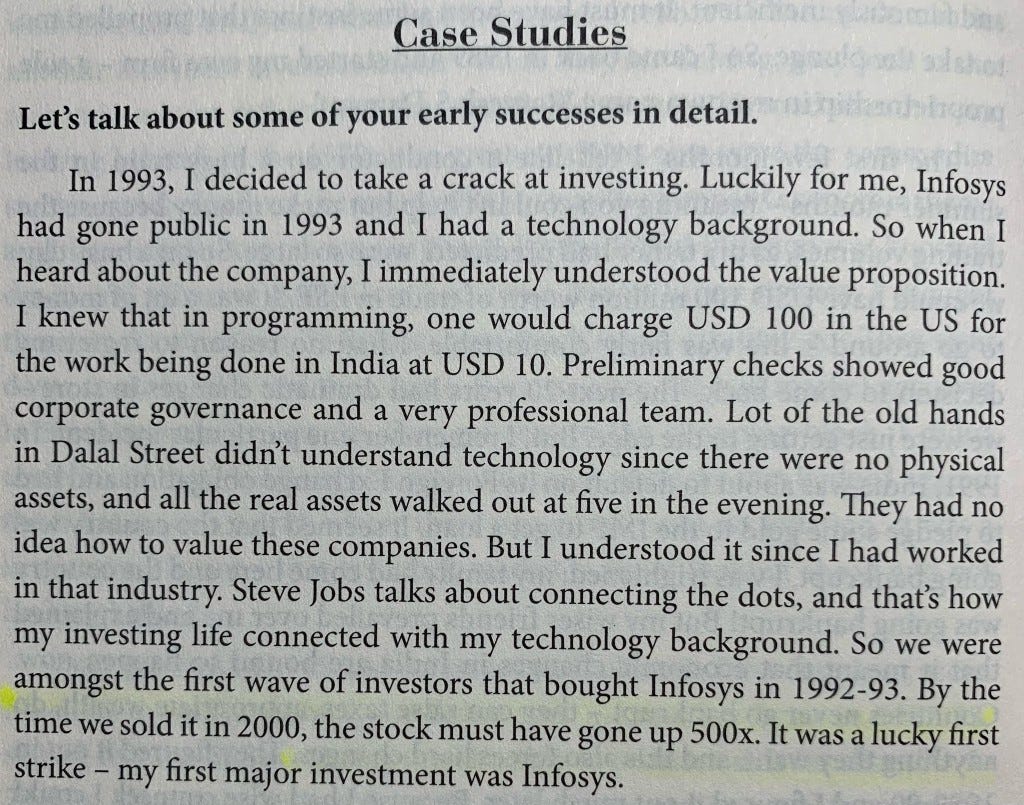

Even in this example from this brilliant book (one of the best you will get on India’s Equity Market Investors), one of India’s richest Investors, Mr. Ramesh Damani, shares his success with Infosys. He understood the pricing advantage and bet big on the stock to earn 500x on his investment.

But when you don’t understand the numbers behind a company’s growth story, you might exit too soon or bet too small. Former will only give you a momentary excitement for booking profits but you will regret later having missed the massive compounding the stock went through after your exit. The latter won’t make any dent to your wealth and hence would have been a waste of time and energy.

“Most people think dramatically, not quantitatively”. — Supreme Court Justice Oliver Wendell Holmes

Someone asked me today if the COVID vaccination is safe? Will there be side effects to it? Pfizer will not be taking any legal responsibility till 2024 for the effectiveness of its vaccine, is this fair? Let’s look at some numbers from a BBC article.

The United Arab Emirates is the first country to rate a front-running Chinese vaccine for Covid-19, saying it was 86% effective in a phase-three trial. According to what is the first public statement on the effectiveness of the vaccine, the analysis found that it produced antibodies that attack the virus in 99% of people who took it, and nobody who took it developed moderate or severe cases of Covid-19.

Moderna says its product protects 94.5% of people. The Oxford/AstraZeneca vaccine is 70% effective, data shows.Data on Russia’s Sputnik V vaccine suggest it is 92% effective. The Russian vaccine has also undergone phase-three trials in the UAE. — BBC

The answer is obvious, it is not 100% fail-proof. There could be complications. And Pfizer or J&J or Moderna are exposed to unlimited lawsuits on these vaccine’s and hence it’s only prudent to allow vaccination for citizens globally while providing some kind of immunity to the Pharma companies behind these vaccines.

In case you think it’s unfair for people to be treated as guinea pigs in the trial phase, then you should ask yourself foll. questions #

what are the alternatives (if any),

what are the costs of not vaccinating (bi-monthly covid tests being mandated across UAE and that costs money),

what is the probability of being adversely impacted by the vaccine (it’s a slim probability but it’s there) and

what is the probability of getting COVID +ve since it still continues to spread its wings as shown in the chart below for Dubai.

And once you have weighed upon these options, then you can arrive upon the decision to take the jab or not. But your decision could be heuristic based and you may just give in to the fact that everyone is taking the jab and hence you should too. Most will exactly do this.

Or, you can quantitatively think about, read a bit about it, go to the source story of these companies’ vaccine development programs and learn about these before taking your call. A write up by Walter Isaacson could be a good place to start. He is the same guy who has written few of the best biographies on Steve Jobs, Benjamin Franklin, Leonardo Da Vinci & Albert Einstein and hence his take on COVID is legit.

“The chance of gain is by every man more or less overvalued, and the chance of loss is by most men undervalued.” — Adam Smith

Having F.U.N. could mean ‘Having Fundamental Understanding of Numbers’ since everything will bring up a decision to be made and there will be numbers to that decision. There is a SALE going at Dubai Mall, a course at Columbia Business School costs USD 3250, a subscription to Online Research by your favourite Analyst cost USD 500, a new fitness tracker costs AED 300, Sadhguru’s meditation course is launched for INR 5000, your wife is enamored by the new BMW 5 Series etc.

These are the decisions that you are met with on daily basis. Your health, wealth, leisure, relationships, lifestyle will call upon your grey cells to get good at the Mathematics of these decisions. And this is where you will need to analyze numbers in terms of its relevance, comparison, frequency and probability. There is a lot behind a number that doesn’t meet the eye.

“I am a better investor because I am a businessman, and a better businessman because I am an investor.” — Warren Buffet

No wonder, some of the best investors in the world are great businessmen too. They understand numbers very well and hence can take decisions that will compound their personal wealth and business growth in equal measures. Radhakishan Damani, Warren Buffet, Marc Andreessen, Andrew Wilkinson, Nandan Nilekani, and many more run/have run multi billion dollar businesses and today allocate capital across many investments in public and private space.

Jason Zweig had a very interesting piece on Warren Buffet in Wall Street Journal — By the time he was in his late 20s, the way Mr. Buffett thought about compounding was like a reflex. When he paid $31,500 for his house in Omaha, he called it “Buffett’s Folly,” because “in his mind $31,500 was a million dollars after compounding” into the future, Ms. Schroeder wrote.

His friends and family regularly heard the young Mr. Buffett mutter things like “Do I really want to spend $300,000 for this haircut?” or “I’m not sure I want to blow $500,000 that way” when pondering whether to spend a few bucks. To him, a few dollars spent that day were hundreds of thousands of dollars forgone in the future because they couldn’t compound.

Recognizing that every dollar you spend today is $10 or $100 or $1,000 you won’t have in the future doesn’t have to make you a miser. It teaches you to acknowledge the importance of measuring trade-offs. You should always weigh the need or desire that today’s spending fulfills against what you could accomplish with that money after letting it grow for years or decades into the future. And the more often you trade, the more likely you are to disrupt compounding and to have to start all over again.

You don’t want to be appearing like Black Adder’s friend in the following video (start at 00:37)

<a href="https://medium.com/media/a72ae458636e15a092c2ed9d29ff0c35/href">https://medium.com/media/a72ae458636e15a092c2ed9d29ff0c35/href</a>

In case this brought a smile to you, then I urge you to start your journey in appreciating, discovering, researching, understanding numbers when you see them. On it’s own, it can mislead you into irrational decisions, that could lead to capital ruin.

But if you understand the reason that number is eg. Bitcoin at USD 36,000 or Tesla at USD 826, then you could make an informed decision. Else, your just relying on hope that someone buys it from you at a higher price. Now this ain't investing, this is speculation banking on divine intervention. I’m just thinking which God would be interested in answering this particular prayer of yours 😄

“A bird in the hand is worth two in the bush.” — Aesop

Have FUN. Fundamentally Understanding Numbers is crucial to making your money work for you. Else, your gonna be vulnerable to many, many smart but ill intentioned people chasing you for the money in your wallet.

😀 No further comments…

Wishing you loads of love and luck.

Warmest Regards

Manish