"It is possible to make money— and a great deal of money—in the stock market. But it can't be done overnight or by haphazard buying and selling. The big profits go to the intelligent, careful and patient investor, not to the reckless and overeager speculator." - J Paul Getty

The dictionary defines ‘patience’ as the capacity to accept or tolerate delay, problems, or suffering without becoming annoyed or anxious. It ain’t easy and no wonder, it is referred to as a Super Power by many. Even the most famous phrase in Herman Hesse’s book on Siddhartha was - “I can think, I can fast, I can wait.”

It is a virtue that you look up to when you spot it in people. You can feel it when you hear a story or read an article or a book. It’s a desire we all have i.e. to play long-term games and achieve incredible things in life. It’s aspirational and worth striving for in every domain that matters to us.

I was listening to a podcast on TSMC by Acquired and it was an outstanding story of long-term thinking in a very advanced industry of Semiconductors. The ex-CEO and ex-Chairman of the company is Mr. Morris Chang and he is worth USD 2.8 billion. The interesting part is that he did not own any equity in the company, in spite of having founded the same and being instrumental in getting TSMC to its pole position in the fabrication of chips for the world’s leading Tech giants i.e. Apple, NVIDIA, Qualcomm, Sony, etc.

So how did he amass this kind of wealth? Stock purchases in the secondary market from his salary while he was employed by the company since the age of 56. You read that right, he used his salary to accumulate this wealth over 30 years with the company. No pre-IPO equity ownership, no land parcel, no inherited properties, and no VC exits. Purely, drip investing in the shares of the company that he knew inside out.

I hope this gives confidence to anyone reading and aspiring to create personal wealth that could create financial independence for you and your families. Irrespective of your income, it can be done with a lot of patience. Morris Chang began at the age of 56, but you could begin at 21 or even earlier. Either way, if you make time your friend, astounding results are possible.

This is one potent example of the power of patience at play. But this virtue applies to any endeavor you intend to ace in. If I talk about my CFA Charter, it takes 3 levels to clear the examination along with relevant work experience. I cleared my Level 1 & 2 at the first attempt in 2004 and 2005, that too by self-study while pursuing a banking career. I was on a high and all geared up to complete the journey at the age of 26, which was a credible feat in the banking circle then.

Then I moved to Dubai in 2005 and got consumed in my profession and the umpteen opportunities that came my way to earn and splurge. It took a COVID-induced lockdown in 2020 to nudge me in the direction of using my time to complete my CFA. And when I did get the results in Feb 2021, I couldn’t resist being elated and jubilant about finishing this chapter, finally. I might be one of the only few that would have taken 17 years to complete a course that could be done in less than 3 years with focus. It was a long long wait but was worth it. Many growth opportunities have come my way since then and I couldn’t be more grateful.

If you too are stuck with your professional qualifications or frustrated with the time it is taking, I would urge you to not give up and complete it. Many times, it’s not the Charter/Degree that teaches you a lot and makes you attractive to others, it’s the ability that you have to focus on things or complete things that increases your appeal. It’s these actions that speak louder than writing on your CV that ‘You are focussed and finish things you started.’ That kind of credibility is definitely worth the pain and suffering of going through with your studies.

Even reading a book takes a lot of patience. I recently started reading Adam Mead’s 800-page monstrous book on Berkshire Hathaway. This will easily take me 3-6 months to wrap up, maybe longer. But BRK.B is my biggest equity position and I am very curious to understand the origins of this entity since Warren Buffet took it over in 1965. My incentive to read this book is to learn the art of decision-making in running a portfolio of public and private investments. I hope to learn about portfolio management, stock picking, asset allocation, the art of selling, business partnerships, and more. I can’t wait to dive in.

But I was never into reading in my teens. It was family circumstances that forced me into spending time in a library since I had no money to spend on cafes and movies with my friends. I was also lucky to have an aunt who always encouraged me to read and even gifted me books from her collection.

I started reading a little on daily basis. I still remember the Hardy Boys and Nancy Drew collection that I enjoyed. Even Sherlock Holmes was a treat. I started with fiction and only a few pages a day, which slowly turned into many pages daily, which slowly turned into a book a month and now it’s at a book a week.

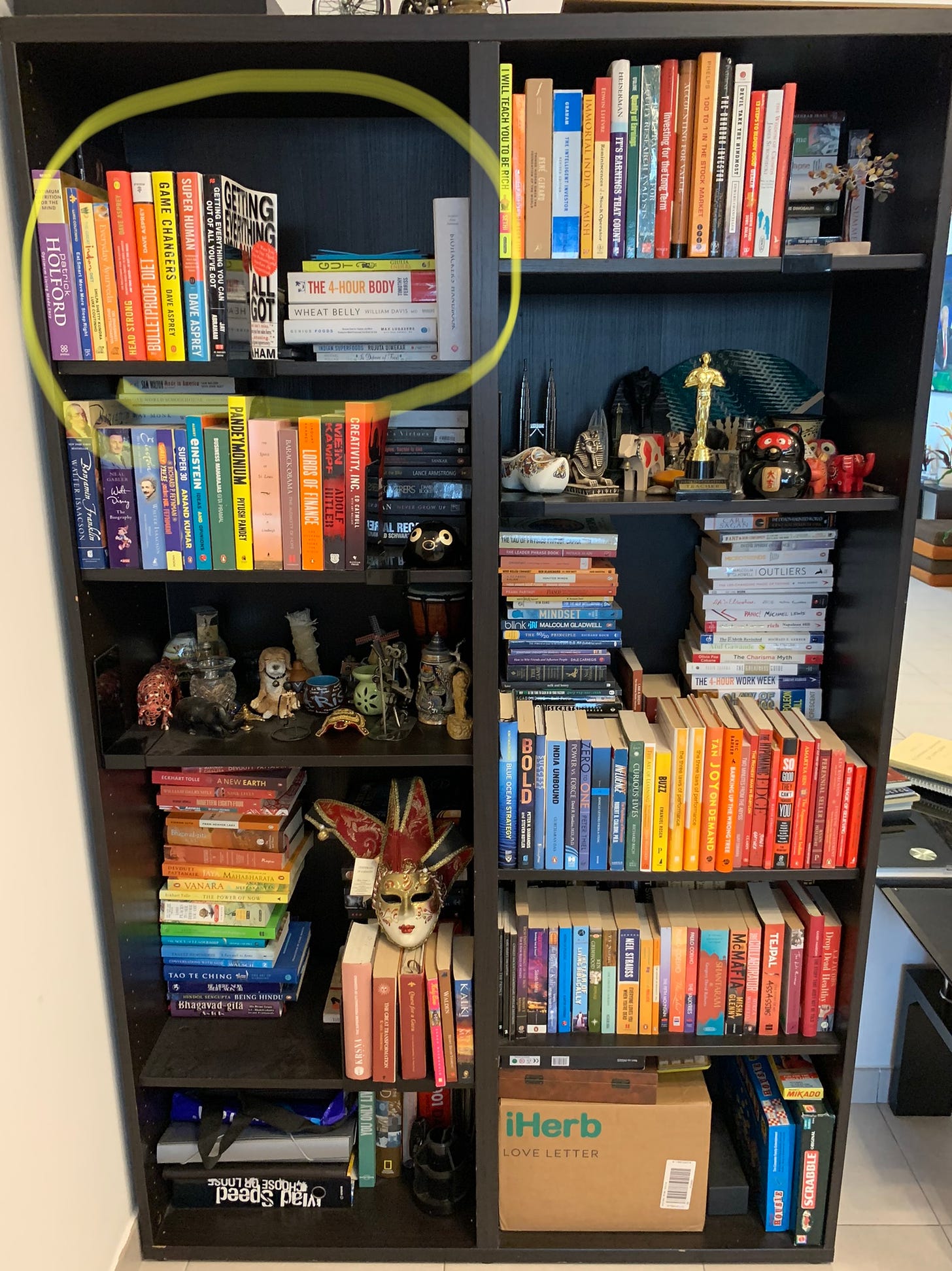

The below picture is of a few of the books that I have reviewed on Goodreads in the last 6 months. The book ‘The Boy, the Mole, the Fox and the Horse’ was a delightful read and is always on my reading desk for random browsing.

I know friends who can be put to sleep just by reading few pages of a book. I know people who want to read and learn but just cannot draw the motivation to do so. They know that the habit can forward their career by miles but they give in to temptations or laziness. But I used to be the same once upon a time until a page a day habit transformed me into a wildly curious specimen who is fascinated by how the world works. It’s a beautiful habit, you just can never feel lonely or left out.

A good book, a hot cuppa coffee, and a comfortable resting place are all we need to be happy in our own zone.

As seen from the 3 examples above - investing, career and habits, they all could get a boost with a dose of patience with baby steps in the right direction on a daily basis. As it is said about a bamboo tree ‘The first year it sleeps, the second year it creeps and the third year it leaps.’ The same goes for patience. It may not have anything to show for in the beginning, but the roots of your chosen principle during this waiting period are getting stronger. They may be invisible but the base is being formed before it can hold the weight of the growth spurt that’s to come.

But, just like sugar, too much of anything isn’t good. This maxim even applies to a virtue like patience. It can sometimes take a shape of a leech that slowly can suck your life away, without you realizing it. The struggle with ‘having patience’ all the time is that it makes you feel good about the virtue and very subtly, makes you inactive and slip into complacency. If you don’t realize what it’s doing, then it could create chaos and it would be too late to act then.

Let’s look at an example in the same domains as discussed above - investing, career and habits.

Just imagine that you bought a stock that was touted to be a game-changer in Green Energy space. The company had plants all over the world, order book from global clients, fancy headquarters for the entire staff, and a chest-pounding CEO appearing on the news on all channels. That’s the background of the Indian company shown above.

Now you bought it at a certain price e.g. 100 in Jan, hoping to make exponential returns on this investment of yours. What would you do if the stock drops 25% by Feb? Hold, Sell or Buy More? Let’s say you had reasons to be optimistic about the future of the company and green energy in general, hence you choose to ‘Hold’ and you wait for a reversal.

In March, the stock drops another 30% from Feb levels. Would you still hold, sell or buy more? Let’s go with Hold again as you are still optimistic and trained enough to not listen to the noise on various channels.

In July, the stock drops 20% more from Mar levels. Now it has corrected more than 50% from Jan levels and you still have to answer the same question - hold, sell or buy more? You still decide to hold because you are hopeful and have a positive personality.

In Oct, it drops 25% more from July levels. You are still holding as you don’t like to book a loss.

In Nov, it loses another 50% from Oct levels. You hate losing money and don’t want to look at the stock. And you still continue holding and hope for a reversal of fortune but that reversal never comes. Today (2021), it trades at a 98.50 % loss from your purchase price of 100 in Jan 2008. By now, you have written off the investment and don’t care anymore.

If you think this is an imaginary story, it’s not. This is exactly how many investors lose money in markets. No wonder the saying “more money has been lost in markets by waiting than by investing”. In other words, errors of omission (avoidance) have been more brutal than errors of commission (action).

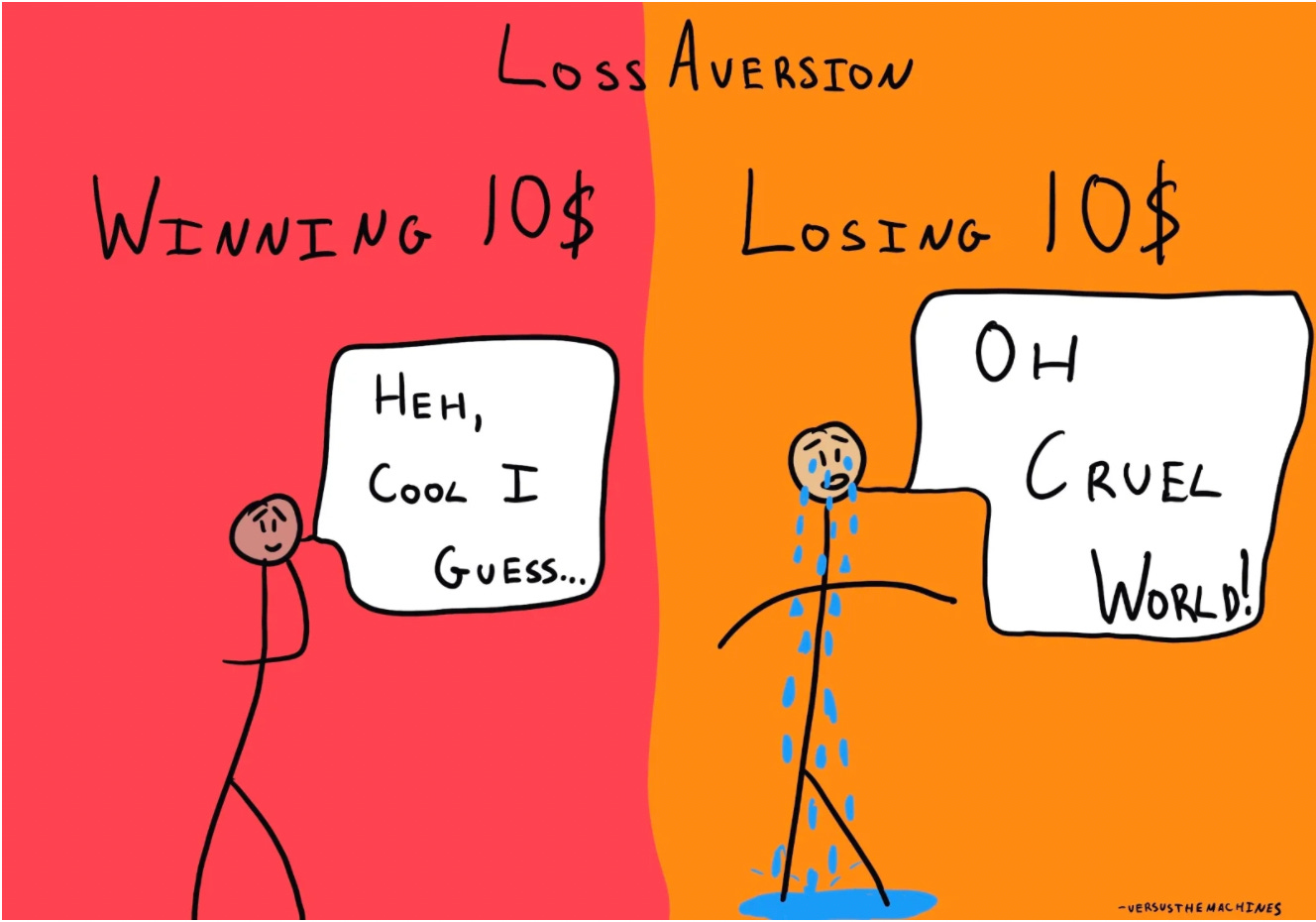

This is called loss aversion bias. It is a cognitive bias that describes why, for individuals, the pain of losing is psychologically twice as powerful as the pleasure of gaining. And hence you would resort to patience in your investing strategy and avoid booking a loss. Accepting a loss is an admission of a mistake and most don’t like the feeling and will do anything to avoid it.

Investors might continue to believe in their story about the company and suffer from consistency bias too i.e. only look for information that supports your initial view. This would make the falling stock price even more attractive, nudging you into buying more when the stock is correcting, in spite of the deteriorating business fundamentals.

There are emotional reasons too that support you in avoiding losses. We are wired to look good and hence admission of a mistake isn’t taken gracefully. The loss of credibility and reputation would be a huge blow to one’s ego and possibly finances, and hence we may be tempted to put things under the carpet for as long as we can. Nick Leeson did the same with his loss-making trades and bankrupted Barings Bank, UK’s oldest merchant bank, in 1995. That’s what made Vijay Mallya continue to invest in his loss-making Airlines and lose his billion-dollar empire in the bargain.

When an investment decision goes wrong, it’s a call to action to test your thesis on the basis of which you made the original investment. It’s time to reevaluate the reasons you first had in mind to buy. Are those reasons still valid? Has the environment changed? Has the management dropped the ball? Has the business become impaired? Is the competition intensifying and taking market share away? There are so many questions you need to answer on a regular basis when your sitting on a dud but hoping that it will bounce back. You need to answer these questions even if you are sitting on compounding machines in your portfolio. Capitalism is brutal and if Nokia could disappear in a few years, then the same could happen to any company in your portfolio, while you were chilling and taking your portfolio for granted.

Admission of a mistake is a sign of a mature individual. Learning from the mistake demonstrates wisdom and makes you better in your future endeavors. But resorting to patience to hide your ignorance or complacency in your due diligence could bite you hard. It might just be camouflaging your arrogance to hold your views in spite of contrary evidence all around you.

“Most people are too fretful, they worry too much. Success means being very patient, but aggressive when it’s time.” - Charlie Munger

Let’s look at a career that you are building. You got into it so that you could pursue your passion, earn money to afford a good lifestyle, and get a shot at success and fame in your preferred industry. And you started achieving one milestone and then the next. You got to travel many countries, started saving for the future, became a Senior Manager or Director and it was good for some time.

And then you hit a wall. You don’t enjoy it as much, you are demotivated and losing interest. This could happen at any stage in your career. That’s when you become vulnerable to bitch, gossip, indulge in loose talk, and spend 8 hrs every day dragging yourself at work. This is the time you start seeing the clock at least 10 times in the last hour of your workday.

You are hoping that all could change if the company recognizes your importance and promotes you, or transfers you into another department, or just recognizes your work and increases your salary and incentives. You wait patiently for this to happen and you take comfort in the opinion that you’re being virtuous in your demeanor and mindset. But that day may never come. Your patience may just be hiding your complacency or your inertia to work on yourself till you become so good that they can’t ignore you.

You could look at others’ growth and ask yourself what are they doing that I am not? What could I do to stand tall amongst the rest? How could I add value to my company, peers, or juniors? How could I make myself indispensable? This is how everyone successful has made it to the top i.e. by standing out. This reminds me of Virat Kohli, India’s most successful captain in the world of Cricket. He would show up for practice in the nets assigned to boys above 16 years of age, in spite of him being only 14. He would be declined constantly until people realized how good he actually was. He did not wait for people to notice him, he stood out tall enough from the rest and still does.

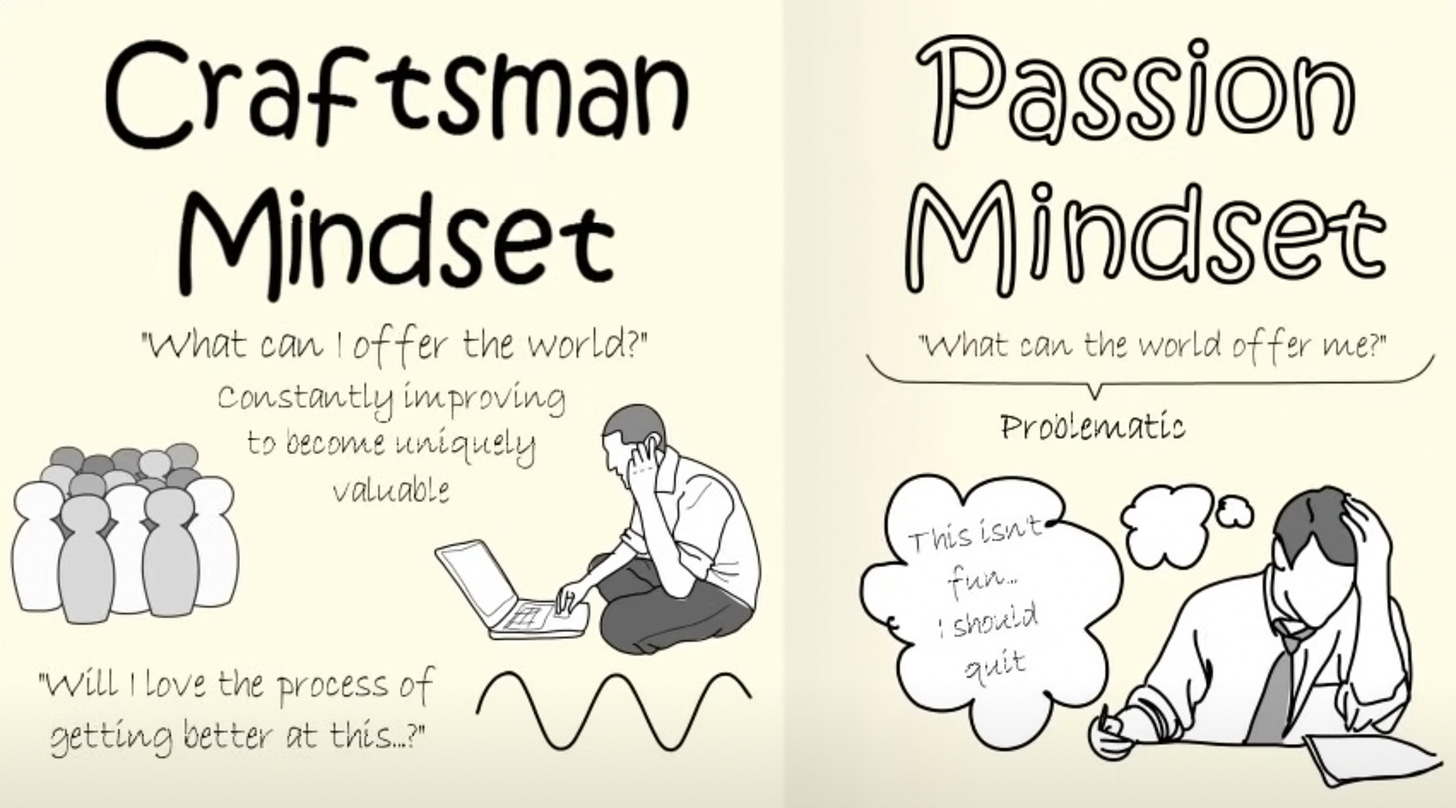

Cal Newport’s entire book is about Passion Mindset vs Craftsman Mindset. The former expects from outside in. Whereas the latter is constantly working on improving so he could offer rare skills/value that would make him contribute to his surrounding in a manner that others will fall way short of. That’s when the floodgates of opportunities could open up and shower upon you the perks that the best have access to.

Buddha has said, “Expectation is the root cause of suffering.” I choose to follow this advice in every relationship of mine. Serving everyone around you in the best manner possible is much better a choice. The maxim of “Give before you get” may sound counterintuitive but it works, always has, and always will.

As for a habit, patience sometimes takes the form of doing the bare minimum and waiting for the results to appear. I have a friend who has tried many nutritionists, gyms, diets and still doesn’t seem to lose weight. She was recently complaining about her health and her inability at dropping a few pounds in spite of all her efforts.

But every time I have shared a meal with her, she is feasting on Cheeze Zaatar, carbs-loaded bread, and pasta, sugar-loaded juices, or coffee. This only reflects that she has attended sessions but not learned much from them. It reflects on her ignorance about many foods, which is at odds with her desire to lose weight. A person committed to losing weight would be knowledgeable about the body, food, sleep, nutrition, and workouts.

In my friend’s case, she is patiently running around paid experts but again hoping for a miracle. A miracle ain’t coming. One has to work towards it, improving daily, getting better daily, gaining more knowledge daily, and measuring results regularly. And if things aren’t working out, then dissecting the problem to its roots so that you could resolve it.

Solving Problems isn’t reserved for entrepreneurs alone. All of us have problems and solving them is our own responsibility. Entrepreneurs solve problems that matter to them, no wonder many create billion-dollar empires and change the world. You and I may have smaller problems like weight, health, money, or relationships. But it still is a problem and needs to be attacked as one.

It would need multiple experiments, iterations, counseling, advice, conventions, programs, books, blogs, and tests. But it would need a lot of patience while you make peace with small progress in the right direction. As Gary Vaynerchuk always states “Be macropatient but microaggressive.” In other words, be patient in the long term for the results but aggressive in the short term for gaining knowledge and executing on the same.

Being patient for things to work out on their own is the wrong strategy. If it really matters, then you will do something concrete on daily basis. If you don’t, then the truth just may be that it doesn’t matter enough for you.

It’s time you get on the drawing board and ask yourself where have been patient too long? what needs to change? what steps need to be taken, starting today?

Today is late already and the ever-elusive tomorrow ain’t coming !!!

Recommendations for week #

Buggy Humans blogpost on Really Sorted Out People - This was the best post I read this week. It shares the two fundamental elements one needs to get a grip on, before one’s performance starts hitting its potential mark. This is applicable to all fields but written from a Stock Picker’s perspective.

Tim Ferriss on Not-To-Do Lists - Tim Ferriss is one of my favorite people and this post showed up in my inbox. It’s a vintage piece from 2007 but relevant today, than ever before.

I think You’re fat from Esquire - This was a hilarious read on how life would look if you were being truthful everywhere and with everyone 😄

TSMC Podcast on Acquired - I began today’s post with the story of Morris Chang and TSMC. This was a fantastic pod covering strategy, patience, luck, leadership, and so much more. Highly recommended.

I would be happy to hear from you any feedback or suggestions you may have. This newsletter is an exploration into the world of behavioral finance and I am learning as I am writing. Your inputs could be very valuable to the future course of this endeavor 🤝

Wishing you a super week ahead 👍🏻