“The best investors make a habit of putting procedures in place, in advance [emphasis added], that help inhibit the hot reactions of the emotional brain.” —Jason Zweig

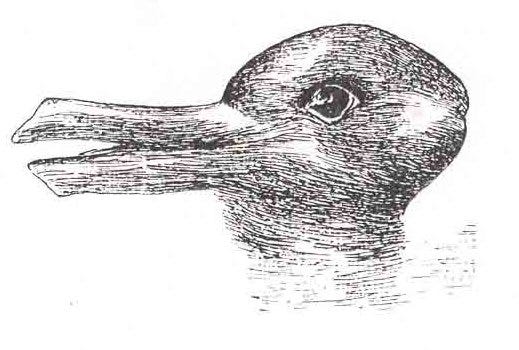

What’s the image that you see above? Is it a duck? is it a rabbit? Or is it both at the same time?

The answer depends on how you see it or rather what you see there. It ain’t about the picture, since that remains static. What changes is your perception of the image. You can try seeing the rabbit, you won’t be able to see the duck. The moment you see the duck clearly, the rabbit disappears. It’s not possible to see both images at the same time with absolute clarity.

This is a classic Duck-Rabbit reference that was made popular by philosopher Ludwig Wittgenstein when he used it to illustrate two different ways of seeing. The object remains the same, but one’s perspective could vary significantly and be supported by reasonable arguments in favor of that perspective.

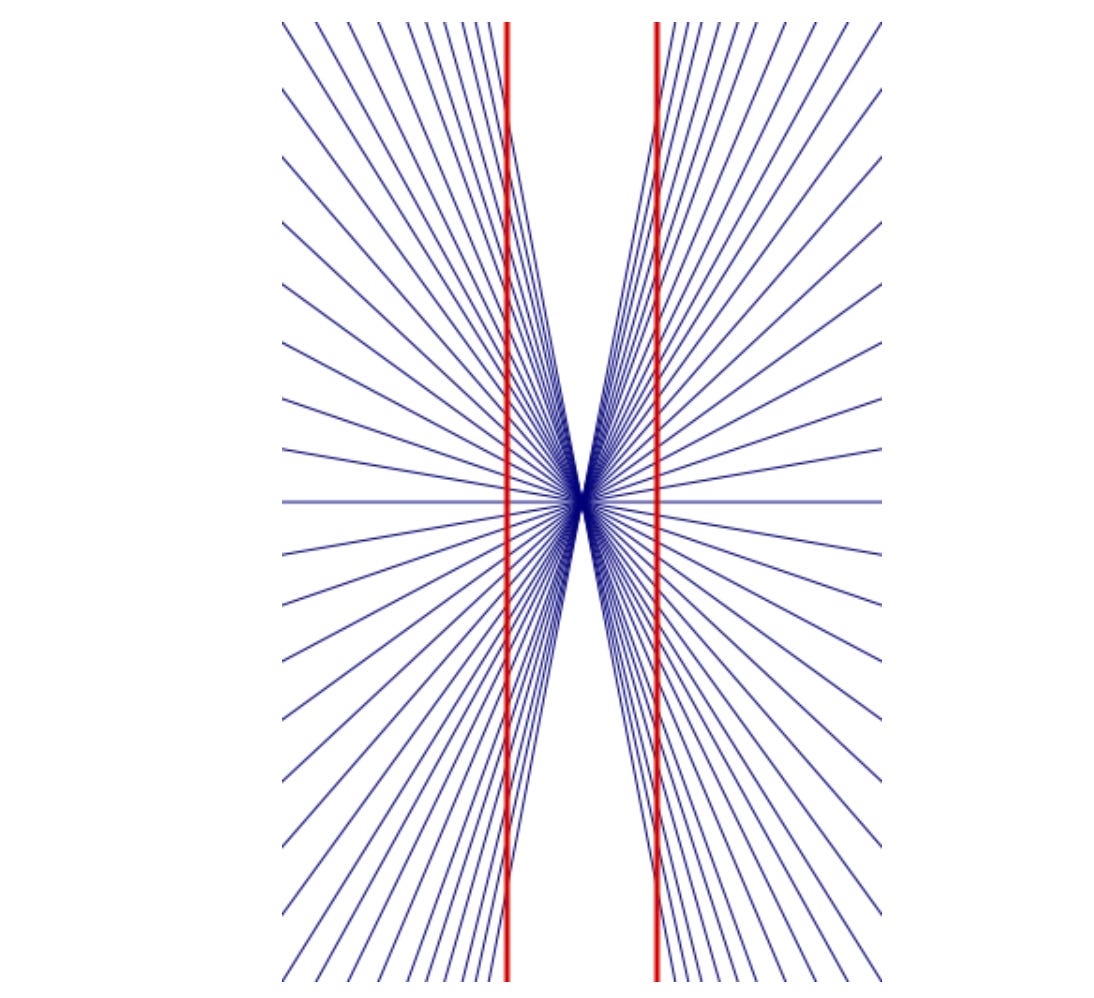

Even in the image above, the red lines appear bent in the middle, but are they really bent? How about you take a ruler and check the lines for yourselves. It will surprise you to know that the lines are straight and absolutely parallel to each other. But, in spite of the ruler proving this fact to you, your eyes still can’t see it that way.

Try as hard as you’d like, the optical illusion will get you.

This geometrical-optical illusion was discovered by the German physiologist Ewald Hering in 1861. He ascribed the effect to our brains overestimating the angle made at the points of intersection between the radiating lines and the red ones. Researcher Mark Changizi of Rensselaer Polytechnic Institute in New York believes it has to do with the human tendency to visually predict the near future.

The horizontal bar in the above image looks gradated, moving from light to dark gray in the opposite direction as the background. What is fascinating to point is that the bar is exactly the same color, it just appears different due to the difference in background colors.

Even here, you can’t see the bar as one color unless you cut out the background and only see the bar in the middle. You can use your hands and try for yourselves.

Fascinating, isn’t it?

We live in a world where “in some sense, almost everything we see can be construed in multiple ways,” - Bavel.

The Lilac Chaser illusion is also a great example and was discovered by Swiss polymath Ignaz Paul Vital Troxler in 1804. The effect results from the ability of our visual neurons to switch off their awareness of things that aren't changing, and heighten their perception of things that are. In the footage, the lilac dots stay still while the absence of the dots moves. Thus, after a brief figuring-out period, the visual system transitions to focusing on only the moving blank dots which turns green because of a second illusion at play here and lets the immobile lilac dots fade.

The Basketball Awareness Test is another example wherein 2 groups of people are passing the ball to their respective teammates and the viewer is asked to count the number of passes during the time that the ball is in play. If you participated in the exercise, you too may have counted up to 13 as the number of passes completed. What you may have completely missed out on was an animal-like figure walking across the court.

These 2 videos illustrate why you don’t see things even if they are lying right in front of you. Sometimes you may just not get the message even if it’s loud and clear. It may be due to you being blind to it and not even looking for it.

The few illusions/tests provided above are clear examples of how your brain can trick you into believing something which isn’t the truth. And hence you may see many people staunchly supporting their belief systems and willing to go to any lengths for keeping their belief systems intact, which (sometimes) makes them eliminate any threat that could jeopardize this intent.

Hence, it is often quoted by Neuroscientists that "We should all be mindful of that when, for example, we're reading a news story, we're often interpreting and understanding information the way we want to see it."

As a result, we are constantly choosing between duck and rabbit. Or looking at a straight line and trying to decipher if it’s straight or bent. Or we are believing the shades of gray in front of us blindly or questioning the appearance of variety here. Or we are seeing a green dot where there is none. Or completely missing a walking Gorilla in the middle of a screen.

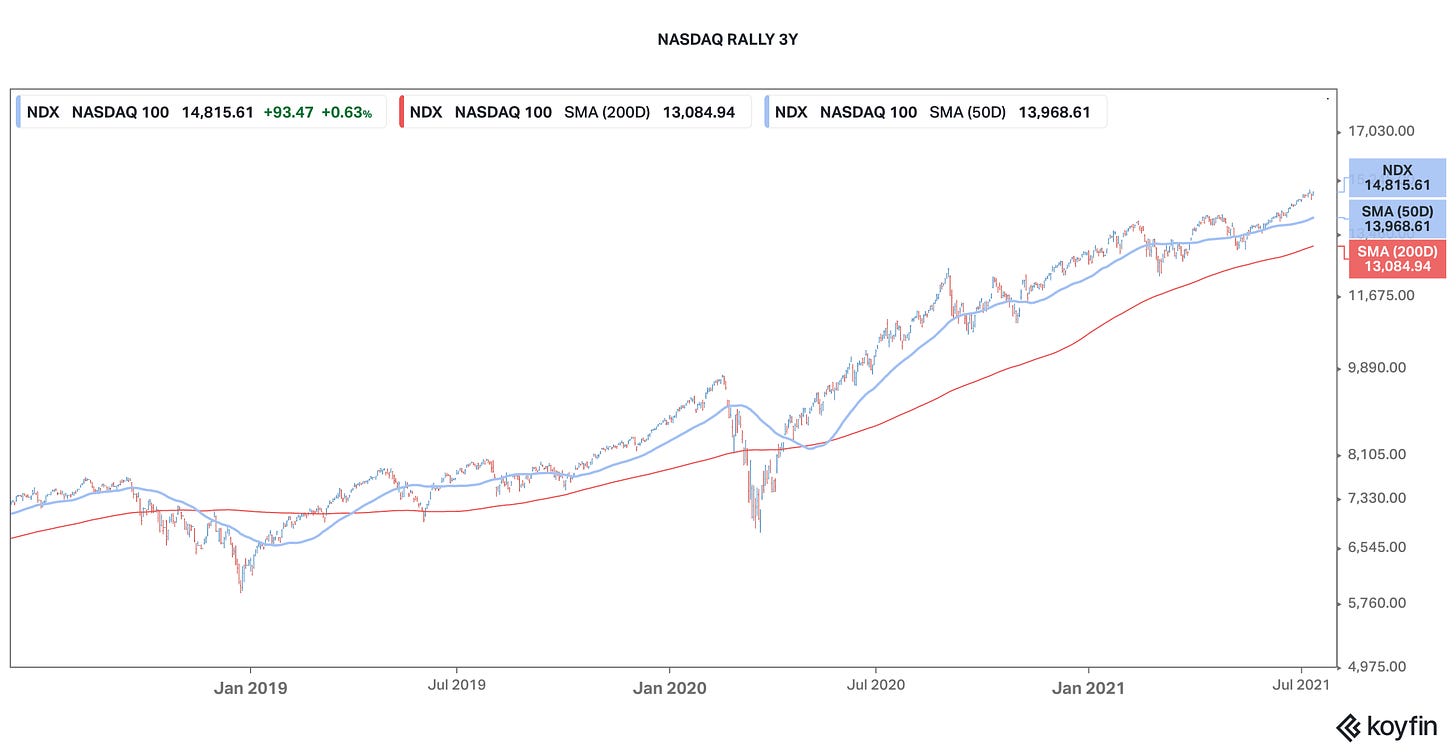

These illusions have a profound implication in your Investing journey. You are influenced by biases that make you overlook many items of significance and focus on what you want to.

Confirmation Bias -

Through this bias, people tend to favor information that reinforces the things they already think or believe. Examples include -

Only following people on social media who share your viewpoints

Choosing news sources that present stories that support your views

Refusing to listen to the opposing side

Not considering all of the facts in a logical and rational manner

For example, a friend of mine almost got into a heated debate with me over my preference for India being led by our current Prime Minister Mr. Narendra Modi. She wasn’t willing to consider my point of view or understand the ground realities of running a country like India with a legacy government having its tentacles of corruption and inefficiencies deep-rooted in the psyche of the country.

Over-Confidence Bias -

As Charlie Munger refers to Demosthenes, the most famous Greek orator, having once stated, “What a man wishes, that also will he believe.”

People, in general, find their own abilities to be better than others. They seem to buy into the narrative that they are more ethical, much smarter, much wiser, much better, more effective than others. This makes them belittle others below them in stature or take things for granted, believing that nothing will happen to them.

This tendency leads to them eating unhealthily, investing carelessly, making concentrated or leveraged bets, and taking shortcuts for saving taxes or fee generation. The recent Archegos Capital blow-up is a classic example of Overconfidence leading to the absolute ruin of finances and reputation for a multi-billion dollar firm and its management team.

There are many more biases such as above that makes one blind to patterns or realities emerging in front of them. Leon Festinger, the father of “cognitive dissonance,” meant when he observed, “that people cognize and interpret information to fit what they already believe.”

If you are bullish, you may easily believe all information that supports your view. If you are bearish and expect the markets to correct significantly, then you will collate all evidence that points to that prediction coming true. Either way, you could build very interesting narratives around your view and believe in it wholly.

But Investing for the long term isn’t that simple, purely because what you believe may not come true. Your assumptions could go haywire, your predictions could hit a roadblock because of COVID-like events, these black swan events may give rise to new competitors or a small insignificant faux pas could bring down an empire.

And that’s where the concept of margin of error, diversification, and hedging comes in. Margin of Error keeps enough room for errors in Decision Making, Diversification spreads the risk across assets limiting your exposure to any particular asset and Hedging protects you from the market crash, even if its probability is low.

Avoiding buying stocks when they are very expensive = Margin of Error

15 - 30 positions in your portfolio = Diversification

Cash/Put Options/Long VOL = Hedge

The game of investing is about making decisions between these 3 concepts. Buying assets comes to us naturally since we are inherently bullish in the long term. But managing risks is what matters more, not losing the money we have is what matters more, preserving and protecting the wealth is what matters more. Do these things right, you will increase your probabilities of wealth creation since you would have avoided betting on trees that were expected to grow to the sky.

One way out of these traps that your mind sets up for you is to tap into human ingenuity by crafting questions, expectations, hypotheses and theories to make sense of their environments. It’s this approach that makes you think instead of buying news, stories, narratives, and opinions blindly.

“In the great chessboard of human society, every single piece has a principle of motion of its own.” - Adam Smith

And for you to discover or interpret the principle of motion of each moving piece, it would take few practices that are non-negotiable for the Masters of Money Game. One of these practices is Writing -

About my hypothesis for the decision in question

About lessons learned

About companies researched

About opinions formed

About discussions had

About understanding of business models or macroeconomic models

About human biases

About stocks that entered your radar

About companies that are removed from your radar

About checklists recommended for analyzing investments or people

About wisdom from people you look up to

About counter-arguments from people that have differing opinions from you

Writing isn’t just about taking a pen and writing on paper. You got to try it to know what I am referring to. Writing requires you to learn how to stop your monkey mind, tap into your memory, sort all the data there, choose the relevant one, assess its utility, and decide upon its application.

This is key in not being fooled into believing stories interpreted as exciting by your brain. Without the guard rails, you will be easily seduced into the next shiny thing that comes up round the corner.

In short, as Albert Einstein put it in 1926: “Whether you can observe a thing or not depends on the theory which you use. It is the theory which decides what can be observed.”

Recommendations for this week include two write-ups and 1 video that were a treat to consume -

Tony Deden is the Chairman of Edelweiss Holdings, a Bermuda-based investment holding company that he first launched as a fund in 2002. He has penned a write-up with 40 remarkable lessons that every Investor must learn. He is a media-shy personality and hence I got lucky in discovering a rare gem that I could read about his thought process around Investing.

Daniel Jeffries is an author, futurist, systems architect, public speaker, and pro blogger. His hacker noon post on Rick and Morty and the meaning of life was one of the most beautiful pieces I have read. It weaves philosophy, decision making, happiness, technology, future, past, and everything in between.

Nightline video on The Impact of Warren Buffet on the World - This was a very heartwarming video for many reasons. Not only does it cover my idol but it goes to show the difference you land up making in people’s lives without even having met them ever. Just walking the right path brightens up the lives of people millions of miles away from you. This video inspires, educates, and touches your heart in a very special manner.

Sources used for this week’s piece -