One-Legged Man in a Kicking Contest

That's what we get to see daily and it ain't a pretty sight...

"It's just that the investment banking profession will sell shit as long as shit can be sold." - Charlie Munger at his Daily Journal Live Event on Yahoo Finance

I came across a story on Bloomberg recently, wherein a 93-year-old lady, Mrs. Beverley Schottenstein went to court against J.P. Morgan and 2 of its bankers who were mismanaging her assets in excess of USD 80 million. The juicy part of the story is that both the bankers are her grandsons. Do read the story if Drama and Investing excite you when meshed together. Wow …

I walked away with only one message from this story - You don’t save money, that’s a problem indeed, but if you do land up saving money, there will still be problems, just of a different kind. And the biggest challenge you face is ‘Understanding Money’ so that you are not taken for a ride by friends, relatives, cousins, smooth talkers, and everyone that will be attracted to you and your money like a bee to its hive.

But Money for some reason has various connotations for people. It either is just a tool to be used, or just means to the rich lifestyle, or a reason to brag about or a resource to be obsessed by all the time or a source of anxiety for many. Very few look at Money as an Asset that needs to be protected while put to work so that it compounds, irrespective of the amounts involved.

Preserving your capital and Growing that very capital needs an understanding of Money, Markets, and People. These 3 subjects need your attention, peripheral if not in-depth, for you to see your money get to work. If these 3 subjects are ignored, you are in for a joy ride that’s being created for others with your money, and you don’t want that.

“There is nothing like losing all you have in the world for teaching you what not to do. And when you know what not to do in order not to lose money, you begin to learn what to do in order to win.” —Jesse Livermore

People reading this blog include doctors, engineers, designers, bankers, managers, entrepreneurs, and many more. And everyone has spent a reasonable amount of time to master their craft or get good at it so that your skills could be traded for a certain amount of money. Hence we have a baker getting paid for the delicious croissants and a marketing executive getting paid for the Sales generated. To top it all, there is a hunger to keep getting better at your craft and eventually make even more than what you take home today, live a better life than today.

But when you ignore the application of money and focus your entire energy only on the sourcing of money, you in a way become the character Rajkumar Rao plays in the movie Trapped.

This is a twisted movie to watch and damn exciting at the same time. Kudos to Vikramaditya Motwane, Vikas Bahl, Anurag Kashyap, and the whole Phantom Films team for making this masterpiece.

As seen in the trailer, the actor is stuck inside his own house, plotting various ways to get out, finding ways to stay alive, struggling to get his message to anybody, talking to himself to succeed at getting out and so many more emotions expressed in this short trailer.

But isn’t one’s struggle to make money the same. That journey isn’t a physical trap as in the movie, but it’s a mental trap. The entire exercise to make money for many is a 24/7 mental endeavor wherein the mind is busy plotting ways to survive and thrive at work, which relationships to invest in, which side to choose, what words to use, how to play your cards right, what course to take, which parties to attend, whom to invite, how to get promoted or whom to promote and whom to fire and so many more questions that need answers daily. Besides of course you doing your job well, which also takes a lot of energy.

One wrong step could backfire and hurt you badly, and hence you think constantly on these subjects, trapped in your own head with survival being the core objective. But just imagine for a moment that you did survive the competition around you and you succeeded immensely, what if you have your own versions of the 2 grandsons of Mrs. Beverly ready to suck you out of the money that you fought so hard to make in the first place. Now that would be a bummer.

While I write this, the last scene of the new Netflix movie “I Care a Lot” comes to my mind. In the movie, Rosamund Pike (actress) builds a massive Elder Care empire using every conniving trick in the book but it all ends horribly for her purely because she wans’t prepared to face what comes in the end. I won’t spoil the suspense for you but the message I intend to put across is that “It need not end bad and it shouldn’t.”

According to Otto Von Bismarck, “Only a fool learns from his own mistakes. The wise man learns from the mistakes of others.” Munger agrees: “The more hard lessons you can learn vicariously, instead of from your own terrible experiences, the better off you will be.”

Wright and Hope worked together at the Wall Street Journal and led the newspaper’s team that exposed the 1Malaysia Development Bhd. (1MDB) scandal, a $6 billion fraud that brought down a government and forced Goldman Sachs to pay the largest-ever penalty under U.S. bribery laws. Sought by authorities for the 1MDB fraud is Malaysian playboy Jho Low, who befriended banks, Hollywood celebrities, and politicians, and remains a fugitive to this day. - Variety

If the Malaysian Government can be duped of its USD 6 billion dollars, so can you. Especially, when you are trapped inside your head only about your profession, your network, your likes and dislikes, your lifestyle, your concerns, and anxieties - while having no regard to the subject of Money, Markets, and People, the trifecta of compounding your wealth handsomely.

Let me start with People -

“When we have a negative opinion about the person delivering the message, we close our minds to what they are saying and miss a lot of learning opportunities because of it. Likewise, when we have a positive opinion of the messenger, we tend to accept the message without much vetting. Both are bad.” —Annie Duke

Human beings are biased. You are and so will be the people you deal with. The entire effort here is to find people with whom the relationship is a win-win for both. You may want to get into a win-lose relationship with others where you derive maximum from the transaction between you two. What you miss is that many times the other person is thinking the same and maybe trying a win-lose with you where you become the patsy in the transaction. Both are painful in the long term.

How about being in relationships that are win-win for both. Now those relationships take time to discover, needs a knack for judging people, needs a little risk to try them out by going with their advice or suggestions, but not betting the house on someone’s guidance just because you like the person or he comes with some reference. Trust is too easily showered upon people I feel.

Let people win your trust. The best in the game will persist and will keep trying to add value to you without pestering you. And you got to keep at the game too, trying to win the trust of others. I have enjoyed dealing with the savviest clients who tested my patience and my knowledge about financial matters. I had to up my game in the process and my standards, which ultimately allowed me to win their trust and got me an opportunity to manage a small portion of their wealth, till it turned into a windfall of an account in my lap.

It takes time, but it’s a win-win and comes with the responsibility to always do right by the client whose trust was so hard to earn in the first place. Seek these kinds of relationships, they may not be easy to build but they are worth the effort.

Psychologist Philip Tetlock once wrote: “We need to believe we live in a predictable, controllable world, so we turn to authoritative-sounding people who promise to satisfy that need.”

As shared in my earlier blogs, I am at my wit’s end with Technology Businesses and hence have subscribed to paid newsletters that come with credibility and references. I have been following their research, their recommendations, and their perspective on markets. In time, I would get a sense of how good the team is and it’s then that I would buy into the ideas they are recommending.

If I was just to go by their fancy newsletter and Advisory platform, then I might have been seduced into buying on all their research and recommendations to date, which would be equal to placing my trust very easily. If I do it once, I will do it again and again. But I won’t. Trusting the wrong people or trusting too soon has been at the source of many shipwrecks and I don’t want to add to the statistic.

Trusting too soon is just one of the tendencies to avoid. There are many more human misjudgments to avoid and there is no better person than Charlie Munger to elaborate on the various other tendencies that humans (all of us) are so easy to get seduced into -

Reward and Punishment Superresponse Tendency

Liking/Loving Tendency

Disliking/Hating Tendency

Doubt-Avoidance Tendency

Inconsistency-Avoidance Tendency

Curiosity Tendency

Kantian Fairness Tendency

Envy/Jealously Tendency

Reciprocation Tendency

Influence-from-Mere-Association Tendency

Simple, Pain-Avoiding Psychological Denial

Excessive Self-Regard Tendency

Overoptimism Tendency

Deprival-Superreaction Tendency

Social-Proof Tendency

Contrast-Misreaction Tendency

Stress-Influence Tendency

Availability-Misweighing Tendency

Use-It-or-Lose-It Tendency

Drug-Misinfluence Tendency

Senescence-Misinfluence Tendency

Authority-Misinfluence Tendency

Twaddle Tendency

Reason-Respecting Tendency

Lollapalooza Tendency—The Tendency to Get Extreme Consequences from Confluences of Psychology Tendencies Acting in Favor of a Particular Outcome

Understanding these 25 human misjudgments and reminding yourself of these at least once a year will make you a better judge of people, and this is crucial to your ability to compound your wealth and keep the bees away from your hard-earned honey 😄

“I like people admitting they were complete stupid horses’ asses. I know I’ll perform better if I rub my nose in my mistakes. This is a wonderful trick to learn.” —Charlie Munger

Let’s look at Markets -

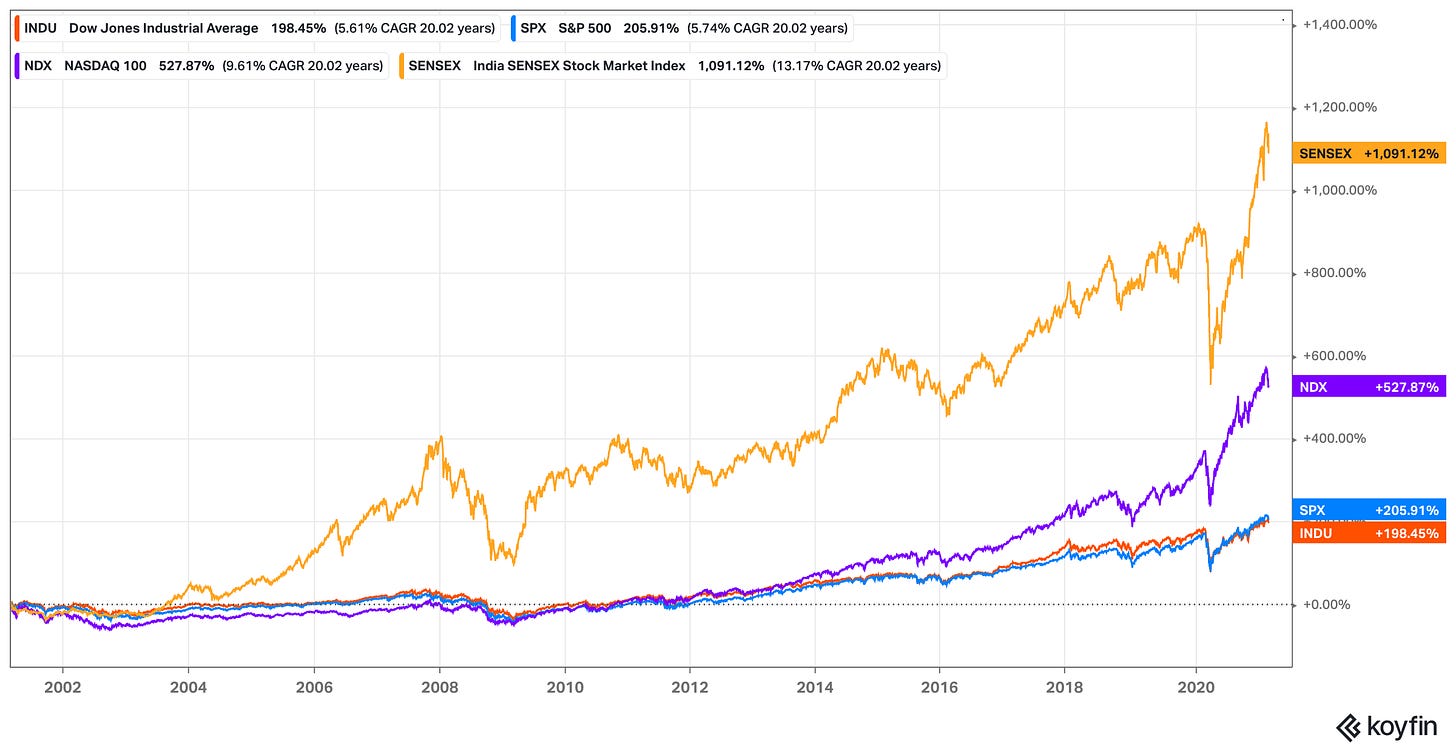

The picture above shows the growth of 4 indices over the last 20 years -

SENSEX (India) - 1091% +

NASDAQ (TECH) - 527% +

S&P 500 (US) - 205% +

Dow Jones (US) - 198% +

In these 20 years, we have witnessed many shocks to the financial markets. Great Financial Crisis in 2008, Brexit, European Debt Crisis, US-China Trade War, Donald Trump winning Elections, India Pakistan scuffle, demonetization in 2016 and now COVID. In spite of all the news that occupies the headlines, overall the world economy keeps growing and that pushes the indices/financial markets in the positive territory over long periods of time.

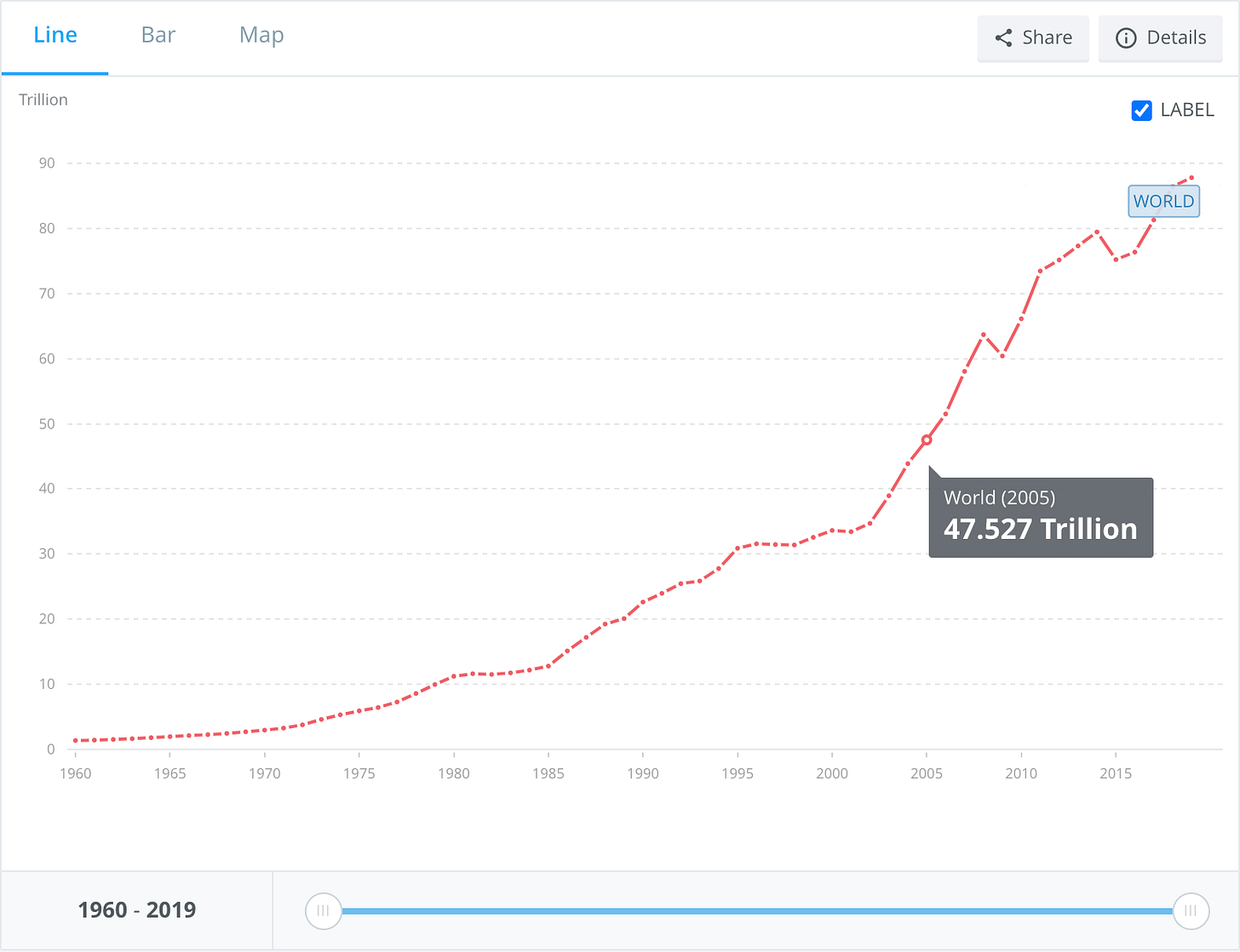

As the data above suggests, the Global GDP has only been on the rise. It was USD 47.527 trillion and had reached USD 87.799 trillion in 2019.

Thinking in billions and trillions isn’t a comfortable thing for the mind, it will draw a blank for many. But what is clear is that the economies have been growing and hence the companies that are well managed will continue to grow over time.

The trick here is to find these “well-managed” companies. If you have the skill set required to analyze companies, then you can take on the job of security selection and position sizing. Most won’t and if you too belong in that category, then simply choose an index and let the wisdom of the crowds work out in your favor over the long haul.

Buffett explains, “There are two questions you ask yourself as you look at the decision you’ll make. (A) Is it knowable? (B) Is it important? If it is not knowable—as you know, there are all kinds of things that are important but not knowable—we forget about those. And if it’s unimportant, whether it’s knowable or not it won’t make any difference. We don’t care.”

Is Investing Important - YES

Is Tesla/Reliance/Airbnb Knowable - If YES, Go ahead and Invest (Gotto be truthful here to yourself)

If NO, then is the INDEX Knowable (as a good representative of the economy) - if YES, then Go ahead and Invest in the most practical, efficient, and low-cost manner used by investors worldwide.

Let’s look at Money -

“To make money they didn’t have and didn’t need, they risked what they did have and did need. And that’s foolish. It is just plain foolish. If you risk something that is important to you for something that is unimportant to you, it just does not make any sense.” - Morgan Housel

Morgan Housel’s book ‘Psychology of Money’ is very elegantly written, weaving his life’s learnings around the subject of Money and sharing with us all through his book. In fact, my blog’s title ‘Psychology of Investing’ has also been inspired by his book and it left a huge impression on me, to the point of influencing my thought process for naming my blog 😃

How you earn money is a function of your ambition and values. And hence, one has to be able to articulate one’s own vision and one’s own values before you get started to accumulate the money. And what you do with it is also going to be a function of your ambition and values. Your Ambition is like the engine that will provide the thrust to your workflow and your Values is like the rail in a bowling alley that will protect you from your efforts going in the gutter.

No matter how much we talk about skills needed to understand Markets and People, it first begins with your own mindset. And if you have never taken the time to write it out or express it, I urge you to take a blank sheet of paper and write them down. Writing your ambition(s) or fantasies is very easy. I am not referring to that. I am referring or 2-3 goals (max) that you want to attain in 2021. Let’s hit these before we try to hit the ball out of the park.

Writing your 2-3 goals is still doable since you think about it constantly, but writing about your values isn’t an easy task. This needs you to really ask yourself many fundamental questions -

What do you love doing? What is your calling/motivation/purpose?

What makes you really happy?

What do you bring to the table?

Why do you care to even wake up and work?

Why should people trust you and partner with you?

What do people think of you?

What are your strengths?

It seems like a task but it isn’t. It is an activity that you ought to ask yourself so you can steer your decisions around money in the right manner. Else you will be sucked into games that other people play, and whose values don’t match with yours, and whose games ain’t as exciting as the ones you wanna play.

As Daniel Vassallo says “Everyone is trying to be the best or top 1%. Few are trying to do what they like, regardless of what everyone else does. Competition makes you chase the preferences of others. Who cares if I’m below average in someone else’s game?”

Think about this one. It is a loaded one. It might just help you in not being the one-legged man in a kicking contest 😉

Wishing you loads of love and luck.

Manish