“On my gravestone, I want them to write, ‘He loved to play games, especially games he knew he could win.’ Cloning is a game. Blackjack is a game. Bridge is a game. Dakshana is a game. And, of course, the stock market is a game. It’s just a bunch of games. It’s all about the odds.” - Mohnish Pabrai

If you have ever played a game, especially the one you liked, you might have immersed yourself in every nuance of the game, relishing every moment and giving it all your energy and attention. You may have even lost sense of time of the day or how hungry you were or the uncertainty about your career path ahead.

The ‘love of the game’ is a very special feeling. It makes you more willing to learn from past mistakes, it transcends concerns and anxieties of the future, and most importantly, makes you present in the moment so that you can focus on the task at hand and deliver the best you can. It’s in this state that a player produces his best and winning awards or recognition becomes the by-product of this state of mind.

The joy that you experience day after day is an added bonus that comes along. That might just unlock the secret to longevity and happiness, a holy grail that many of us seek.

I still remember about my Snooker days in Wellington Gymkhana, Santacruz, Mumbai. I would practice for a minimum of 4 hours a day, 2 hrs each in the morning and evening. And most of the practice was solitary, playing alone on the table and honing my skills to pot or snook.

Let me be very frank, practicing alone isn’t fun at all. It’s painful since my back is bent throughout the practice. There isn’t anyone to cheer for you. You are left alone on a table not to be disturbed. And it’s the same shot being attempted again and again so that I get damn good at it. And if I get consistent with that particular shot, then the process repeats for another shot at a different angle. And this goes on for days, sprinkled with few matches in between for practice.

I did it, only because I loved the game. I find the green carpet on the table very soothing to the eyes. I get to play with many principles of physics i.e. mass, movement, velocity, and angles. I find it fascinating to try out various permutations and combinations of these principles, using just my cue and the 21 balls on the table. I enjoyed the thinking process that goes in before I decide on playing my shot. I would cherish the moment when my execution went perfect for the shot I was intending.

The highlight of my time spent on Snooker was that I won a tournament in my club, beating the best of the players. I even got to play in the Mumbai Open Circuit though I lost miserably there. These are memorable moments, good ones and bad ones too, but these became possible because I loved the game. I didn’t go after trophies, prize money, and recognition at any time. These things came long, as a byproduct of loving the game of Snooker.

Even today, I spend 20-30 mins a day watching Snooker matches on Youtube and play Snooker every Friday from 3-5 pm so that I never lose touch with the game.

“Games are won by players who focus on the field, not the ones looking at the scoreboard.” - Warren Buffet

Investing, like Snooker, is also a Game. It’s a Money Game. And if you choose to focus on the scorecard all the time, you will never develop the skills needed on the ground. You could choose to pay attention to accolades, lifestyle, recognition, and ego trip that comes with boasting about your Portfolio size & returns. Or you could focus, like a hawk, on getting better at the game of Investing and leave the rest to happen naturally, since it will.

Few questions to address here # How does one fall in love with the game? How does one create a mindset to not focus on the scorecard? How does one go through the discomfort of the practice it needs? How does one develop skills on the ground?

How Does One Fall in Love with the Money Game called Investing?

Before you even think about Investing or Money in general, the most important thing is to get clarity on what do you deeply care for? What are your goals and ambitions? What kind of a life would you like to create for yourself and your loved ones? What items on the bucket list do you definitely want to achieve?

This requires some deep thinking. Every wish isn’t a goal that you want to commit your time and energy to attain. But every goal that you care for, would draw your time and attention more naturally. You can’t rely on Motivation and Self Help books to be high-spirited at all times to put in the work. It’s only your goals that put a spring in every step of yours.

It’s like that feeling you have when you are going on a holiday a week down the line. Eg. Usha & I are off to Serbia in 2 weeks’ time and I am already checking out the places to visit, the weather there, checking our passports, supplements supply, foods to carry, or clothes to buy (if any). I am checking for all work to be completed before I leave. I have rescheduled shipments to my house from Apple for my iMac for post 6th August.

The future is so exciting, that the present gets managed accordingly. The future shouldn’t get messed up and hence the focus and attention provided today for the affairs to be put in order. The joy of tomorrow makes one productive today. Hence, I urge you to journal your goals. The first thing I do every morning is to write my goals. I do this every day as this activity alone gives purpose to what follows in the next 16 hours of my day. It gives me clarity on what comes next for me, which is aligned to what comes years ahead from now.

Without clarity of what tomorrow holds, today cannot be utilized well enough. This is the most basic step before the journey to Investing Mastery begins.

"If you don’t know where you are going, you will probably end up somewhere else." –Lawrence J. Peter

How to accomplish these?

The next step is to gauge the gap between your financial reality in the present and the financial independence you desire in the years ahead, or any other goal that matters to you. Assessing this gap looks exactly like the scene from a Discovery Channel Documentary on Mt. Everest wherein the trekker looks at the mountain that needs to be scaled.

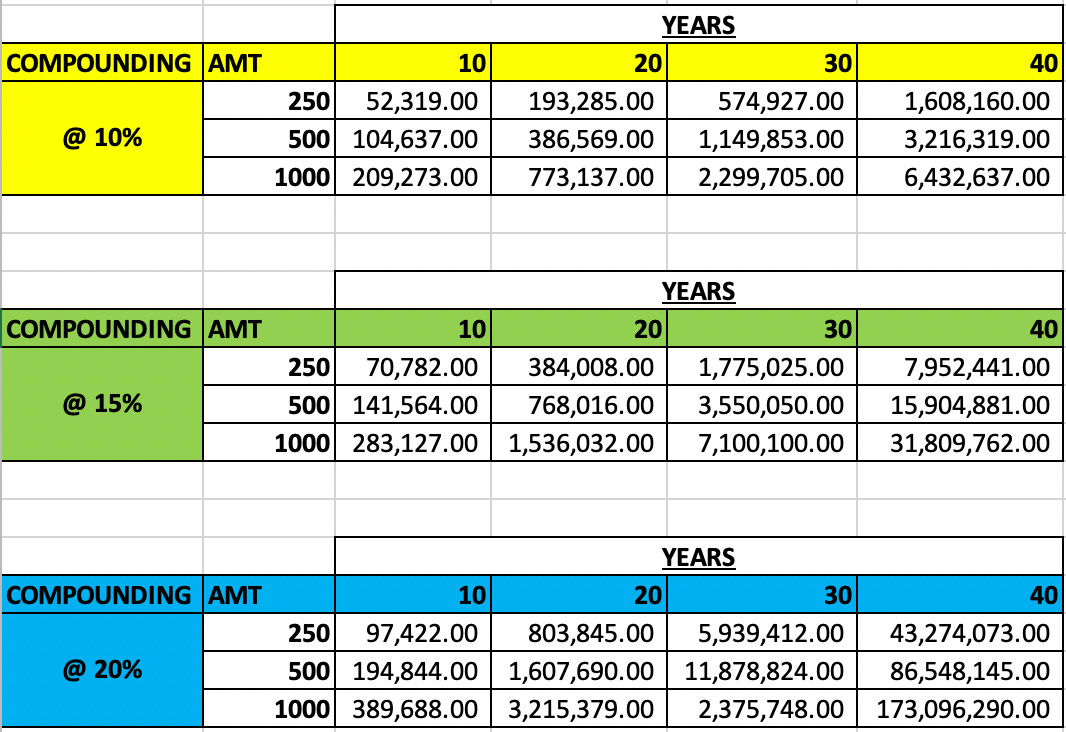

If you have clarity on your goals in the future, then you have an approximate understanding of how much it will cost. And if you don’t have the funds currently, then you will need to start saving for it. How much and for how many years can be figured out from the table provided below -

I am hoping that by now you have got a better grip on what future you aspire to create and how much amount of monthly savings it may need. This is the easy part and you may have also been exposed to data on these lines before.

These are just prerequisites to play the Money Game i.e. it’s like the qualifying degree needed to participate. Without these 2, you are just a sitting duck for the complex world of Money and the profit-seeking gatekeepers therein.

“We are short-term demanding and long-term inattentive. Our brain is hardwired for immediate rewards.” - Gautam Baid

How do you spot the Right Opportunity?

This is where the game actually begins. The key component of the chart above is the left-most column i.e. Compounding @ 10%, 15%, or 20%. You must be naive to believe any product brochure that promises these returns or a salesman showing you these fancy projections in his Sales Kit.

For you to be able to earn these returns, you will need to understand many concepts around Investing -

Asset Allocation

Diversification

Developed & Emerging Market Investing

Passive Vs Active Investing

Historical Returns in different Asset Classes

Liquidity & Taxation Issues on each of these

Direct Equity v/s Fund/ETF Investing

Inflation Hedging Instruments

I could break these down further into sub-components but that ain’t needed. I am sure you get the drift. Understanding these elements is what adds to your compounding returns. The better you get at the game, the better off you are against many that would like to get hold of your hard-earned money, for their personal gains. It ain ‘t comfortable, but it surely is worth it.

Just imagine 2 scenarios - (1) in which you generate 10% p.a. for 20 years on a Saving of USD 1000/m. That would turn into USD 773,137 as per the chart above. (2) in which you generate 10% p.a. for 20 years on a Saving of USD 1000/m but you pay 1% every year as fees. That would turn into USD 678,992 based on calculations above. That is a loss of USD 94,145. You could buy a nice apartment with this amount, if only saving on expenses or fees or taxation was important to you.

Another example on Active Investing - I remember some of my clients would not give me money to manage since they were making 4% per month (you read it right, per month) on Halal deposits made with Heera Group. And I would urge them not to do so since generating 48% p.a. is impossible unless its a fraudulent scheme or a very high risk endeavour. As expected, I lost the deal to Heera and eventually clients lost all their money when the Scam got exposed in 2018.

Nearly 175,000 people lost their money in these schemes and why do you think people get smitten by these lucrative (unrealistic) options? Simply, because they are ignorant and all it takes is a smooth talking professional that could make you believe that the trees can go the sky.

If investors have a sense of current reality i.e. prevailing interest rates, income possible from Bond Funds, historical returns on Equity/Gold/Real Estate, risk involved on these or other exotic options - only then will an Investor make a wise choice. Without knowledge, you may depend on how good you feel about the guy selling an option to you or on how good you feel about the particular option. But feelings ain’t based on facts, it’s based on emotions and that’s a dangerous way to play this game. You will lose more often.

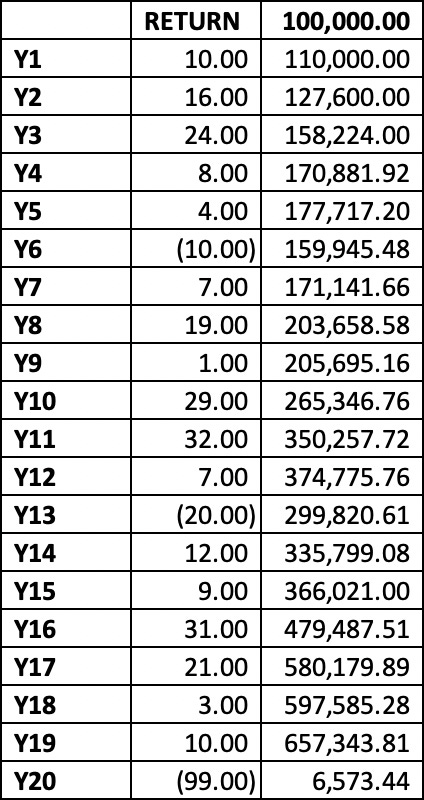

One more example to highlist the importance of being on your toes always -

As seen in the charts, the investor makes decent returns for 19 years and compounds his USD 100,000 to USD 657,343. That is handsome 10.41% p.a. returns on original amount invested, in spite of the volatility in between. But one call going drastically wrong in the 20th year, can result into the entire portfolio dropping to measly USD 6,573, which literally means you are busted.

Just in case you think it’s an extreme example, it’s not. Consider what happened to investors in 2000 crash, 2008 Great Financial Crisis, Heera Group Scam or Bitcoin crash of 50% recently that led to liquidations (margin calls) on USD 8 billion of positions.

And many a times this happens to the smartest of people e.g. Anil Ambani, Vijay Mallya, Boris Becker, Nicolas Cage, Eike Batista, Bill Hwang and many more. These guys had all the money but may not have understood the concept of keeping enough margin for error i.e. buffer zone so that wrong decisions do not affect them or their families financially. But when you are on a high and everything you do turns into success, you start believing in your skills and feel invincible. But life can knock you down in ways you cannot forecast or fathom. Who could have predicted COVID and lockdowns that followed?

Similarly, the next risk is already brewing, you just can’t know in advance. You can only prepare by becoming financially savvy and staying away from dumb mistakes which have always been the common thread in these ‘billionaire to zero’ stories shared above i.e. Leverage, Expenses, Lifestyle Creep, Concentrated Bets, No Diversification and venturing in untested waters.

This is where reading, listening to podcasts and journalling the lessons learned pays huge dividends. Those who don’t do these, are seduced into indecision i.e. keeping the money in cash and hoping to make one mega investment when the time is right. But the cash languishes in the bank at a rate way lesser than inflation, resulting into money losing its buying power year after year.

Or they will get attracted to opportunities that is an easy sell because everyone does it i.e. buying gold or property. If you were to ask anyone “How much will you earn on Gold/RE by investing in these assets?” , they might not be able to answer with assertion. Most likely they will revert on the comfort of doing it since others are doing it and it feels right. This isn’t playing the Money Game, this is just following herd mentality, nothing more.

Or, the worse option, they will get attracted to buying things that money can afford. Just yesterday I was asked about the brand of watch I was wearing. When I mentioned the brand, the my friend says “It’s time to buy Rolex, Manish.” I had a big smile on my face since I could sense the narratives people can build around what money can buy, instead of using the money to secure the future to become unbreakable or to create memorable moments with family and loved ones.

Not only are our brains hard-wired to believe we can predict the future and make sense out of random acts, it rewards us for doing so. The brain of someone engaged in this activity experiences the same kind of pleasure that drug addicts get from cocaine or gamblers experience when they enter a casino.” - Dan Solin

How to win the Inner Game?

If you have lasted till here, then you would have realised that so much of winning the Money Game is about winning the Inner Game first. Mastering one’s own emotions and cognition is the key to acting rationally and investing only when odds are in your favor. Without these, you might be buying a lottery ticket and hoping it’s an Investment.

Acting rationally isn’t going to be natural to you and it takes a lot of mental effort to stay calm and not get sucked into greed or fear. It takes clarity of purpose first, before you can create a process and tap into a network that would assist you in making investments that will serve your purpose. Clarity, process and people is like a 3 legged tool you will need to have in place. Any one of them missing, it’s no more useful and will set you up for sub par returns.

Clarity of Purpose requires Deep Thinking and Journalling can help.

Process can be set up only when you understand the fundamentals of Investing. Reading can help.

People can be turned into confidants that you can count upon only if you have an understanding of emotional and cognitive biases that lead to human misjudgments. Being observant and thoughtful here can help.

It’s these 3 legs that decide whether you will earn 3% on your Investments or 15% +. It’s these principles that will determine if you reach a milestone of USD 1 million or not. It’s simple, not easy. It’s out of your comfort zone but worth it.

“Smart people learn from everything and everyone, average people from their experiences, stupid people already have all the answers.” — Socrates

Which of the circles are you in the picture above? The one on the right, hoping you get lucky? Or the one on the left, working on yourself and learning from as many sources as possible to develop your skills and mindset to play the Money Game?

Think About It !!!

Recommendations for the Week #

A brilliant article on Altos VC website on what goes into decision making and how to get it right.

A fantastic Podcast on Facebook hosted by Business Breakdowns

A thoughtful Twitter thread on Second Order Effects of Decisions taken.