“Rule No. 1 - Don’t lose money.

Rule No. 2 - Don’t forget Rule No. 1” - Warren Buffet

If the quick turnaround of the US economy was projected to make people believe that a company can grow indefinitely at the same pace, then these investors (including me) have been locked onto their seats on a rollercoaster ride of sorts. And right now, they are heading vertically down and screaming “STOP STOP” on the top of their voices, but no one’s listening.

It’s brutal out there and I am witnessing events I never imagined I would.

Aravt Global shuts down - That's a Hedge Fund founded by Yen Liow, who has been a guest speaker on many podcasts and youtube channels. His videos have been recommended by many newsletter writers, fund managers across the globe, and many college investment funds. And they have been very informative and educational for me over the years.

And here he is shutting down the hedge fund that has been hit hard by the unraveling of ‘growth Trade’ i.e. meltdown in valuations of high growth companies. His concentrated bets in 10 odd names (e.g. Paypal) had made matters worse, resulting in double-digit losses in 2021 and also in Q1 2022 till date.

In our industry, there are many heroes, till they are not. Very few will stand the test of time and the gyrations of boom and bust cycles. Those who do survive will be called legends, not only because of performance but also for the mental strength that’s needed to avoid the ruin of capital at disposal. No wonder Warren Buffet is revered by all, and he still continues to deliver.

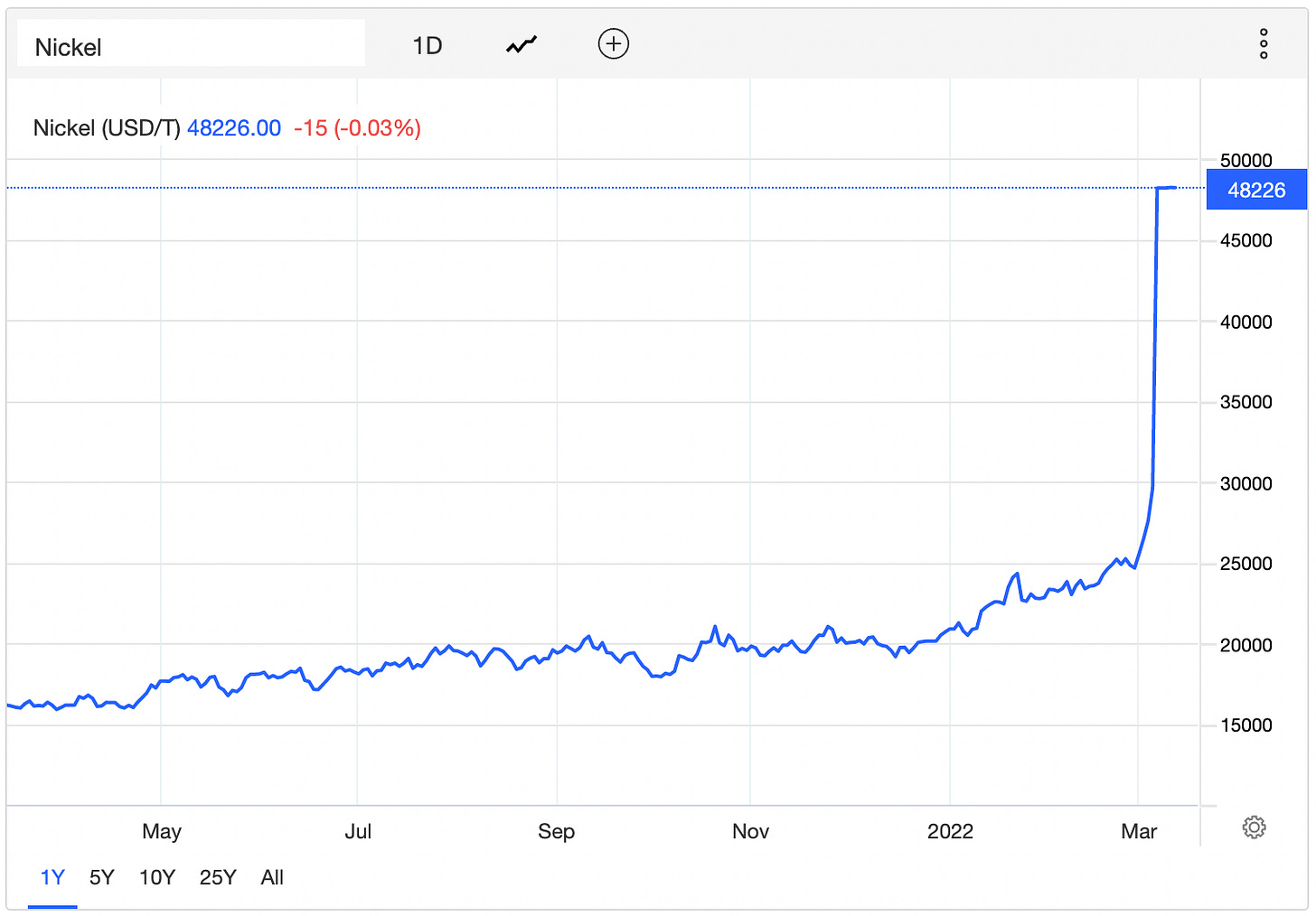

LME cancels trades - An exchange is created to facilitate risk-taking and to ensure the execution of these trades. But you would never imagine that the same exchange would decide to cancel the trades in case it jeopardized the credibility of one of its biggest participants i.e. China’s Tsingshan Holding (TH) in this case.

TH couldn’t have met the USD 1 billion margin call due to Nickel prices going up vertically, and this would have resulted in profit taking for many other brokers/speculators who were on the other side of the trade with TH. But TH defaulting could have led to a knock-on effect for many members of the exchange, and hence LME decided to cancel 9000 trades worth about USD 4 billion.

Yes, canceled !!!! Cancel culture just turned a new leaf.

As is often quoted “If you have a loan of USD 100, then it's your problem. But if you have a loan of USD 1 billion, then it’s the bank’s problem.” In this case, it became the exchange’s problem, leading to a decision I couldn’t fathom. Or were they right by choosing to avoid the default by TH, which could have led to wild repercussions in the metals market?

The system has become so mesh-ed up, that any crisis could lead to a domino effect across markets and investors. Its fragile in its current state and hence a small spark is enough to create a wild swing that could take your portfolio down, way down than factored in.

And it’s this interconnectedness that could make you lose money, for no fault of yours or in spite of all the efforts from your side. No wonder Charlie Munger often says “Investing is Hard. Don’t let anyone fool you by stating otherwise”

My personal portfolio is in the red too and my holdings in high-growth stocks in China & US are to be blamed for the same, inspite of these businesses' continuing to grow y-o-y. A few examples of business performance of my portfolio companies in the last 4 years are provided below (sourced from TIKR) -

Meta ($FB) has grown revenues 30 % + p.a., Operating Income by 23% + p.a., Cash Flow from Operations by 24% + p.a., and EPS by 26% + p.a.

Ali Baba ($BABA) has has grown revenues 45% + p.a., Operating Income by 22.75% + p.a., Cash Flow from Operations by 29% + p.a., and EPS by 33% + p.a.

These are multi-billion dollar companies and they continue to grow handsomely, but I am still losing money on these positions. What could be the reason -

Did I enter at the wrong time?

Did I buy at the wrong price?

Is the Russian invasion of Ukraine going to impair the business fundamentals?

Is the China growth story over?

Is social media a thing of the past?

There are too many variables at play here and it becomes overwhelming to get a grip on what’s exactly going on. Times like these could make you feel terrible about the losses being incurred. It makes you feel that picking future compounders could be a futile exercise irrespective of the no. of books you read or trainings you attend. It could even make you doubt your own ability to generate returns in excess of what index funds can deliver for you.

And that’s when the inner voice starts making a pitch, which goes like this “Why are you even bothering to manage money on your own when Index Funds are there? Just liquidate all your holdings and park it all in Vanguard S&P500 ETF and let the market-weighted index do its own thing for years ahead. Sacrificing all your time to read, learn, analyze and do your own stock-picking just isn’t worth it. It’s a losing battle.”

Money Managers also have an inner voice, and it gets louder every time the markets come crashing down. Unfortunately, crashes are a regular feature of our industry and not a guest appearance to be forgotten. And that’s what makes it painful.

In a recent podcast from Insecurity Analysis, Dan McMurtrie from Tyro Partners states that many fund managers feel burnt out after many years in money management. Many a time, it has resulted in stress, leading up to health breakdowns or even family issues. No one would admit it as everyone got to put up a strong face in front of others, as looking good in society matters to everyone. Well, almost everyone.

But I still wouldn’t make the choice of going with Index Funds, even if it sounds like an easy way out. And there is a reason for this, actually three of them -

Managing my own money makes me commit to learning businesses, industries, opportunities, risk-return trade-offs, asset allocation, position-sizing, and many other portfolio management-related subjects. These subjects may put someone to sleep, but it’s music to my ears.

It makes me think. As easy as this 5 letter word sounds, it isn’t easy at all. It requires me to be able to synthesize all lessons learned, make connections between them, make an assessment of choices at hand, and finally make the bet on a few of them. This requires an ability to slow down the chain of thoughts and to see through the clutter of information, to make an informed choice, while I give weightage to the risks involved too. I am a work in progress in this department, but way better than a few years back.

It challenges my “thought process” and tests my “conviction”. These ain’t easy demons to deal with as you have to confront your own fears and doubts, especially in times like these when the market isn’t supportive, while new geopolitical challenges keep emerging on daily basis. It’s like being on the Jungle Cruise with Dwayne Johnson, only to be facing one surprise after another.

It’s these 3 elements that make my endeavor of generating decent returns, even if it's a tad less than the indices, highly rewarding, mentally, and emotionally. It’s these elements that have built into me a composure that helps in avoiding panic or rash decisions of any sort. It’s these puzzles that make this journey an exciting one to be on.

When I think of Mahatma Gandhi, he spent 44 years with the puzzle of getting India Freedom from the British Raj. If you read the book by Louis Fischer, you’d realize that many a time Mahatma Gandhi would be helpless in getting different factions of India to work together, and hence would retreat to his ashram and focus on doing what was in his control, before he made his next move.

He did solve the puzzle, eventually. But lost his life in the bargain. How would you judge him for his choice? Was he right? Was he wrong? Was it worth it?

It doesn’t matter !!!

What matters is that he walked the path that he found the most rewarding for him, the most purposeful for him, the most satisfying for him.

And that’s what matters. Always did !!!

“In the jungle, life and food depend on keeping your temper.” - Rudyard Kipling

And keeping your temper isn’t a target that you can achieve unless you are curious about solving the mystery, and finding a solution. This calls for embracing the surprises that life will throw at you. Your profession will keep increasing its demands, your family life will pull you in different directions, your health would draw your attention - can you still figure a way out to manage it all, while you solve the mystery at hand.

Mine is to compound my wealth handsomely and reach 8 figures + networth before my 60th birthday. This excites me as it would create financial independence, allowing me to make choices that matter to me, say what I want to say, do what I want to do, be where I want to be. This matters to me and my wife and we are up for the challenge ahead.

I was just going through my 2022 goals in the morning, and I am on track to achieve a few of those mentioned at the start of the year, and many still need lots of work. I can’t lose my temper over the markets melting down. I got to adapt and play along. I got a mystery to solve, and I got miles to go.

How about you? What mystery are you solving?

How about you enjoy the ride too ;)

Recommendations for the Week #

Ray Dalio recently released a book “The Changing World Order”. This book brings readers along for his study of the major empires - including the Dutch, the British, and the American - putting into perspective the "Big Cycle" that has driven the successes and failures of all the world's major countries throughout history. The book may be a heavy lift for you, but the youtube video on the subject is a MUST SEE for all. Very insightful and gives you a taste of Geopolitical battles to come. Russia Ukraine is just the preface, many more chapters are yet to be written.

Morgan Housel’s post on Low Expectations pairs well with my piece above. His perspective on this topic could be a game-changer for you in all your endeavors. MUST-READ blog. Every piece is a gem on its own.

I have exciting news to share: You can now read Psychology of Investing in the new Substack app for iPhone.

With the app, you’ll have a dedicated Inbox for my Substack and any others you subscribe to. New posts will never get lost in your email filters, or stuck in spam. Longer posts will never cut-off by your email app. Comments and rich media will all work seamlessly. Overall, it’s a big upgrade to the reading experience.

Wishing you all a lovely weekend ahead.

Stay Safe 🤝

It is excellent piece of intellectual reflection of breakdown in markets since Feb , you could have

included the other article Feb 23 , Now you get it by Morgan Housel