“The web is an unhealthy place for someone hungry for attention.” - Bed of Procrustes, Edition 1, Nassim N. Taleb

Aphorism is an intriguing word and I first came across it when this book was launched in Nov 2010. I had thoroughly enjoyed his previous books i.e. Fooled by Randomness and The Black Swan and hence couldn’t resist getting my hands on his 3rd book.

The dictionary defines ‘aphorism’ as a pithy observation that contains a general truth or a concise statement of a scientific principle, typically by a classical author.

To me, they signified as loaded statements with a core message hidden behind them. For e.g. the opening statement of this write-up. You just can’t read it and get the deeper message in one go. You will have to make an effort to understand the meaning behind it. You will have to stop your chain of thoughts, pay attention to every word until the whole sentence gives you a glimpse into the world the author is trying to paint.

What does hungry for attention mean? Is he referring to likes, followers, adulation, engagement?

Why would it be unhealthy? Is he referring to the insatiable pursuit of constant dopamine hits? Is he hinting at emotions of envy, greed, and fear taking over one’s judgment?

And if you enjoy the pursuit of deciphering messages hidden in these bite-sized statements, then this book will be a joy ride of sorts, as it was for me.

Recently, Nassim Talen released additional aphorisms that will be included in Edition 3 of the book, and fortunately, he shared these on his Twitter profile. And of course, yours truly did land up reading them all, slowly, digesting each statement, and savoring the meaning behind each of them. You can find the link for all additions here.

But in today’s post, I will share 4 of the 90 new aphorisms from Edition 3 and elaborate on each of these from my perspective -

This one reminds me of Warren Buffet’s statement on an interview with CNBC “We made a lot of money but what we really wanted was independence. What’s really great is if you can do what you want to do in life and associate with who you want to associate in life, and we’ve both had that spirit all the way through, it is one of the luxuries of life.”

Money for the sake of money or as a virtue signal to others is a losing battle. You will never be able to impress them all, convince them all, prove them all - you always (ALWAYS) will have naysayers, critics, and skeptics, even haters in some cases.

But if you can gain independence i.e. the ability to choose your language, demeanor, working hours, vacation time, people to associate with - that indeed is true freedom. Without this freedom, you always are vulnerable to getting sucked into situations that drain your energy or creative juices, getting trapped in relationships that don’t give you the room to flourish as an individual or a professional, or worse, you get caught up in a race with no end in sight, risking burn out or ruin.

I started writing ‘Psychology of Investing’ for myself first. Everything I was learning about compounding my money, I wanted to write it down so that the principles of legendary investors get etched on my mind forever. And I must admit, that the newsletter is free for readers, but it has paid me handsomely over the years, through good execution of my habits around money and stock picking.

I also resonate with the idea of being physically strong, not only for the benefits that come with looking good and physically toned. This has many benefits that accrue to you due to liking bias that people are unconsciously given into.

But the added benefit is feeling good about yourself, feeling confident to stand up for your beliefs, and expressing yourself freely. Lifting weights may not have anything to do with your self-esteem directly, but it indirectly boosts that virtue in you. Regular workouts are a signaling mechanism to your conscience that your life matters, your body matters, and your opinion matters.

Try getting stronger physically, you will exactly understand what I mean. It has a price to pay, but the rewards will be a multibagger of sorts.

You might have mastered one or more of the fields that are known for lucrative opportunities therein e.g. engineering, coding, finance, marketing, marketing, or others. But have you learned about avoiding stupidity, ignoring noise, saying NO to distractions, staying away from status games, or refraining from herd mentality? None of this gets taught in the school/college curriculum.

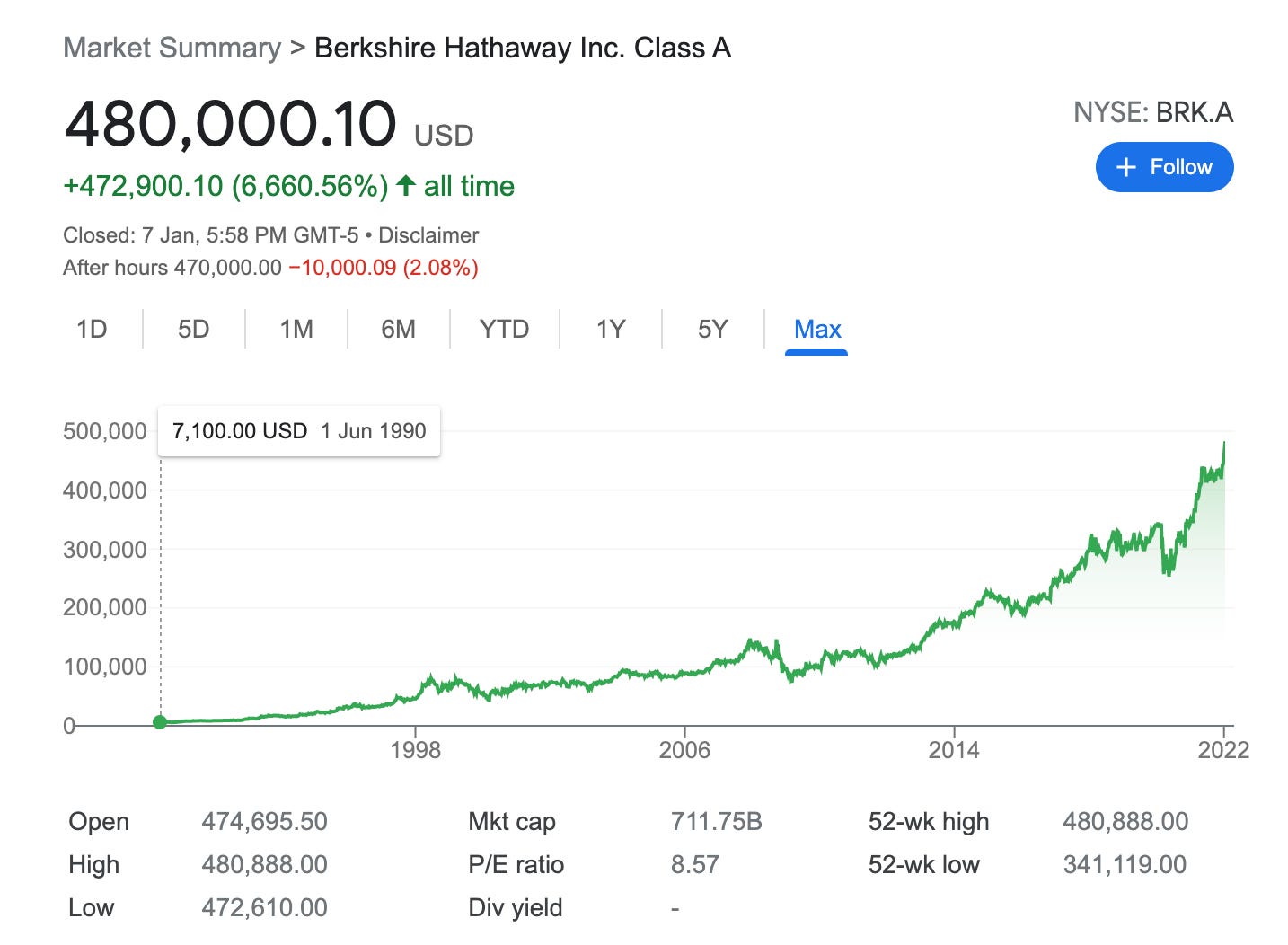

Every success story has more to do with the mistakes that were avoided. At the same time, many stories of massive failures included very smart and knowledgeable people. Let’s look at Berkshire Hathaway, the company’s Chairman & Vice Chairman are very well known worldwide, for their wisdom and investing acumen.

What most do not know is that they had a 3rd partner in the 1960s, Mr. Rick Guerin. In Warren’s words “Rick was incredibly smart but in a hurry to get rich.” Rick lost a fortune on leveraged bets in the 1970s and had to sell his stake in BRK to Warren Buffet at USD 40. Today, the stock trades at USD 480,000. Rick missed out on a 12,000% gain only because of his urgency to gain riches.

Being knowledgeable but exposed to fatal errors, is like drunk driving a Maserati on a 140 km/hr lane. You come across as cool if you survive, but you are dead if you land up making a mistake. And you are human after all, trying to make some sense of the messy world with many other buggy humans around (as Investor Anand Sridharan would like to call it). In this fluid environment of fear and greed oscillating between all-time highs and lows, the odds are very high for making a mistake.

So embrace that uncertainty and volatility in the future, rather make it your friend that may show up as a surprise from time to time. Just ensure that your mistakes hurt a bit, and not more. Rather in 2022, take on assessing every single habit, relationship, and investing strategy and rate them on a scale of 1 - 10. 10 means it contributes to making your future bulletproof and 1 means it could cause ruin or severe losses in case of a black swan event.

I just had a talk with my sister-in-law yesterday about her eating habits. Her high carb intake (fries, burgers, noodles, packaged foods) has made her body vulnerable to inflammation and her covid diagnosis has left her reeling under a bout of cold, fever, weakness, and lots more for over 10 days now. I suggested to her to take it as a wake-up call, else the body just keeps disintegrating till it’s too late to make a turnaround.

Mistakes ain’t just financial, they have many angles to it - mental, emotional, social, habitual, and nutritional. Surprisingly, we spot it easily in others but are blind to it when it involves us. There is no need to resist this flaw in humans, just use this to your advantage - ask someone to give you feedback, rather ask 4-5 people. Once you have the feedback, start tackling the ones that are repeat offenders. That may be a good place to begin.

Every time you make an investment, you might be aware of the reasons that would make the price of the asset go up. They might have a great allocator at the helm of affairs, their technology may be superior to others, they may enjoy patent protection for another decade or they may have a kind of competitive advantage for the future. Most analysis goes into proving why your pick is the right horse to bet on.

In Psychology, we term it as confirmation bias i.e. the tendency to search for, interpret, favor, and recall information in a way that confirms or supports one's prior beliefs or values. But how about being aware of the risks involved.

And there are always risks involved.

Howard Marks has spoken about a story of the gambler who lost regularly. One day he heard about a race with only one horse in it, so he bet the rent money. Halfway around the track, the horse jumped over the fence and ran away.

Do not entertain the illusion of certainty while placing bets. There always is uncertainty, just the degrees vary at different times. I bet on the property market in Dubai in 2007, when every Tom, Dick & Harry was making 100% + returns in a few months. I was so certain about doubling my money but only realized later that I was the last fool in the Greater Fool’s Theory to have entered the market at its peak.

That experience taught me a valuable lesson that pays me dividends to date. Every investment begins with a position size that is between 1-3% of my total corpus. It only increases in allocation as I gain confidence about the entity in question e.g. my stake in FB has only increased with time, but it still is less than 9% of my US Portfolio and less than 5% of my global portfolio.

I also like equities for this very reason. Your allocation to this asset class doesn’t have to be a major portion of your assets, unlike real estate. In 2007, Real Estate was 100% allocation of my portfolio and it stung me hard when it didn’t pan out as I had intended. I was naive then, not anymore.

Financial Security means different things to different people. I would use Mr. Money Moustache’s definition of the term “if your annual spending is USD 50,000, then you must have 25 times of that amount as your Investment corpus i.e. USD 1,250,000.” Having this corpus provides you the freedom to build a career of your choice and to pursue the course of action that provides you maximum joy. Until then, it's a hustle all the way, which includes doing things you may not like, but still got to be done.

In my first job, I had to travel from Khar to Dombiwali (in Mumbai), and that required 3 train changes along the way, almost requiring 2 hours of one-way travel. It used to be horrible during the rains, many times I had to carry a spare shirt in case my shirt got spoilt or drenched during travel. I hated every bit of it but did it anyway. Today life is much more comfortable, but it’s been a hustle all the way from my days in those crowded trains in 2003.

The journey till today has taught me many lessons and the most important of them being - never to take anything for granted as it can be taken away anytime. It’s this paranoia that keeps me on my toes regarding the tasks at hand, personal or professional. It’s the acknowledgment of the role of luck in my life and to always be on guard to not allow for bad luck or bad judgment to derail me off the path I’m on.

But alternately, I have seen many families with extreme wealth where the founder (grandfather/father) exhibited virtues that transpired into amassing wealth for the family. Whereas the children do not have that drive for the hustle, and that worries their parents quite a bit.

I still remember a client, who was concerned about his son making the wrong choices in life. His son had studied in the US but returned to Dubai in a few years. Then he worked in his father’s business but missed the US. So he was torn between the pleasures of his bachelor life and the perks of his entrepreneurial endeavors. It’s been years since I met them, but I will never forget the anxiety in my client’s eyes for his son’s future.

His son had all the money to choose what he wanted, but he couldn’t as he was spoilt for choice. His father had no choice but to build the business that his father had started, and he did a remarkable job of it.

The evils of extreme wealth repeat in many people’s lives e.g. Vijay Mallya (billionaire) squandered away his father’s empire, Anil Ambani (billionaire) went bankrupt inspite of being the son of the richest man in India, Bill Hwang (billionaire) lost his reputation and credibility on account of insider trading and leveraged bets, and Muammar Gaddafi (billionaire) was dragged to his death in Libya and there are umpteen more examples.

There are many ultra-wealthy people, but few know how to manage this wealth and how to bring up their children without spoiling them. Warren Buffet, Mark Zuckerberg, Bill Gates, and many others have sworn to donate the majority of their wealth to charitable causes as they do not want to leave that money to their children’s disposal. It could rob them of any motivation or purpose to live a meaningful life.

Yours and my daily hustle have a purpose. We may be trying to build our dream home, go for the dream holiday, or build a retirement kitty big enough to secure our financial futures. And that pursuit has its own beauty to it, allowing us to experience pleasure when we attain these.

But what if you have everything, everything you ever desired. It might just throw you off the rail, to seek pleasures that even provide you bigger dopamine hits e.g. drugs, addictions, gambling, risk-taking, etc. Add to this the easy target that you become for others. And now add the Troll magnifier called ‘social media’. It’s a potent combination to tear you down and it does, as pointed by Naval in this Youtube video.

So don’t envy a multi-millionaire or a billionaire, as it won’t be as rewarding as being on a journey to reach there. Irrespective of you reaching that targeted milestone, the joy it brings on a daily basis, the purpose it gives to your work, the bounce it gives to every step of yours is far superior to having achieved it all and wondering what to do next.

Added bonus would be when you attain financial security and have planned a lifestyle that could be met with your accumulated means, you can eventually draw a line and say “STOP” to the Money Game altogether. Now that’s an aspiration to go after. This might just be the point where your creative juices go into overdrive and take you into uncharted territories, where you find your tribe and a powerful purpose.

Nassim Taleb has exactly done the same. He is a professor today and a best-selling author with huge demand for public speaking engagements worldwide. He walks the talk here, he always did !!!

I would have loved to elaborate upon many more but I will let you dive into the other aphorisms on Nassim Taleb’s Twitter post. Read them slow, slow enough that it opens up a door for you into a mind-shifting perspective. I hope it enlightens you as much as it would entertain you.

2022 has begun and a fresher perspective is always welcomed 🤝

Recommendations for the Week #

Of all the new year’s messages I read, Ryan Holiday’s post for 2022 was the best I read. The post has bite-sized takeaways for the new year, but each one is a very powerful practice on its own. My decision to engage in cohort-based courses in 2022 came from his newsletter. My last one with On Deck Writers was one of my best decisions of 2021 and we as a group continue to hone our skills via weekly reviews and discussions over Zoom on Thursdays. I even look forward to our physical get-together in US/Europe. The venue is still not confirmed but I am soo excited about it.

In preparation for this post, I watched Nassim Taleb’s only commencement speech given in Beirut in 2016 for the American University of Beirut. These 19 minutes could be the best 19 mins you can spend on Youtube at the start of the year. It defines what a fragile life looks like and how you can create a career that’s anti-fragile i.e. it gets stronger with chaos. Now that’s a powerful context to work with.

I’d like to hear from you about any specific topics you may have for me to dive deeper into. My intention is to enable and empower you to play the Money Game better, and in the process, share the essential tools and tactics that you could use in other domains of engagement. Any feedback/comment is appreciated. So feel free…

So good, “choice” is one the best luxuries!