“Doing something according to pre-established rules, filters and checklists often make more sense than doing something out of pure emotion.” - Peter Bevelin

We have only 24 hours in a day and that is a BIG problem, at least for many. The chief reason is that 16 hours of your waking time comes down to making 1000+ decisions and there is no way for you to be thoughtful about evaluating them all on the basis of merit alone.

Optimizing for the best decision-making will paralyze you for want of more information before you could make the final call.

Let’s make a decision on which toothpaste to buy?

How do you decide which one to use? Which ingredients are harmful? What proportion of fluoride is safe for consumption? Does it have GMP (Good Manufacturing Practices Logo)? Is it branded or local?

Answering these questions could take you a week and you still might have trade-offs between the options available. It is very rare for one option to emerge as best in all categories of evaluation. Brushing one’s teeth wasn’t supposed to be an intellectual exercise, till now :(

So what do you do?

You create a shortcut and let that be the deciding factor for you e.g. you will use the same product that your parents have been using for decades. And that’s how Colgate’s penetration in many markets globally is in excess of 50% and has been since the 1990s.

Colgate Palmolive India (NSE: COLPAL) has compounded at 12.53% p.a. for the last 10 years, just marginally beating the index performance for the same period. An investor would have done well holding this company in their personal portfolios.

As for me, I choose herbal options and hence go with Meswak almost always. I choose herbal options due to higher odds of having lesser chemicals, lesser/no fluoride and I find it better tasting. Can I provide you with an accurate comparison between Colgate and Meswak? No, I can’t but it works for me and hence I stick to it.

It’s a simple filter but it surely isn’t optimal. And yes, I will miss out on trying many other brands, but that’s ok. I have only 24 hours and I’d like to have a super productive day, day after day, and hence will have to resort to these filters a.k.a. shortcuts that have served me well over time.

24 hours has a tendency to zip too soon and hence we ought to get better at excluding options, which leads to arriving on a smaller subset to dive into for evaluation and to finally choose from. You want to stay miles away from analysis paralysis and creating filters is a decent solution for this predicament. It is an efficient way to exclude many other options that could become a drag on your time.

Investing, more than most other professions, requires filters to be put into place so that you could avoid wastage of time and preserve your hard-earned money. These are precursors to growing your money and hence let’s look at the reality of the investing landscape.

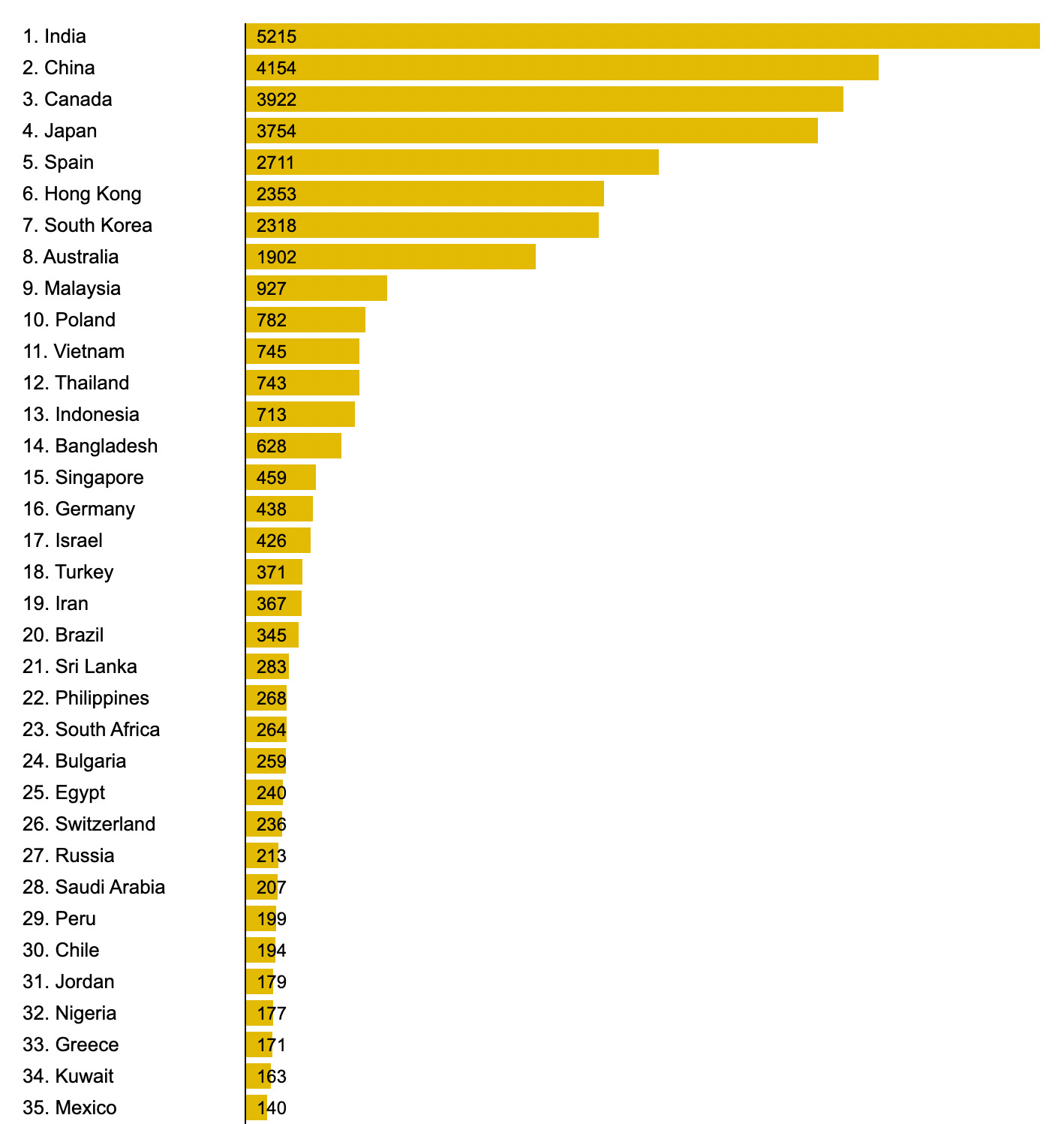

There are 43,000 + listed companies globally. The breakdown of countries looks as follows -

This is a huge no. of countries to look into, massive streams of data to go through to analyze industries, and even more terabytes of information to select companies to buy into. It is humanly impossible to sift through so much information, even if you are supported by screeners like Koyfin or Bloomberg. And it is mentally daunting for anyone to take on understanding every industry, and every company in that industry and what the future holds for each of them.

As smart as people may seem on Fintwit or one on one conversations, most are just winging it. Speaking fluent English supported with technical language around finance is no guarantee of one’s success rate in projecting the future. And hence I always chuckle when investors use words like “markets will fall tomorrow”, “Russia will attack Ukraine on Wednesday” or “Oil will touch USD 150 next year”. It’s like an intellectual comedy of sorts and it’s highly entertaining :)

This is where the sifting process comes in.

One can have a filter in place to evaluate if the company is worth diving into or not. And the filter got to be simplistic enough to indicate in a very short time whether you should proceed with investigating the thesis further. A filter serves no purpose if it's going to take a week/month for you to figure out whether the idea deserves your attention.

2/3rd of my portfolio is invested in India and almost all incremental savings of mine is being channeled into my country for building my Investment portfolio. It takes a split second to know whether the opportunity is India-centric or dependent on many international factors to come into play.

This filter alone reduces my investing landscape to 5215 companies i.e. almost 90% of the information eliminated for me to even look into. That’s amazing, to begin with. The next round of filters would be related to industry tailwinds, business quality, management, and finally valuations. When all of these are used together, the universe of stocks to look at drops below 100.

100 is a small no. to look into for attractive opportunities. It gives me enough time to build my knowledge base around these companies, the industries, the management, and the prevailing valuations. It also gives me comfort to be fishing in a pond that I understand, with enough room for error without permanent loss of capital.

I may not make multi-bagger returns in 2 years in this pond of opportunities, but I can sleep peacefully while I compound my capital around 15% +. I may miss hyper-growth companies in other sectors, disruptors in the medical space, or world-changing fintech plays. I am ok with it.

My filters are designed to grow my capital at a pace I am comfortable with. It’s a simplistic approach, not the most optimal one. But it works for me.

As Sanjay Bakshi says “The emotional rate of return on my processes ought to be high”. The financial outcomes are not in my control and the gestation period also is much longer. But the peace of mind and good sleep is possible today and that is valuable to me.

My filters provide just that.

Even for Idea generation, I follow many Fund Managers, Independent Advisors, and Social Media Influencers. I respect them and look forward to consuming every piece of content they deliver online. Some of my favorite ones are Saurabh Mukherjea from Marcellus, Ishmohit Arora from SOIC, Samir Varthak from Sage One, Viraj Mehta from Equirus, and a few more.

There are very specific qualities I look for in Money Managers before allowing them to become a part of my knowledge source -

Content Quality

Consistency

Authenticity

Humility

If any of these is missing in their communication or research, then I would make a snap judgment and move on. Again, I am not certain of my decision but I would be uncomfortable associating with someone who may not acknowledge his own mistake or live in denial of a decision gone wrong. I would be unnerved to consume content from someone whose work is shoddy or whose research leaves many gaps to deflate the thesis.

I was happy to see Ishmohit from SOIC Youtube Channel admitting his mistake on Sequent Scientific and sharing publicly that he was exiting the position before eod. I even read the comments from the trolls and they were being very harsh on Ishmohit, expecting him to be God himself who can predict right at all times. He was very calm and graceful about the negative comments and handled them very well. My respect shot up twofold for him post witnessing his communication and his intent.

Ishmohit scored top-notch marks for humility and authenticity during this episode. And you can get a sense of these values from Money Managers or Company Management when you follow them enough to get to know them a little better.

But we have only 24 hrs at hand and the world has been designed to distract me from my long-term goals. And hence, I have to be wise in allocating my time across my endeavors and through the week. For sake of efficiency, I have allocated every single day of the week for a very specific purpose.

Tuesdays & Wednesdays have been assigned solely for my personal portfolio, nothing else. I only consume content around my current holdings and these could be -

Quarterly Calls

Annual Reports

Industry Webinars

Business Analysis

Management Interviews

Competitor analysis

Any content on Tues & Wednesday that doesn’t fit these filters, I won’t be reading it then but will save it for later. There are 5 more days in a week to look into it.

Is this efficient? It is for me.

Is it optimal? Surely not, but I can live with it.

Time is limited and hence it comes down to selection. Selection comes down to exclusion. Exclusion needs filters to be put in place. Filters lead to missing out on many things. But I could still hit a home run with my portfolio and I am confident I will.

I have implemented the same kind of filters for almost everything in my life.

Friends #

Would I like us to be friends for the next 20 years? If yes, then I will proactively build the relationship and look forward to spending time together.

Books #

Is it highly recommended by people I admire? If yes, I will download a sample and read a few chapters. Sometimes I buy the whole book and trust my gut with it.

Music #

Is it house music? If not, I won’t be keen to listen.

Podcasts #

Are these armchair experts or industry veterans? If it's the former, I am out. But if it's the latter, then I am all ears to learn from the best in the business.

Courses #

Is it cohort-based or self-paced? I am game if it’s cohort-based with live participation. If it’s self-paced, then the group dynamics are missing and it isn’t an exciting adventure. It rather becomes a battle to finish it and I am not interested in that.

Expenses #

Can I buy 2 of these today? If I can’t, then I am not keen to buy even one. If I can afford two of them in cash payment right now, then I will pick it up today, as I did with the Volvo S90. Mercedes S Class can wait, I am not in a hurry ;)

Filters make my life simpler. And I’d prefer a simple one instead of a life that overwhelms me with enough noise and data to cause a nervous breakdown of sorts ;)

I shall have Warren Buffet sum up today’s piece through his “Newspaper Test” for his employees #

“I ask the managers to judge every action they take — not just by legal standards, though obviously that’s the first test — but also by what I call the ‘newspaper test.’”

If a manager expresses uncertainty, Buffett says he asks them how they “would feel about any given action if they know it was to be written up the next day in their local newspaper.”

He tells them that the article would be “written by a smart but pretty unfriendly reporter” and read by their family, friends and neighbors.

“It’s pretty simple,” he says. “If [the decision] passes that test, it’s okay. If anything is too close to the lines, it’s out.”

And being the great leader that he is, Buffett says his managers can call him if they want to check on something. “But if they do, there’s probably something wrong with them,” he jokes.

All the best with creating filters for yourselves. It’s a very rewarding exercise, it just pays in the long term. I just hope you have the patience for it...

Recommendations for the week #

As I mentioned earlier about Ishmohita Arora, his recent write-up on “Art of Selling” is a damn good read for an Equity Investor. This one would make you think about the whole process in a very effective manner. Be prepared to bring about some changes to your SELL decisions going forward.

There used to be a time when recessions would last longer, bear markets could go on for years and the capital markets were void of any action. But that was the past and seems like dinosaur age for modern investors with access to Fed Stimulus, Robinhood apps, and enough to play with margins on Options & Futures. This write-up by Jack Raines is a delightful read on Investing in the present vs the past.

Paul Graham is a legendary VC investor, co-founder of Y Combinator, and the mentor to founders of companies like Airbnb, Stripe, Razorpay, Coinbase, and 100s of others Unicorns. His writeups are considered a Must Read in Silicon Valley and some bankers like me are also huge fans of his craft. His write-up on ‘Writing’ is a Must Must read for any knowledge worker today. It might just inspire you to pick up a pen, a paper, and get started !!!

Wishing you a fantastic weekend & stay safe 🤝

Manish