“I don’t know what’s the matter with people: they don’t learn by understanding; they learn by some other way—by rote or something. Their knowledge is so fragile.” - Richard Feynman

I am in Mumbai and quarantined in a hotel before I get to meet my family. Funnily, I am quarantined in a hotel as a precautionary measure not to carry the virus home in case it hooked onto us in the flight. But here I am contemplating if I should extend my quarantine period in the hotel since my mom was diagnosed as COVID +ve yesterday and my sister and dad await their results. What a coincidence.

Mom’s fine though and sounds as chirpy as always. Keeping fingers crossed for dad’s and sister’s results to come -ve, so I could go home as scheduled. I am super excited to meet them after more than 14 months. Nothing beats being with family. High Five to all those who love Fam-Jams 🤗

Today, I’d like to share with you a few lessons in the English Language and trust me, it’s got everything to do with your Investing results. Before that, let’s hear Mr. Bachchan share his take on this beautiful language.

Just in case, you are still wondering why, just why do you have to listen to Amitabh Bachchan for Investing - let’s dig deeper…

Dr. Sanjay Bakshi (a.k.a. Fundoo Professor) runs a very resourceful website that is a must-read for serious investors or committed advisors. For the purpose of this post, I will be using an excerpt from his blog post ‘Relevance of Price/Book’ published in Oct 2020.

I want to specifically talk about situations where the price-to-earnings ratio is low, but the price-to-book value ratio is high, and this applies, by the way, not just to financial stocks, but to any kind of business. So let’s first talk generally and see what happens when price-to-earnings ratio is reasonable. That is, the market value of the business as a percentage of its earnings potential is low. And, when I say low, it means low in relation to AAA bond yields, low in relation to earnings available to investors generally in fixed income and so on.

The paragraph here looks very simple but it is not. And that’s because many words used have multiple meanings and unless you don’t know the context that the author has for his writings and teachings, you might completely miss the point. Let’s look at many of the words from that one para -

Price-to-earnings -

Does he refer to P/E (NTM) or P/E (LTM)? NTM refers to the next twelve months and is he referring to P/E multiple looking at forecasted numbers? Or is he calculating using the last twelve months’ numbers i.e. on actual earnings reported?

For E.g. Twitter currently trades at a P/E multiple (NTM) of 65 which would make it very expensive at these levels unless you are a Tech/Growth/Momentum Investor. But the same stock trades at a P/E multiple (LTM) of 15.4 which would make it attractive to investors with a Value Bent of Mind.

Only when you know with absolute certainty if Mr. Sanjay Bakshi is using LTM or NTM, only then can the reference to P/E in a statement can be fully understood. Else, you are in for a rude shock in case you interpret his statement incorrectly.

Low / High -

What does low exactly mean? How low should a stock trade at for it to be considered low? Is it low in absolute terms or is it low in terms of peer group valuations?

What does high exactly mean? How high is high actually? Is it high in absolute terms or in terms of peer group valuations?

High/Low is immaterial on its own unless compared to other choices available in the asset class. Just because a stock trades at USD 1000 doesn’t make it expensive and nor does a USD 1 stock make it cheap. Absolute levels have no bearing in financial markets, but a lot of activity is based on price levels and not the context of it.

No wonder, Apple and Tesla volumes shot up after the stock split, making it appear cheaper for many investors to get into. Doesn’t make sense but it still invites transactions, making many brokers richer in the bargain.

Financial Stocks -

Do Financial stocks refer to Banking stocks or Non-Banking Finance Companies or Private Credit Entities or all of these and more? Is a Fintech company like Square or Paypal to be considered a Financial Stock or a Tech stock?

Price-to-Book -

Has the management written down book value or are they keeping assets and liabilities off the balance sheet to distort the book value? Book value provides liquidation value for debt investors but doesn’t show the capital at play which is more relevant for equity investors. Does that render book value inefficient in the first place?

Add to this context, the low book values for Tech companies or companies going through a digital transformation, their book values will make P/B look very expensive but it again misses out on the capital at play in terms of IP, Culture, Talent, Software that could create network effects or flywheels making the business very profitable.

Amazon had a P/B of 25 in Dec 2015 and wouldn’t have been touched by many investors then, citing expensive valuations in terms of conventional and widely cited metrics like P/B.

AMAZON closed @ USD 672 in early Dec - 15 and rose to USD 3,052 on Mar 26th, 2021. That’s more than 35% compounding p.a. These are phenomenal returns and the P/B did not reflect many aspects of the business that sustained the growth trajectory of the company.

In 2015, AWS wasn’t even being reported as a separate line of business under Amazon, but today generates more than 60% of its profits worldwide. The entire investment in Cloud Computing then would be expensed as maintenance expenditure and not shown in PPE (Property Plant & Equipment) and hence out of Book Value completely.

Earnings Potential -

Does this refer to EBITDA? or EBIT? or Revenue Growth? or Operating Margins? or Gross Margins? Earnings mean different things to different people and what is the writer referring to and why?

Tesla’s valuations currently are factoring 40% EBIT Margins on millions of cars being sold, which would be a fair assumption if Tesla was a Tech company. But it’s a car company, needing billions of dollars in investments in Plants, Equipment, Warehousing, and other physical infrastructure. And if it’s a car company, then margins worldwide for car companies are lesser than 10%.

So is Tesla’s earnings potential being calculated on basis of 10% margins or 40%? Depending on what you choose, your calculations could differ from someone else’s as night differs from day.

AAA Bond Yields -

AAA Yields differ from country to country and company to company. Which one’s is being referred to? Is it a Government Aggregate or a Corporate Aggregate or all of them? Bond Yields influence the cost of capital being used to discount future cash flows and the choice you make again changes the output of your calculations.

That was just one paragraph of 6 lines that require you to have a deep understanding of so many concepts. Only and only then, can you understand what the writer is trying to tell you, which you can then use to your benefit by making good Investment BUY/SELL decisions. And that calls for a lot of cognitive energy to be invested into subjects of your interest. This whole endeavor would make you feel overwhelmed or frustrated or challenged or all of these at the same time.

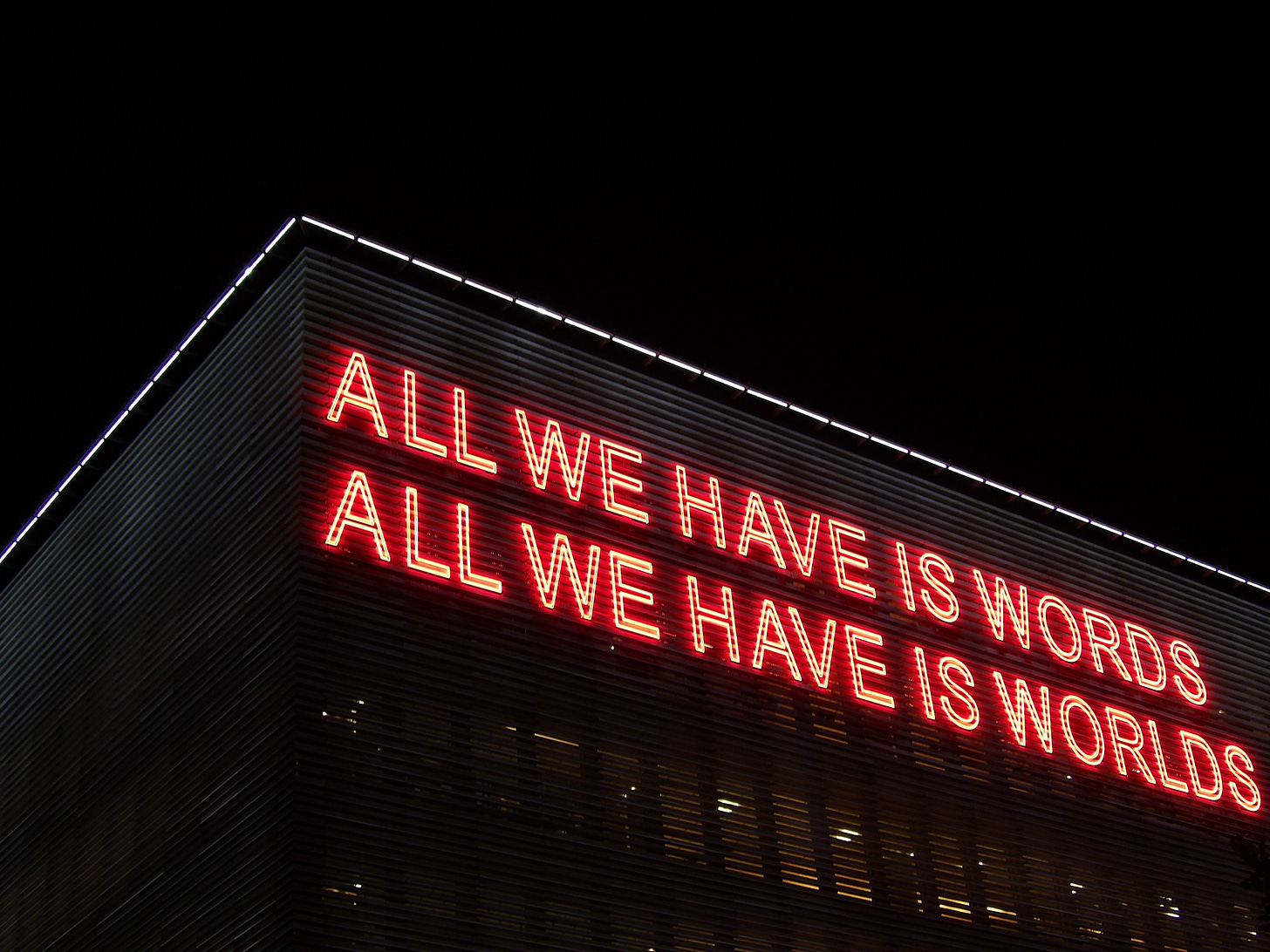

But IT IS WORTH IT TO GO DEEP !!! Not only in the work you do but also in how well you understand things when you read or converse. And the better you get at understanding the words spoken/written, the better you get at understanding the context of expressions all around you.

And if the previous paragraph was a jolt to you, let me share with you a taste of things to come in the future -

DeFi is sometimes known as “Lego money” because you can stack dApps together to maximise your returns. For example, you could buy a stablecoin such as DAI and then lend it on Compound to earn interest, all using your smartphone.

Though many of today’s dApps are niche, future applications could have a big impact on day-to-day life. For example, you will probably be able to purchase a piece of land or house on a DeFi platform under a mortgage agreement whereby you repay the price over a period of years.

The above is a take on the Blockchain Infrastructure being built on Ethereum and the one provided below is from Bloomberg’s Matt Levine’s newsletter -

We have talked about SPACs before, but I have somehow neglected to express appreciation for the clever and elegant bit of financial engineering at the heart of the SPAC structure. Here’s how a SPAC works:[2]

You give me $10.

I put your $10 in a pool with a bunch of other people’s $10, held in a trust account at a bank.

I give you back one share in the pool (representing $10 of money in the pool), and one-quarter of a warrant to buy another share for $11.50. (The combination of the share and part of a warrant is sometimes called a “unit.”)

I try to find a company to take public within two years.

If I fail, I give you back your $10 with interest.

If I succeed, I merge the pool with the company, giving the company the money in the pool and giving you and your fellow shareholders shares (and warrants) in the new combined company. Also I get a bunch of shares and warrants in the combined company, as a reward for my work.

When I do this, I give you the choice to either (a) let your money ride and take a share in the new company or (b) get your $10 back, with interest.

With SPACs, NFTs, Defi, Fintech, Derivative Options, and all the engineering that is taking place around us, you will need to get good at deciphering the spoken/written word and hence the need to question/think about what you are reading or what you are getting into.

"One should not aim at being possible to understand but at being impossible to misunderstand." - Marcus Fabius Quintilian

We ain’t used to it naturally since we act on impulses, guesswork, and heuristics. Google makes the search easy and hence you don’t need to remember things. Calculator makes maths easy and hence you never got better at Vedic Maths which would help you in computations without devices or gadgets.

Process Notes/Systems/Computers provide step-by-step direction on many things and hence you don’t invest time in understanding things from first principles i.e. how do things actually work.

In July 1945 after the United States issued the Potsdam Declaration demanding the surrender of Japan in World War 2, Japanese Prime Minister Kantaro Suzuki called a press conference, and in a statement, he said: “No comment. We are still thinking about it”. Unfortunately, the interpreter’s rendition was: “We are ignoring it in contempt”. We all know what happened next.

In 1980 Willie Ramírez, an 18-year old, was admitted to a Florida hospital in a comatose state. At the time of admission, an interpreter made a mistake and translated the Spanish term “intoxicado” which means poisoned or having an allergic reaction as: “intoxicated”. Willie, who was suffering from an intercerebral hemorrhage was only treated for an intentional drug overdose. As a result, he was left quadriplegic.

Both the above examples were taken from a website that is resourceful for Interpreters of English & Spanish languages. But it hints at the damage that can be caused when you misinterpret things.

So do not take anyone at face value. When they refer to ‘Growth Stocks’, ask them what they exactly refer to. When someone refers to Margins, make sure you understand if he is referring to Operating Margins or Gross or Net. When someone says that the future is better, ask them the time frame for the future they refer to. Is it short term or long term or very long term or for your next life 😀

Conversations are one of the best ways to develop a better sense of what the other person is trying to express. I would never miss a chance to participate in the Q&A sessions. I do not hesitate to email/dm the person if I seek clarification or find the source of the information cited.

And if you would like to best understand a particular writer’s written word, read more of his works, watch his videos on Youtube, listen to a podcast with him being interviewed, or best of all, read a book written by him, if there is one.

This investment of time and energy has a high ROI for you. So don’t settle for less.

"The limits of my language mean the limits of my world." - Ludwig Wittgenstein

Wishing you loads of love and luck.

Regards

Manish