“Nothing is original. Steal from anywhere that resonates with inspiration or fuels your imagination … Authenticity is invaluable; originality is non-existent. And don’t bother concealing your thievery — celebrate it if you feel like it.” – Jim Jarmusch

If you have read any books or watched interviews or heard podcasts related to Investments, then you would have surely come across names like Guy Spier, Mohnish Pabrai, Charlie Munger, Warren Buffet, and Benjamin Graham. All of them are looked upon by the entire community for the humongous success they have achieved financially and the difference they have made to the community and society at large.

Each of them is on my list of role models to emulate, for specific roles if not their whole life. But there is something that irks me about the articles I have read and the references made about them - “They are Original / Self Made Genius / Born Genius.” That is far from the truth.

If you actually read the books written by each of them, you will realize the paths they have crossed where one of them influenced the other. Guy Spier was influenced by Mohnish, who had been influenced immensely by Charlie, who had been influenced by Warren Buffet, who had been influenced by Benjamin Graham, and by Charlie Munger too.

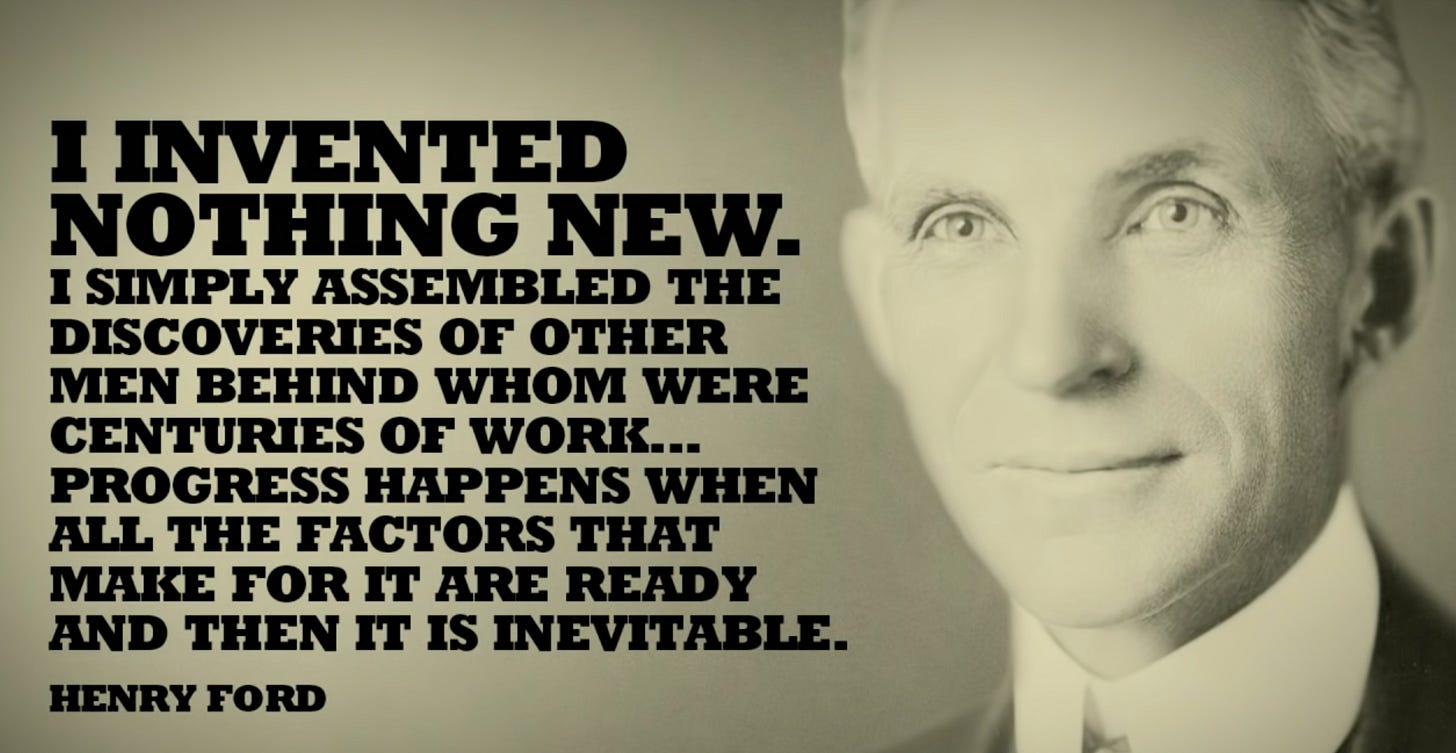

And hence the 1st statement in this post is “There is nothing original…” Everyone steals from a source that came before them, remixes it with their own flavor, and goes about their work. The quality of your work and the success that follows, depends on the source you copied from and the quality of the copy you made. And this applies to every walk of life, not just Investing.

The TED talk by Kirby Ferguson is 10 mins of pure delight. It’s remarkable to see how Bob Dylan remixed the creative works of Jean Ritchie, Dominic Behan, Paul Clayton. It wasn’t original, but it was influenced by a source that came before him. Even Mahendra Singh Dhoni’s famous helicopter shot in the world of Cricket was influenced by his friend, as beautifully depicted in the movie M.S. Dhoni. Even India’s EDM sensation, Nucleya has been influenced by the sounds heard in the streets across the country.

Kirby’s ending statements struck a chord with me, “Our creativity doesn’t come from within, it comes from without. We are not self-made, we are dependant, on one another. And admitting this isn’t embracing mediocrity, it is a liberation from our misconception. And it’s an incentive to not expect so much from ourselves. And to simply begin.”

But we struggle to clone others and instead, we put in all our efforts in being better than others, being the best, being original, and being special. Nothing wrong here, except the fact that it is a difficult game to play unless you are Steve Jobs or J.K. Rowling. If you ain’t blessed with the imagination that visionaries are endowed with, then the focus can shift to delivering results instead of being the best. And a lot can be learnt from the wisest for fulfilling that responsibility.

“Humans have something weird in their DNA which prohibits them from adopting good ideas easily,” says Pabrai. “What I learned a long time back is, keep observing the world inside and outside your industry, and when you see someone doing something smart, force yourself to adopt it.”

I’ve shared this picture in my earlier posts. What is interesting to note is that Warren’s choice of living in Omaha, miles away from the humdrum of New York and the Wall Street, has been copied by many of the greatest investors, for exactly the same reasons.

Guy Spier, who has attention deficit hyperactivity disorder, moved his family from Manhattan to a rented house in a quiet neighborhood of Zurich, where it’s easier for his beautiful but distractible mind to resemble “a calm pond.” Spier’s office, which is a short tram-ride from his home, has a library in which he doesn’t permit himself a phone or a computer. He has consciously designed his physical environment to support contemplation.

Chuck Akre, who has beaten the market by a huge margin over three decades, finds it easier to think with equanimity in rural Virginia, where his firm, Akre Capital Management, is based in a small town with one traffic light. He lives in a house that looks out on the Blue Ridge Mountains. “We see deer and bears and foxes and coyotes and wild turkeys,” he says. “It’s a beautiful place. It’s good for the soul.” One benefit of being there is that he feels so distant from all “the stupidity and the nonsense” that he doesn’t get “uptight about what’s going on in the market and the world. . . . We just turn it off.” - From Richer, Wiser & Happier

Warren Buffet figured out a way to amass billions of dollars and a lot of it had to do with having enough time to read, think and converse with people he’d like to. Everything else was a distraction for him and he had no qualms in using the word “NO” wherever he could. Many invitations, events, lectures, meetings, and business deals have been declined only so that he has enough time to do what he wants to do and only with people he wants to associate with. His secretary even has to remind him to carry his mobile when he is leaving office since he doesn’t use one on regular basis.

Though you may consider this extreme, but you can choose to clone him in his obsession for decluttering his life and having enough room only for the stuff that matters. If Guy Spier and Chuck Akre could do so in their own way, we can too.

In the book Richer Wiser Happier, William Green talks about Paul Lountzis, President of Lountzis Asset Management (LAM). With AUM in excess of USD 300 million, Paul shoulders many responsibilities in addition to delivering Alpha for their clients. And his success has a lot to do with cloning the best, as he shares in the interview with the author.

“I immersed myself fanatically,” he says. At thirteen, he read about Buffett. At fourteen, he was mesmerized by Ben Graham’s The Intelligent Investor. He then became captivated by Philip Fisher’s 1958 classic, Common Stocks and Uncommon Profits, which introduced him to the practice of “scuttlebutt” research as a means of gaining an informational advantage. “Those two books really created the foundation,” says Lountzis. “I’ve read them both fifty or sixty times.”

Lountzis says he has at least five hundred videos of Buffett, along with any recording he can find of Munger’s infrequent public appearances. And then there are his transcripts of dozens of their annual meetings.

His aim is never to replicate other investors’ behavior. “You can’t mimic them because you’re not them,” he says. “Learn it and adapt it and modify it into your own process.”

...what makes Lountzis such a powerful learning machine is his habit of obsessive repetition. For example, he estimates that he’s watched Buffett’s 1998 lecture at the University of Florida fifteen times and has read the transcript at least five times. Likewise, he’s studied Berkshire’s 1993 annual report with such devotion that he can recite, in order, the five main factors that Buffett said he considers when evaluating the riskiness of any stock. - From Richer, Wiser & Happier

Just think about the cloning in process here. It may seem like Paul is just reading a book or the annual letters or going through videos. This is normal and you too do the same in your free time. But when you do the same activity repeatedly, day after day, your understanding of the subject changes fundamentally. You start absorbing concepts seamlessly, you start recognizing patterns, you start making connections, you start thinking differently, your language starts changing and all of these changes have a huge bearing on the decisions you will make.

With USD 300 million + to manage, Paul surely is benefitting immensely by choosing to clone the best in the trade. He doesn’t want to be like them 100% and no one can, but you can learn, adapt and modify it into your own processes. If the recipe is already prepared, it helps a lot to download the same and use it.

“We were kids without fathers . . . so we found our fathers on wax and on the streets and in history. We got to pick and choose the ancestors who would inspire the world we were going to make for ourselves.” - Jay Z, Decoded

Cloning (a.k.a. stealing) can be respectful when you put in time and energy to study the person you are stealing from. Stealing can be graceful when you have the humility to give credit to the source. Stealing can be honorable when you transform yourself in the process. Stealing can be fun when you can play with the tools created before you. Stealing can be a lifelong expedition when you are sourcing from many people.

Stealing gets a bad rap in our society and the word itself has negative connotations to it. The only reason is that many choose to steal from one as a thief does, many choose to steal others’ work and claim it as their own, many skim others’ resources to ultimately deprive them of the potential rewards, many are lazy and hence steal so that they can avoid the pain of the work required.

But it completely depends on you to build the context around cloning and do the job that is a win-win for both.

“A wise man ought always to follow the paths beaten by great men, and to imitate those who have been supreme, so that if his ability does not equal theirs, at least it will savor of it.” —Niccolò Machiavelli

I am currently watching this TV Series on Netflix and I have enjoyed it a lot. My favorite episode was ‘The Tall Grass’ where a passenger wanders away from the train and gets lost in the tall grass, struggling to find his way back to the train. And that leads to panic, fear, and a brush with death until a savior shows up and saves him. It’s a beautifully executed plot with a lot of meanings to me.

The Tall Grass depicts the inability of finding your way back in life when you get lost with no clear goals or get derailed with the wrong company or get lax with lousy processes or habits. The passenger gets saved in the show, but most in real life succumb to irreparable choices, from which it could just be downhill and misery.

“To be wise one must study both good and bad thoughts and acts, but one should study the bad first. You should first know what is not clever, what is not just, and what is not necessary to do.” —Leo Tolstoy, A Calendar of Wisdom

Chapter 8 in Richer, Wiser & Happier is on Charlie Munger and has very important lessons around avoiding stupidity and rational thinking. It also emphasizes cloning only the right examples, not the wrong ones. The latter can cost you a fortune. The question is how do you know if you are cloning the right example or not. That’s where the importance of taking time out to read and think becomes so important. Without the ability to sit quietly and contemplate, the odds are not in your favor. It could take one costly mistake to ruin the reputation or goodwill you would have built over time.

But Why must we refer to Charlie’s wisdom for these lessons? Let a few of the greatest minds share their take on Charlie -

In the 21st May 2021 episode of Infinite Loops Podcast, Tren Griffin, Senior Director at Microsoft calls Charlie Munger a “National Treasure”. Warren Buffet refers to Charlie as “the sharpest mind in the world”. William Green refers to him as “the Grand Master of Stupidity Reduction”.

“Other people are trying to be smart. All I’m trying to be is non-idiotic. I find that all you have to do to get ahead in life is to be non-idiotic and live a long time. It’s harder to be non-idiotic than most people think.”

On being asked why he focuses on stupidity reduction, Charlie’s reply is “Because it works. It’s counterintuitive that you go at the problem backward. If you try and be smart, it’s difficult. If you just go around and identify all of the disasters and say, ‘What caused that?’ and try to avoid it, it turns out to be a very simple way to find opportunities and avoid troubles.”

Finding out what’s wrong and trying to avoid it is different from finding out what’s good and trying to get it. You have to do both, of course, in life. But this inversion of looking for the trouble and trying to avoid it keeps you out of a lot of messes. . . . It’s a precaution. It’s like a checklist before you take off in an airplane.”

Munger guards against irrationality is by emulating the “extreme objectivity” of scientists such as Charles Darwin, Albert Einstein, and Richard Feynman. When I ask what we can learn from them about how to think through a problem, Munger says, “They were all very hard on themselves. . . . They worked at reducing stupidity. They cared about thinking it through properly. They had long attention spans and they worked, worked, worked to avoid the stupidities.” - From Richer, Wiser & Happier

Charlie Munger has cloned Benjamin Franklin, Jacobi, Charles Darwin, Einstein, and many wise men from yesteryears. His book ‘Poor Charlie’s Almanac’ is one of the most resourceful books you will ever read. It’s no surprise that today, the greatest investors are attempting to clone Charlie Munger’s sense of morality, integrity, rationality, and work ethic.

In World Without Mind: The Existential Threat of Big Tech, Franklin Foer warns, “We’re being dinged, notified, and click-baited, which interrupts any sort of possibility for contemplation. To me, the destruction of contemplation is the existential threat to our humanity.”

And if emulating the greatest interests you and you are aware of the bountiful rewards in store if you could clone them successfully, then it will have to begin with you taking time out to think.

Thinking takes many forms -

Taking Notes from what you are reading, watching, or listening

Journalizing your thoughts on your learnings and your decisions

Habit Tracker to analyze if you are on track or not with your goals

To-Do Lists to ensure that today is utilized for a better tomorrow

Company of friends who won’t take your bs and will call spade a spade

Company of people better than you so that you don’t lose your edge and are forced to become a learning machine in their company

Reading a lot

Writing in public / Using Twitter

Teaching a skill to someone

As easy as all of them may sound to you, none is actually as simple as it looks. Try doing any one of these for 30 days in a row, and you might just discover something about yourself which you were blind to.

You will be surprised to know that I have taken professional lessons to get skilled at using many of the tools mentioned above. I was a part of Building a Second Brain Cohort 11 and it was worth the USD 1000 + spent on it. I got introduced to Readwise, Instapaper, Things 3, Zapier, IFTT, Notion and so many processes around all these Apps/Widgets. It has saved me 1000s of hours to date and released me of all the anxiety I would feel while drowning in all sorts of information.

I am currently enrolled in On Deck Writers (ODW) Cohort 3 and learning the ropes of professional writing, building a personal brand, engaging with the community, sensory writing, editing, collaborating, publishing and so many nuances around the skill I aspire to build.

I am enrolled in SOIC Intensive which gives me access to all the knowledge needed to value Indian companies and make good stock picks in that market. Besides the lessons, the interactions with the founders and the many guest sessions they bring to the community are worth tens of thousands of dollars.

“It’s not where you take things from – it’s where you take them to.” — attributed to Jean-Luc Godard

“Good artists copy, great artists steal.” — attributed to Pablo Picasso

I strive to become a better version of myself and hence have resorted to cloning the best in their respective trades. I intend to clone anything that can make me richer, wiser, and happier. More than the rewards, it’s the journey where I get to discover myself and I am thoroughly enjoying the ride.

Wishing you loads of love and luck.

Manish

Brilliant article and summary of what some of these greatest minds have followed to make the lives of theirs and everyone whom they associate with better. Thanks.

Interesting read Manish and I must say you’re becoming better at the writing too. Keep up the great work and All the best to you!