"Think for yourself, not of yourself. Think of others, not for others."- Naval

This post is a continuation of the earlier post and hence titled Part 2. If you haven’t read it yet, I would highly recommend reading Part 1 first.

These 2 posts were inspired by Charles Munger’s 1986 Commencement Speech on ‘Prescriptions for Guaranteed Misery in Life’, which spoke on 7 Sureshot recipes to fail miserably in life. I spoke about one of them in Part 1 and I will speak about one more in Part 2, leaving the other 5 to be discovered by you when your curiosity hits the roof 😀

I will let Charlie himself quote it for you -

My third prescription for misery is to go down and stay down when you get your first, second, third severe reverse in the battle of life. Because there is so much adversity out there, even for the lucky and wise, this will guarantee that, in due course, you will be permanently mired in misery. Ignore at all cost the lesson contained in the accurate epitaph written for himself by Epictetus: “Here lies Epictetus, a slave, maimed in body, the ultimate in poverty, and favored by Gods.”

What Charlie is trying to say is that, no matter how good you are, you still will fail for no fault of yours, you still will lose due to bad luck or left tail events, you will get hurt from people you expected to be really close to you - you will experience adversity in some shape or form but staying down is a guaranteed route to misery. Feeling sad, envy or regret in these low moments is the easy choice and the shortest route to your most hated destination.

Or you could choose to get back up and start again. Though it hurts to start the process again, there ain’t a better alternative. Rather, there ain’t any other alternative. Go All In Once Again or Carry the baggage of the past, that will slow you down mentally and emotionally.

And there are many reasons built into human psychology that make this adversity an almost certainty and Incentives Bias is the biggest of them all. Let me share with you a clipping from New Amsterdam, one of my favorite shows on Netflix.

Just for context - this scene shows a sister manipulating her brother to give her his phone.

It would give you the chills to see this kid act out her role as a sociopath in the TV Series. But she manipulates people to get what she wants. A sociopath of course takes it to an extreme, but all normal humans do the same too, just in a more diplomatic and civilized manner.

“The iron rule of nature is: you get what you reward for. If you want ants to come, you put sugar on the floor.” - Charlie Munger

And the society we live in has rewards attached to the accomplishment of goals a.k.a. Goal-Driven Society. In a Goal-Driven Society, processes and relationships take a backseat. Let’s look at a few examples -

A Sales Team is incentivized to Sell, many times with no regard to your objectives or the quality of the product.

A Businessman is incentivized to survive, many times with no regard to the quality of the ingredients/raw materials being used.

A Private Business is incentivized to look attractive to VC/PE firms, hence a major thrust is given to Sales/Marketing/Promotion/Branding while putting the product/feedback/market fit in the backseat.

A Social Media influencer is incentivized to garner maximum likes and followers, hence the intense drive to look good while throwing authenticity out of the window.

A friend is incentivized by sympathy and emotional support for being right, hence the passionate statements/allegations to make someone else look wrong.

A Newsletter/Online Course is incentivized by gaining subscribers, hence the repeated marketing/promotional material hitting your email day in day out.

An interviewee is incentivized for a good presentation in the interview, hence the lies and fluff in the CV.

A lender is incentivized to lend and build the loan book, hence the disregard to the credit ratings of the borrower and hence the creation of the Junk Bond Industry or NINJA Loans (No Income No Job) 🤦🏼

An accountant is incentivized to make the income statement look good, hence the cooking of the books.

A trader is incentivized for a higher turnover in the account, hence the churn in client portfolios.

Even the best in the world lose battles only because of the wrong incentives. Warren Buffet’s Berkshire Hathaway also got duped by Wilhelm Schulz, a family-run manufacturer of stainless steel based in Krefeld, Western Germany. The accounting books had been doctored to create the impression of a booming business resulting in Berkshire overpaying by EUR 600,000,000 +.

The best get deceived by this perverse pursuit of incentives, you and I are mere mortals.

I was reading a fantastic article yesterday, wherein Tony Deden, Founder of Edelweiss Holdings states 40 invaluable lessons he has learnt. And lesson no. 6 elaborates upon Incentive Bias in the clearest manner possible - “When you are younger and new to investing, you want to believe the authorities, rating agencies, government statistics, etc but as you grow older you realize that they all lie and everything is phony. This realization alone will make you look at places where no one is looking and help in developing the courage to acquire the things that everyone has brushed aside.”

It’s a wake-up call just in case you are naive and a blind believer of everyone trying to help you in your goals. Being optimistic is one thing, but being rational and being skeptical at the same time helps in making better decisions and wiser choices.

If incentive bias wasn’t enough to run you over, one of the other 25 biases will. If human bias doesn’t do the damage, then left tail risks like COVID-induced losses will. If COVID doesn’t touch you, maybe some other misfortune from the most unexpected placed will.

If you are unscathed and achieve the ever so evasive Success with millions and billions to your credit or a massive reputation, your own Success could become your biggest burden. No wonder, Bill Gates is trolled by many as the one who started COVID in a lab, Warren Buffet is trolled for being a miser and stuck in old school ways of managing money, Narendra Modi is attacked for being an Authoritarian, and Mahatma Gandhi even got killed for being perceived as Pro-Pakistan.

Recently I read Richard Feynman’s autobiography ‘Surely You’re Joking Mr. Feynman’ and it indeed was a classic read. I thoroughly enjoyed it. But one of his statements is so vivid in my memory - “I just didn’t want to be this Nobel Peace Prize Winner. I don’t want anyone to know about this achievement.” He even asks a Newspaper reporter to avoid mentioning the Nobel Prize in the article about him.

And Why?

Since that achievement would result in his privacy being invaded, photographers thronging his place of residence, nonstop requests for interviews, invitations to meet the royals or the bureaucrats of that city or nation, and many more boring or forced events. He dreaded these and derived no joy from these to the point that it felt like a huge burden upon him.

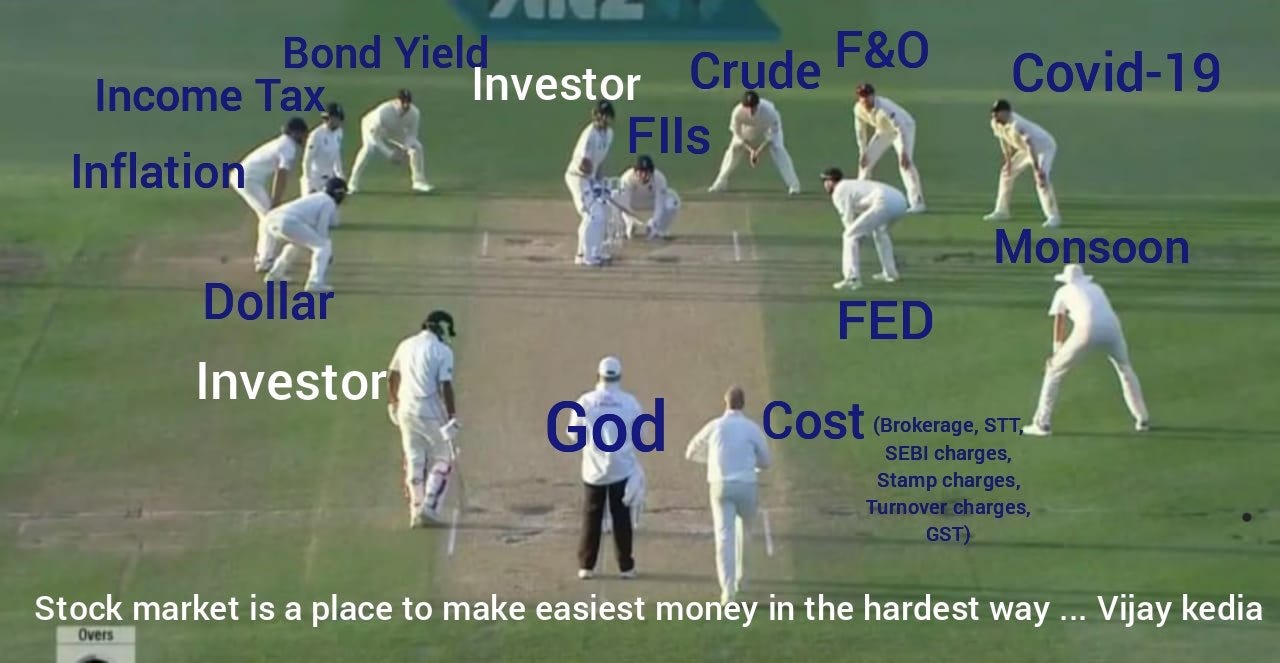

Adversity is like a shadow, it will be with you wherever you go. It actually looks like this for Investors -

😃 I sourced this pic from Fintwit but it is spot on…

I hope that by now, you would have got the message from this blog - You will be knocked down, time and again, irrespective of your plans and preparations.

Question is - will you stay down or will you learn from it and move on. Staying down and being sad/regretful/envious does no good, except make you feel right about your situation. But being right doesn’t pay the bills. Moving ahead does. And the only way you can move ahead is if you take your failure as an experiment that teaches you something.

"School requires you to learn about things after the answer has already been decided. Life requires you to learn about things while the answer is in the process of being decided."– James Clear

Charlie Munger lost his clients 53% in 1973-1974 and this episode severely impacted him, mentally and emotionally. But if you dig deep into his life, you will realize that it was this year itself that changed Charlie Munger forever. From the Cigar Butt approach of investing, he moved onto buying quality businesses at fair prices instead of lower quality businesses at extremely lower prices. And this started a whole new chapter of his life and the impact he will go onto have on Mr. Buffet himself.

Even Rakesh Jhunjhunwala has admitted to making many mistakes e.g. buying ACC at Rs 10,000 per share at the height of the Harshad Mehta-led bull run in April 1992, investing heavily in companies from ‘sunrise’ industries such as finance, aquaculture, textiles, and steel in 1994, stacking his portfolio with PSU stocks in the mid-nineties in anticipation of disinvestment and even entering Wipro when it hit five-figures as his broker told him it would double in six months. - Sourced from Outlook Money

But his takeaway in his own words, from these mistakes, was - "You learn the stock market by trial and error. Without making mistakes in the market, you will never be able to progress in it. What’s important is to spot the mistakes, learn from them, and move on.”

“One sign of emotional intelligence is the ability to admit an error. A mistake denied is a lesson not learned. Reflect deeply and objectively evaluate your performance.” - Gautam Baid, Joys of Compounding

Investing isn’t a science. Things don’t work like an equation in our field as it does in Physics or Chemistry or Mathematics. Nothing can be predicted with certainty. All movements are unknowns and unknowable. All that remains is one’s own sense of making probabilistic decisions without risking ruin.

Since all decisions are probability-based, you will have to experiment, test, try, attempt so many different models i.e. financial and mental. You may try Value Investing and may turn into a Growth Investor later in life. You may start as a Commodity Trader and pivot into Crypto Assets later. You may be a star Momentum Trader today but end up as a Coffee Can Investor later.

I have been in Sales all my life, but have been diving deep into the world of Equity Analysis, Valuations, and Accounting for the last 18 months. It’s a struggle to get a solid grip on these subjects since my expertise lies in Soft Skills, Closing Deals, and Relationship Management. But I am committed to getting better at Business & Security Analysis and I am just getting started.

Nobody’s path is crystal clear. But if you pay close attention to processes and relationships, you certainly will find the path that gets you the most bang for your bucks.

Till you find a path that makes sense to you, is aligned to your personality, is potent enough to achieve your goals - all that you’d need to do is an experiment and embrace the results that come in. Some days you will learn and some days you will earn. But all the days, you will move ahead !!!

"Children are happy because: 1) They're not self-conscious 2) They lack a sense of time pressure 3) They've no goals. The bottom line is they are living from moment to moment, and the mind is not there to interfere in their bliss." - Naval

Be childlike. Onward & Upward, always 😀

Wishing you loads of love and luck.

Manish