“A lot of success in life and success in business comes from knowing what you really want to avoid - like early death and a bad marriage” - Charles Munger

Our generation has seen all the superheroes coming alive on giant theatre screens and it’s been a treat to enjoy them all with friends and family. My favorite series has been the Batman Trilogy with Christan Bale in lead and Christopher Nolan directing the epic 3 part movie.

The bank robbery scene stands out for me as the best one for some reason. The background music while the robbery is in process, the introduction of Joker, and the twisted plot till only Joker remains. That was delicious to watch. For fun, herein is the link for the scene.

But I think that a lot of attention and adulation is showered upon Superheroes, with every house having a poster for their kids, toys of Superman on study tables at home, Batman tattoos forever on one’s arms, and Hulk figurines (really large ones) in some homes, and offices too.

This has a perverse effect that doesn’t get spoken about. It makes everyone believe in the immense potential of one’s own abilities, one’s own grandiose vision, one’s own unique skillsets, and how great or a good one is compared to others. It’s not what Superhero comics and movies intended but such is the nature of human behavior that it takes those lessons which are easiest to digest and exciting too.

Eg. becoming Hulk-like aggressive and tearing down any opposition or retaliation coming your way is seen time and again and it makes for a good story on screen and reaps huge rewards for Marvel & Disney.

But Subroto Roy (Sahara, India) tried doing the same and lost almost everything along with his reputation. Donald Trump repeated this Hulk-like behavior too and paid a heavy price at the end of his 4-year presidency, becoming the first president to be impeached twice.

“Wise men profit more from fools than fools from wise men; for the wise men shun the mistakes of the fools, but fools do not imitate the successes of the wise.” - Marcus Porcius Cicero

Read again - … for the wise men shun the mistakes of the fools.

But a fool’s story doesn’t make for a grandiose and delightful read or a movie. It’s not tasteful and maybe a commercial flop. Now, who wants to lose money on an economic project unless it’s depicting the greatest of failures like Hitler or Mussolini or sensational actresses like Silk Smitha.

Nonetheless, these commonplace failures/crashes/fall from grace stories have a lot to learn from. It helps not to repeat the mistakes that have costed others dearly. Just in case you are thinking that you are rational and smart enough to watch out for your mistakes. Let me remind you, yet again, Mr. Feynman’s often quoted saying “The first principle is that you must not fool yourself — and you are the easiest person to fool.”

You rather could do yourself great service by reading Charles Munger’s 1986 Commencement Speech on ‘Prescriptions for Guaranteed Misery in Life’, which makes for a very profound read and also inspired me to write this blogpost. One of the prescriptions therein is ‘being unreliable’.

Do not faithfully do what you have engaged to do. If you will only master this one habit you will more than counterbalance the combined effect of all your virtues, howsoever great. If you like being distrusted and excluded from the best human contribution and company, this prescription is for you

This one, first requires you to be clear about what have you engaged to do (in the context of investing)? Is it investing for the long term without taking huge risks? Is it going for quick returns speculating in the short term while taking huge risks? Is it making most of the current momentum in growth stocks, crypto, and now NFT? Or is it feel good investing so you don’t miss that party where drinks are on the house?

Just because you can buy stocks with a click of few buttons doesn’t make you an Investor. A trader, a speculator, a gambler, and an investor - all exactly do the same thing i.e. click a few buttons and buy securities. But why exactly are you doing so? What exactly are you engaged in? What is the purpose of transacting in the markets?

The other night, we were celebrating my CFA Completion Party (my preferred gluten-free, dairy-free, sugar-free cake pictured above 😁) and one of my friends there stated that he was thrilled with his returns in the stock market and only does short-term buy-sell trades. But in the same breath, he told me that he believes in the long-term potential of Equities as an asset class and intends to invest in equities rather than property 🧐

This is where engaging faithfully goes out of the window and being unreliable comes in, which of course is one of the guaranteed paths for misery in life. Engaging is easy, just tinker, experiment, dabble or play around with the subject of your attention. Faith is a powerful force and you would have witnessed its grip on humans where religion is concerned.

But engaging faithfully means bringing that very force onto your engagement so that you don’t stop at just dabbling, experimenting, goofing, or just playing around. Time is precious and it will serve you well if it is treated as precious as money. Money is hard-earned too and it would require you to up your game to see it multiply 2X every 4-5 years i.e. 18.92% return if you would like to 2X your investments in 4 years.

This translates into 32X of your current Investment in 20 years from now eg. If you currently have a portfolio of INR 10 lacs and you are just 30 years old. In 20 years, this could turn into INR 3.2 crores. Just think about the possibilities if you could generate these returns on a higher corpus. Now that’s EPIC!

18.92% p.a. returns ain’t happening if you are unreliable about your process around Investing. Everyone is on a high when times are good and the market’s on a bull run. You realize how risky your portfolio is only when the bears return to haunt the markets. And without faithful engagement, many a bull have seen their investments turned to dust and you certainly won’t enjoy taking the hit. Some don’t recover from that blow ever.

Let me share some examples of blind engagement -

Ostrich feathers took off in a big way in the 1880s…

At the market’s height in 1913, farmers were expanding, and brokers and investors were stockpiling large quantities of feathers in anticipation of even higher prices. Many in the trade were utterly convinced that the profits would keep rolling in, for feathers, like diamonds, were an ‘investment for life’, and in 1911 the world’s only ostrich professor confidently stated that ostrich farming would be a permanent feature of South African farming.

Three years later, however, the feather market began a precipitous and permanent decline. By late 1914, changing fashions, growing concerns over animal cruelty and conservation, and the advent of the motor car, which rendered elaborate headgear impractically, all spelled the end for feather mania. The crash resulted in great hardship for South Africa’s feather farmers and merchants.

Scores of farmers committed suicide rather than face life without their farms. Merchants’ feather mansions were auctioned off for the price of their windows and doors – one merchant even forced his wife to sell her oven door to pay off his debts. Ostrich carcasses littered the South African landscape because farmers could not afford the birds’ feed.” - Down on the Farm, Winton

Taxi companies using radical new technologies and promising to transform transportation have arisen before.

In 1897, what became known as the Electric Vehicle Co. began operating battery-powered taxicabs in New York City. In the U.K., the London Electrical Cab Co. also began service that year. In 1899, the Compagnie Française des Voitures Électromobiles got underway in Paris.

The electric taxis offered some great advantages over the horse-drawn cabs they sought to replace. They were clean and quiet and, because they were so innovative, they appealed to the wealthy and fashionable.

In New York, the electric-taxi business boomed. In June 1898 alone, nearly 1,600 customers traveled a total of 4,400 miles, according to business historian and management professor David Kirsch of the University of Maryland. They paid 30 cents a mile, more than $9.75 in today’s money. (Horse-drawn cabs charged 50 cents a mile.)

In 1899, the Electric Vehicle Co. had about 45 cabs in service, averaging 27 miles of trips per day, and a financing rush was on. A rival, the General Carriage Co., sought to raise $20 million in capital (about $650 million today). The New York Central railroad said it would launch a service with 100 electric taxis based at Grand Central Terminal.

That year, estimates of demand for electric taxis quickly ratcheted up from 1,600 to 2,000 to 12,000. To shuttle passengers to New York’s booming Metropolitan Street Railway trolley system, which covered 232 miles in Manhattan, 1,500 battery-powered taxis would be needed. The Electric Vehicle Co.’s parent ordered as many as 850 “electromobiles” from its manufacturing affiliate in Hartford, Conn.

In seven weeks that spring, the share price of the New York electric taxi company nearly tripled.

Then the surge began to fade as overexpansion took its toll. Short battery life doomed the London and Paris firms in a year or two. In 1902, the General Carriage Co. collapsed after its stock shot from 87.5 cents to $20.50 and fell back again. Most of the electric-taxi services in smaller U.S. cities never got traction.

Above all, Henry Ford supplanted the electric car by changing the idea of what automobiles were for. - Jason Zweig, Wall Street Journal

Are you also seeing such bling engagement today or is it just me 🤠

Being unreliable entails being seduced into stories easily, being distracted very easily, not finishing the job at hand repeatedly, being careless and reckless. Being unreliable as an investor is allowing all these behaviors to have an effect on your decisions around money.

Hence the saying “You get What You Deserve”.

Your bling engagement works on the hope that you too will get lucky or you too will get another fool to buy into the security you want to dispose of, just at a much higher price than your cost of purchase. That’s exactly what’s happening today in many securities/assets and that’s an exciting game to play, it’s just not investing.

Let me give you a glimpse of faithful engagement -

How to Read a Book provides the necessary skills to read anything. Adler and Van Doren identify four levels of reading: elementary, inspectional, analytical, and syntopical.

Elementary reading: This is the most basic level of reading as taught in our elementary schools. It is when we move from illiteracy to literacy.

Inspectional reading: This is another name for “scanning” or “superficial reading.” It means giving a piece of writing a quick yet meaningful advance review to evaluate the merits of a deeper reading experience. Whereas the question that is asked at the first level (elementary reading) is “What does the sentence say?” the question typically asked at this level is “What is the book about?”

Analytical reading: Analytical reading is a thorough reading. This is the stage at which you make the book your own by conversing with the author and asking many organized questions. Asking a book questions as you read makes you a better reader. But you must do more. You must attempt to answer the questions you are asking. While you could do this in your mind, Adler and Van Doren argue that it’s much easier to do this with a pencil in your hand. “The pencil,” they argue, “becomes the sign of your alertness while you read.”

“Nothing so much assists learning as writing down what we wish to remember.”

Syntopical reading: Thus far, we have been learning about how to read a book. The highest level of reading, syntopical reading, allows you to synthesize knowledge from a comparative reading of several books about the same subject. This is where the real virtue of reading is actualized. Syntopical reading, also known as comparative reading, involves reading many books on the same subject and then comparing and contrasting the ideas, insights, and arguments within them. In syntopical reading, you create a latticework of the information in those books, along with your own life experiences and personal knowledge, to create mental models and new insights and form an understanding of the world that never quite existed before. This is the step that prepares the way for an original thinker to make a breakthrough. - From Joys of Compounding, Gautam Baid.

Just in case you thought reading a book is drudgery, then let me remind you that it is just blind engagement, without a deeper connection to the subject being investigated or researched. A profound understanding of the subject requires Syntopical reading, as described above. No wonder Bill Gates reads 50 books a year. In fact, he takes regular leaves to just take time out to read the books he has allotted for that specific holiday.

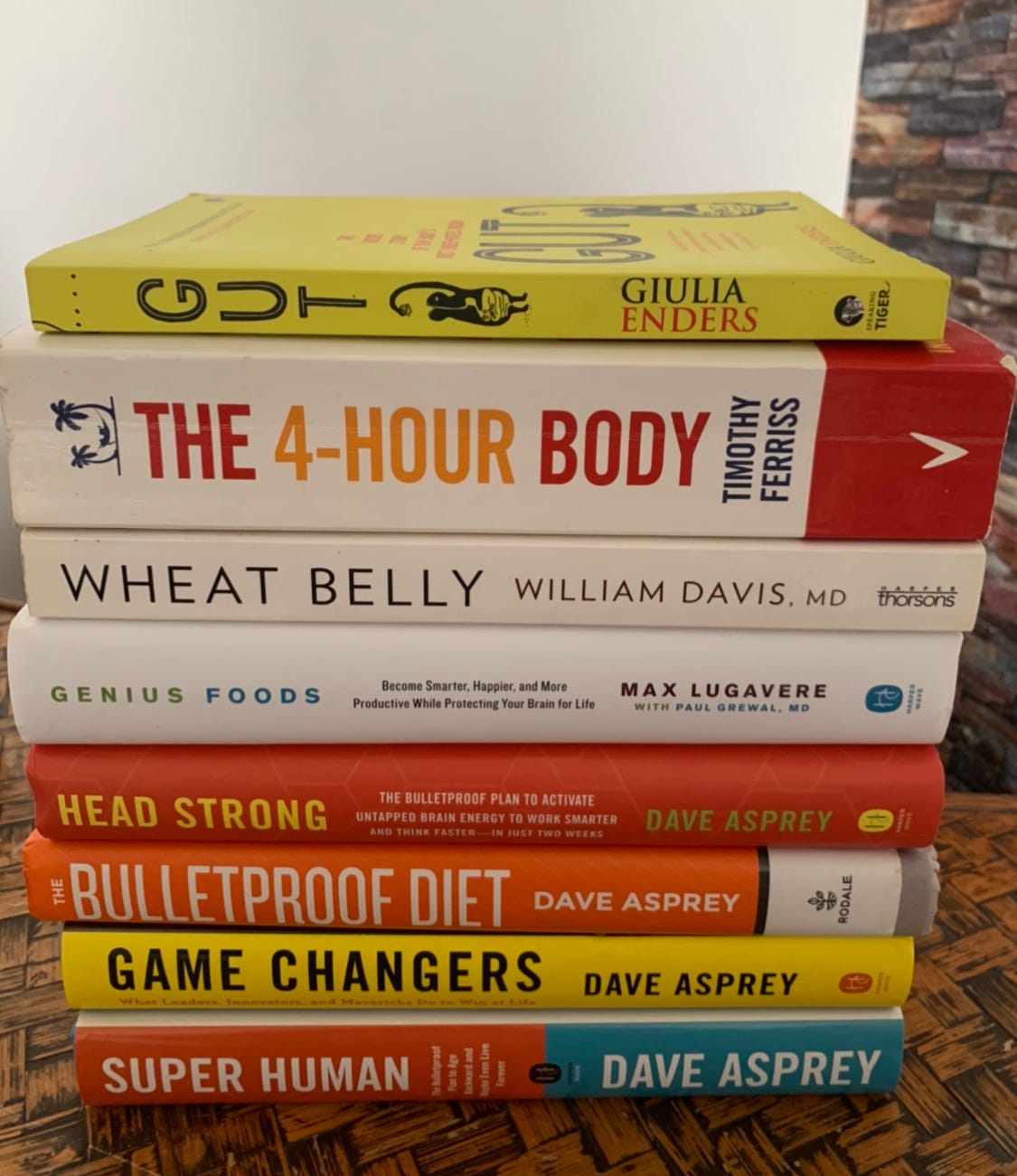

These are just a few of the books I read when I was diagnosed with Thyroid and I was asked by doctors to remove my thyroid gland and be at peace with taking iodine tablets for life. I didn’t buy that theory and faithfully engaged myself in finding a nutritional pathway out of the thyroid disease I had developed.

That was in 2015. My T3, T4, and TSH levels were back to normal in 6 months after switching to a healthy diet recommended by Dave Asprey along with added supplementation of essential nutrients eg. Magnesium, Selenium, Ashwagandha, and many others. It’s almost 6 years now and I have never been as healthy as I am today.

Getting rid of the thyroid wasn’t something I was interested in. It was a goal I was deeply committed to. Engaging faithfully entailed reading books, attending conferences, talking to nutritionists, listening to podcasts, and most of all, implementing many things that I learnt in the process. And I did.

The results showed up in 6 months !!!

When someone asked Jim Rogers what was the best advice he ever got, he said it was the advice he received from an old man in an airplane: read everything.

I learned early in my career that if you read the annual reports, you’ve done more than 90 percent of the people on Wall Street. If you read the notes to the annual report, you’ve done more than 95 percent of the people on Wall Street. —Jim Rogers

I’ve been reading IBM’s annual report every year for fifty years. This year I saw something that sort of clicked [emphasis added]. —Warren Buffett

I met Charlie Munger in my USC graduate school investment class and had the opportunity to ask him this important question, “If I could do one thing to make myself a better investment professional, what would it be?” He answered, “Read history! Read history! Read history!” This was among the best pieces of advice I ever received. —Bob Rodriguez

“Read 500 pages like this every day. That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it.” - Warren Buffet - All quotes from Joys of Compounding, Gautam Baid

Go Deep or Go Home !!!!

2020 and 2021 ain’t the odd years. But be ready for when it comes, it always does !!! You ain’t old now, but be ready for when it comes, it always does !!! Your doing great now, but be ready for bad times when it comes, it mostly does !!!

If you are faithfully engaged today, you will be well prepared tomorrow.

Wishing you loads of love and luck.

Manish

Great piece Manish. Good to see others who think alike.